Four essential financial skills that must be learned in life are: opening a bank account, building and maintaining credit, investing, and saving for retirement. The problem is that these essential four are rarely being taught in schools as part of critical skills. But, this knowledge can pave the way for financial success and inclusion later in life.

Some kids are exposed to the occasional special assembly revolving around subjects like how to save for your business or why it’s not a good idea not to spend everything you earn from your first job. Yet widespread financial education isn’t happening on a large scale — which is a big problem. As pointed out in a Forbes article, only 20% of people have someone in their life they trust to share money secrets. That’s a scary statistic.

However, this isn’t to say that financial education isn’t on the radar of some of the country’s leaders and politicians. According to a March 2022 survey by the Council for Economic Education, 23 states require high school students to take a personal finance course, and 25 states require high school students to take an economics course. On the flip side, three states plus the District of Columbia don’t include personal finances in their education.

Table of Contents

ToggleFuture Financial Literacy

Things may be looking up, though. As noted in a 2021 piece in The New York Times, more than 20 states are considering mandating financial literacy in their schools. In addition, Congress is making progress toward driving increased financial education in the classrooms. For example, representative Matt Cartwright (D-PA) introduced H.R. 1547—Youth Financial Learning Act, which aims to award grants to integrate financial literacy education into public elementary and secondary schools.

Efforts are also being made at the state and local government levels. According to the National Conference of State Legislatures, 38 states introduced new financial literacy legislation in 2021. These are certainly steps in the right direction. And these steps are hopefully a positive start to a future of financial inclusion for everyone.

Balanced Personal Budgets: A Goal Worth Pursuing

Currently, millions of young people learn how to handle their finances on the fly. Maybe they see a parent or grandparent write a check now and then. More likely, they don’t. So many people now conduct most or all of their banking online. This means it’s away from the eyes of children. So, they don’t learn the ins and outs of these everyday transactions with their ebank.

This needs to change. Far too many people, particularly those from underserved communities, have been left out of the mainstream financial system. It will only be more difficult for their children and grandchildren to build a better life if they don’t understand managing a transaction account or creating a budget.

Indeed, building a solid financial literacy foundation is critical to driving more financial inclusion. The more people who become familiar with the ins and outs of the financial system and the resources available to them, the better positioned they will be to actively improve their financial well-being.

Take access to fair and affordable credit, for instance. Many people want to buy a car, own a home, or have the capital to start a business. They can only make these big ideas happen if they have at least a modicum of understanding of what wealth is and how to steward it appropriately.

Demystifying Money for the Good of Current and Future Generations

As a society, we already have many significant, bold objectives that we hope to achieve sooner rather than later. Financial literacy should rank right up there, and the best place to make it happen is in the schools.

What’s the core benefit of weaving money management into the K-12 curriculum? For one, bringing financial education to the classroom creates a life cycle of financial literacy. Kids who learn about money at an early age can build on that basic knowledge as they get older.

Another advantage is that educators become smarter about their own financial decisions. Teaching our teachers to successfully navigate the mainstream financial system and become more financially literate themselves gets them excited about the topic and helps them better teach children.

A final benefit is the long-term effects of demystifying money on whole families and even friend groups. Young people can take the lessons they learn in the classroom to their parents and peers. This would allow everyone to learn and exhibit healthier habits together. It’s a chain reaction that better prepares our communities to improve their financial health and well-being. This, in turn, would lead to greater financial inclusion in the future.

Again, these positive outcomes can quickly begin in the classroom. It doesn’t have to be challenging for any school to begin to talk about money in elementary, middle school, or high school, either. It doesn’t even have to cost anything—which is an ironic bonus.

