Decided to plan your retirement but confused with where to start from? For sure, that question needs considering various aspects: your lifestyle, needs, and other circumstances that can have a significant impact on our life.

Though some people used to think early retirement might be like a garden of Eden, in fact, it also may lead to losing all the money after some time. On the contrary, later retirement until the age of 70 can enlarge your benefit by over 32% than it would be with your full retirement age according to Investopedia.

But what exactly is the right time for retirement? in this article, we will get that covered!

Table of Contents

ToggleGlobal Retirement Statistics

Before we start diving into the key points of the retirement age determination, let’s start with the global statistics. For sure, the official and actual retirement age varies for each region and is considered to be one of the very first factors that help to find out the right time for retirement.

For instance, the average lowest retirement ages are in France (60.55) and Greece, when the highest ones are in Mexico (69) and Japan (69.95).

Thus, the national retirement tendencies of your region can give you some hints on when people tend to leave the workforce.

| Country | Average Retirement Age | Official Retirement Age |

|---|---|---|

| United States | 66.85 | 67 |

| United Kingdom | 64.5 | 65 |

| Canada | 64.75 | 65 |

| France | 60.55 | 62 |

| Greece | 60.7 | 67 |

| Italy | 61.7 | 66.58 (men)/65.58 (women) |

| Netherlands | 63.25 | 66 |

| China | 64 | 60 (men)/50 (women) |

| Israel | 67.8 | 67 (men)/62 (women) |

| New Zealand | 68.4 | 65 |

| Mexico | 69 | 65 |

| Japan | 69.95 | 62 |

Things to Consider before Choosing the Right Retirement Age

Nevertheless, the retirement age is rather an individual criterion, which shouldn’t only rely on general statistics. To determine whether you’re ready for the retiring, finance experts suggest answering the following questions:

#1 Have You Reached the Retirement Age?

Though there are the exact numbers of the full (official) retirement age, it is generally accepted to divide the retirement period into the 3 categories:

Early Retirement – (usually before the age of 65)

This year fits the people who feel burned out, or when there is a need to reduce the stress level by switching to a part-time job, traveling, or finding more time for hobbies. However, this option also implies additional things to consider: for example, In the US you can claim for the Social Security benefits at the age of 62, but the monthly payments will be reduced compared to those claimed after reaching the full retirement age (FRA).

Furthermore, the Medicare coverage will be unavailable until you’re 65, so your early retirement plan should also cover the possible healthcare spendings. That is why, you should have a significantly greater nest egg, and make some additional contributions for the retirement accounts for its growth.

Normal Retirement –(from 66 to 70)

For most people, a normal retirement may sound the best, as people reaching the FRA can finally finish their working period and still have some energy and resources for themselves.

These people are eligible for Medicare and get the full Social Security payments, which is another benefit if you’re likely to have at least an average retirement duration.

Late Retirement – (after the age of 70)

Those who enjoy their working routine and busy days prefer to retire after they’ve turned 70. Among the advantages of late retirement is the 132% of Social Security benefits, which means you’ll have more money for your favorite hobbies.

