Table of Contents

ToggleRegional Rate Disparities

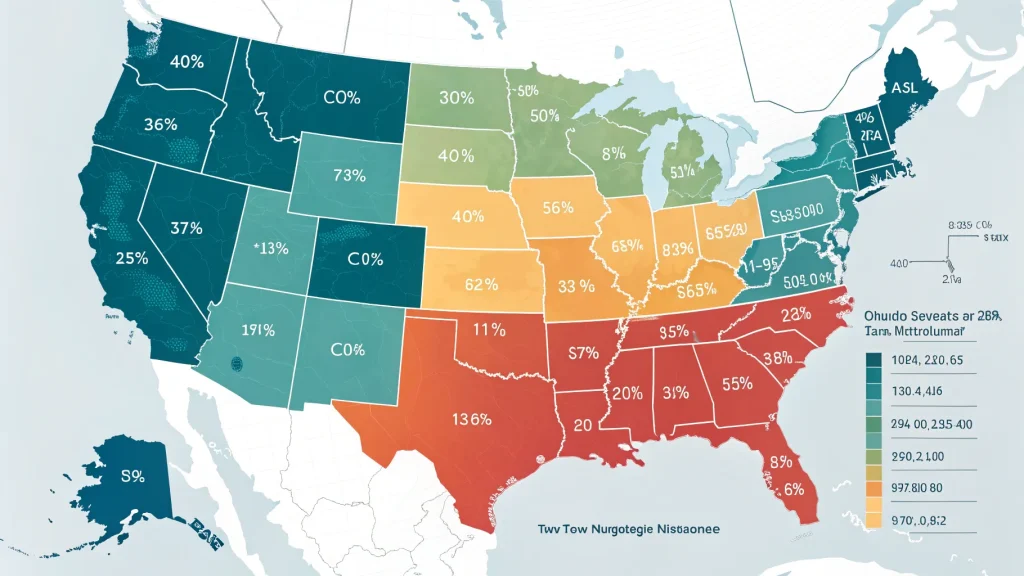

The data highlights notable geographic differences in refinancing opportunities. While the East and West Coasts — specifically New York and California — show the most competitive rates, North Carolina stands out as another area where homeowners can secure advantageous refinancing terms.

These regional variations can translate to thousands of dollars in potential savings over the life of a loan for homeowners in these states compared to areas with higher average rates.

Market Implications

Financial analysts note that several factors contribute to these state-by-state differences, including local economic conditions, housing market competition, and regional banking practices.

The concentration of major lenders in financial centers like New York and technology hubs in California often creates more competitive lending environments,” explains one mortgage industry expert. Meanwhile, North Carolina has developed into a banking center with its own competitive lending ecosystem.

For homeowners in these states, the current rate environment presents a potential opportunity to lock in lower monthly payments or reduce the overall cost of their home loans.

Using the Interactive Tool

The interactive map offers a user-friendly interface that allows homeowners to:

- View current average 30-year refinance rates for any state

- Compare rates across different regions

- Track changes in refinance rates over time

- Make more informed decisions about refinancing opportunities

Users can access detailed information specific to their location with a simple click, making it easier to determine if refinancing makes financial sense in their particular situation.

National Rate Context

While New York, California, and North Carolina currently offer the most favorable rates, the tool provides valuable insights for homeowners across the nation. Even in states with relatively higher rates, refinancing might still be advantageous depending on when the original mortgage was secured and individual financial circumstances.

Housing market analysts recommend that homeowners regularly check current rates in their state, as mortgage refinance rates can fluctuate based on Federal Reserve policies, inflation data, and other economic indicators.

The geographic disparities in refinance rates also reflect broader economic patterns across the country, with some regions experiencing stronger recoveries and more robust housing markets than others.

For homeowners considering refinancing, experts suggest comparing offers from multiple lenders and calculating the break-even point — how long it will take for refinancing savings to exceed closing costs — before making a decision.