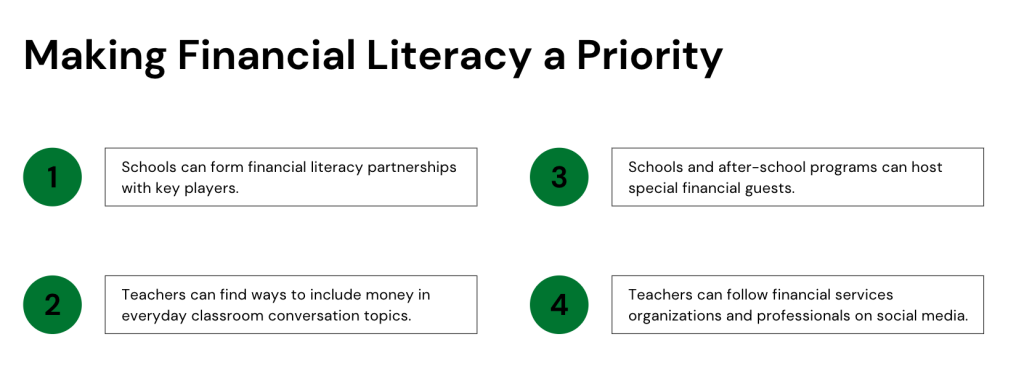

Below are a few strategic ways for eager teachers and administrators to make financial literacy a priority.

1. Schools can form financial literacy partnerships with key players.

A school or school district doesn’t have to “go it alone” when it comes to bringing money matters into the classroom. Plenty of big-time players in the finance sector, such as banks and mortgage lenders, have programs to share.

Take Experian and the Jump$tart Coalition for Personal Financial Literacy, for example. The two entities have partnered for many years. Together, they recognize and celebrate the value of financial education to drive increased financial inclusion across communities. Their work has provided teachers with information, tools, and resources to educate all students, especially those historically excluded from the mainstream financial system.

2. Teachers can find ways to include money in everyday classroom conversation topics.

Some detractors of financial education in schools might say it’s easier said than done. They point to too many competing priorities, too few qualified teachers, and a lack of time and resources. Of course, these are all valid concerns. Yet when most people deal with money daily and rely on finances to navigate the day-to-day, there’s no reason to relegate financial education to the sidelines.

Without a doubt, it would be hard to think of any other school subject that could or would be condensed to a single day or week. Teachers should be encouraged to talk about money in different ways. A history teacher might touch upon how governments divide their budgets or collect taxes. A math assignment might involve a money component. It’s simpler to bring money into the classroom than it might sound. There are online resources, such as the Jump$tart Clearinghouse, where teachers, parents, and even students can find effective, financial education materials from various sources.

3. Schools and after-school programs can host special financial guests.

To their credit, many schools do invite financial leaders from their communities into the classroom. As great as teachers are, visitors spice up the school day. Also, those professionals can talk about finance’s multifaceted, complex aspects. Plus, kids can ask questions and get ready answers from people already working in the field.

The problem is that far too often, schools and individual teachers have to go through quite a few hoops to arrange for guest speakers and teachers. Perhaps a silver lining of the COVID pandemic is our increased comfort with virtual communication. This makes it easier for someone from a local bank, credit bureau, credit union, investment firm, or nonprofit to take 30 minutes every two weeks to talk to a class about pertinent money issues and reply to questions. These small touch-points may not sound like a lot but can add up over time. This will help people be more financially literate and pave a future pathway to financial inclusion.

4. Teachers can follow financial services organizations and professionals on social media.

For even the most qualified personal finance teachers, it can be challenging trying to keep up with the constant developments in the financial field. Unfortunately, many schools lack sufficient funds for training programs, and the limited prep time that teachers are given isn’t enough for self-directed learning. But, social media offers teachers an easy and inexpensive way to tap into the expertise and trends of the financial fields.

By following financial experts on social media and programs like Experian’s #CreditChat, teachers gain access to insights, information, announcements, and resources. The trick, though, is to be sure you follow reputable organizations or accredited professionals rather than self-proclaimed experts and influencers.

A World Full of Bright, Confident Money Managers

Right now, the baseline financial knowledge of children and adults across the country could be better. Research from OppU suggests that not only are more than half of all adults worried about their finances but more than three-quarters live from one paycheck to the next.

It doesn’t have to be this way forever.

Making sure young people understand finances at the earliest possible age will help them construct healthier wealth accumulation and spending behaviors. As one of the leading societies, Americans must step up help kids and adults make wiser money decisions.

Certainly, the education system has a lot on its plate. Nevertheless, including educational tidbits about money and the financial system will go a long way toward better financial inclusion, changing each person’s opportunities—and maybe even changing the world.