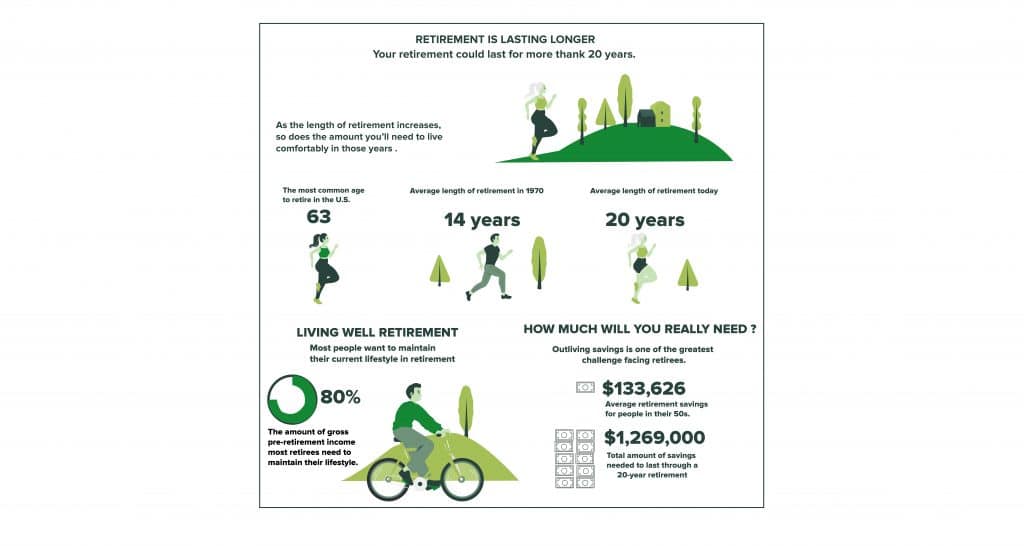

However, sometimes that’s not the matter of choice: according to Investopedia, though baby boomers are now retiring in large numbers, they don’t have enough savings for their retirements. That is why it’s really critical to make sure you’ll possess enough savings before going to retirement

#2 Are There Any Debts Left?

If you’ve paid off the debts before your retirement and accounted for the approximate monthly spendings for the retirement days with the unexpected risks included, you can think over the more detailed retirement plan.

With no debts left on your account, you won’t need to count each penny to have some for living and minimize the risks of getting stuck in larger debts.

#3 Have You Created a Retirement Budget?

According to The Balance, the average estimated spending for each retirement year accounts for around $60,000 including taxes and live spendings. Additionally, some of the pre-retired expenses may disappear after reaching the FRA, such as payroll taxes, 529 plan contributions, transportations, life insurance, etc.

Nevertheless, you still need the retirement budget to make sure you can sustain yourself. The earlier you start growing the nest egg, the more likely you will be guaranteed to have the costs for covering your retirement expenses.

#4 Do You Need To Support Your Family?

Some individuals may also need to put their kids through college or university, or regularly support their parents. In case of the financial support of your family members, the retirement expenses should be recalculated and the numbers enlarged correspondingly.

“As the educational expenses and housing costs are on their rise, there is often no way left rather than downsizing the live spendings”, says Carlos Dias Jr., founder, and managing partner of Dias Wealth LLC.

Thus, a family component can play a serious role in building your retirement budget

#5 Do You Want to Work After Retirement?

Most individuals don’t want to spend the rest of their life just running the household on retirement. Some of them switch to part-time jobs that are just right for retirees:

- essay writer,

- bookkeeper,

- office manager,

- administrative assistant

- secretary,

- nanny,

- cashier,

- a registered nurse, etc.

Along with some new experiences and emotions, this can be beneficial to your retirement budget as well. With the additional source of money, you will be able to review your expenses and add some new activities you haven’t tried before: workshops, yoga, gardening or traveling, and others. Besides, that’s a really nice idea of trying some new occupations in completely different industries, which can provide you with additional costs and fresh impressions as well.

#6 What is Your Spouse Opinion?

Needless to say, for most people going to retirement means a significant change in the overall income. And, unless you’re alone, you need to realize that retirement may also influence your family too, especially your partner.

To make sure the income change won’t influence your daily routine and common habits, make sure you both can find the common denominator in the income planning. This is supposed to be one of the key aspects of a successful retirement, as it helps to set the framework for retirement plan success.

Additionally, you should keep in mind that it’s not obligatory for the couple to retire at the same time. Just like we have stated before, that’s still a kind of personal decision: if you or your spouse wants to go on working and delay the retirement period – that’s totally fine. Mark Hebner, founder, and president of Index Fund Advisors Inc. says: “Communication is always important, especially when it comes to your household finances,” as it helps to complete the step-by-step transformation to the next phase of your life.

Thus, finding common ground regarding the retirement questions, creating a detailed plan of your monthly spendings, and adding some for the unexpected expenses (medical expenses or emergency travel) can greatly help you and your spouse to create a comfortable lifestyle after going to retirement.

#7 Have you Received the Vacation Pay

It often happens that people retire without knowing they can get the vacation pay funds from their employer. However, sometimes that can be a really considerable income for your retirement nest egg.

Before going to retirement, most experts suggest finding out when you can receive the vacation pay money, as they are considered your personal earnings and may influence the Social Security benefits you’ll claim for afterward. Instead, you can wait until the funds are received and then ask for Social Security benefits.

Main Signs for Retiring

Along with the questions that can help you to determine the appropriate time for retirement, let’s cover more general factors people usually consider before making the final decision.

Health Status

One of the major factors that make people think about retirement is health problems. Even an average 9 to 5 office worker who runs a healthy lifestyle can have some serious health problems related to the working peculiarities, location, genetics, social environments, etc.

“Common conditions in older age include hearing loss, cataracts, and refractive errors, back, and neck pain and osteoarthritis, chronic obstructive pulmonary disease, diabetes, depression, and dementia,” says the WHO.

That is why more and more people at present need to go to retirement due to health issues which make their working routines more challenging.

Bank Account

Not that common, but still an essential option that gives you a green light for retirement is your life savings. After estimating how large your nest egg is and how long you’re planning to use it along with the Social Security benefits, you will be able to find out whether it’s good or not to retire at a certain age.

As you might have understood, this factor is also the individual one. Unfortunately, for the people who don’t have any savings for retirement at all, that might be a serious reason for delaying the retirement period.

Activities to Implement

Before retirement, you should know exactly how you will spend the time after finishing your working period. Creating a retirement plan full of the activities, hobbies, and routines you like to implement during this time can help you succeed in productive and pleasant feelings about your retirement.

However, if the only reason for switching to retirement is the job escape – think twice before making such a serious decision. As a good option for this case, you can just switch the job to the one you really like! This simple yet effective trick will also help you to prevent such a common for the early retiree’s “buyer’s remorse” feeling.

Part-Time Job

However, if you often feel more tired and exhausted after the full-time working day, that’s a real sign of going to retire. With the times, it becomes more difficult to complete the work than before, and these uneasy feelings are nothing more than your body signaling you should change daily routines.

However, if you do like your work, haven’t reached the FRA, or currently aren’t ready for the full retirement lifestyle – switch to the part-time job then!

Steps for Deciding If You’re Ready for the Retirement

Are you ready for retirement right now? Here are some pretty clear and simple steps to determine that!

- Count your total monthly and annual spending, including the unexpected expenses for medical services, house repairs, and periodical hobbies like traveling, books, etc.

- Include the potential income sources after retiring. Check the funds you can claim for in Social Security now and later (after the age of 66 or 70)

- Estimate the real state of affairs when accounting for your nest egg, income, and spendings. For sure, you’ll never know how much and when you will spend more or less, but it’s critical to ensure you won’t run out of money soon after retirement.

- Instead of analyzing according to the average numbers, ask for a professional consultancy. An expert opinion will only improve the quality of your retiring plans and assumptions and make them more realistic, as well as adapted to the real world.

- Find out the ways of getting more money savings: part-time job, habits change, or adding some new hobbies that can bring you more income.

Feeling comfortable with the state of affairs you’ve got after the analysis? Then, it’s time for entering the final stretch.

What Is Your Retirement Age?

As you can see, there are different factors that indicate the exact retirement age for you. Family status, health situation, nest egg, personal desires, and ambitions – all these can have a significant impact on what your ideal retirement should be.

That is why taking all the aspects into serious consideration is the best option of estimating the most comfortable age for getting retirement. In such a way you will not only be able to ensure it gets off the right foot but also spend the best years of your life on retirement.