Money preferences have shifted over time, and while cash is still the preferred way to handle a wide range of transactions, money transfer apps and digital wallets are quickly rising in popularity. In a recent survey, 77 percent of respondents had used bank transfer apps and 69 percent have tried money transfer apps, according to CreditLoan. With the majority of the population aware of these apps and trying them out, is it just a matter of time before cash goes away for good? Let’s see what the numbers have to say about shifting money preferences for payments, transfers, and beyond.

The rise of digital money

Cash and coin based money started in China around 1,000 years ago and made their way to Europe with Marco Polo in the 13th century. Money preferences stayed largely the same for most of that thousand years, but these days we are witnessing a massive revolution in how people choose to pay. With the rise of computers, credit cards, debit cards, and other non-cash payments made their way onto the scene in a meaningful way starting in the 1950s, less than 100 years ago.

Among noncash payments, a 2016 Federal Reserve Report shows strong preferences for debit cards, which were used for about twice as many transactions as credit cards in 2015. ACH is slowly growing over time, with paper checks on the way out. But how does that compare to cash?

Cash is still by far the preferred payment method. Payment data studies don’t happen nearly as often as changes in consumer preferences. As of 2015, 32 percent of transactions were made with cash, according to a Federal Reserve study, compared to 40 percent in 2012. If that trend holds, cash will be down to 26 percent of transactions in 2018, but with increased enthusiasm for convenience, cash may fall at a faster rate than the historical trend.

According to a new survey from CreditLoan, over three-quarters of respondents have tried a transfer app of some sort, whether through a bank or a dedicated payment app. That is a huge number and shows big potential for the future.

Digital money preferences taking shape

It seems that when it comes to convenience, money preferences lean clearly toward apps over cash, as they offer fast, simple transfers and can go right from one bank account to another. But there is more to payments than convenience.

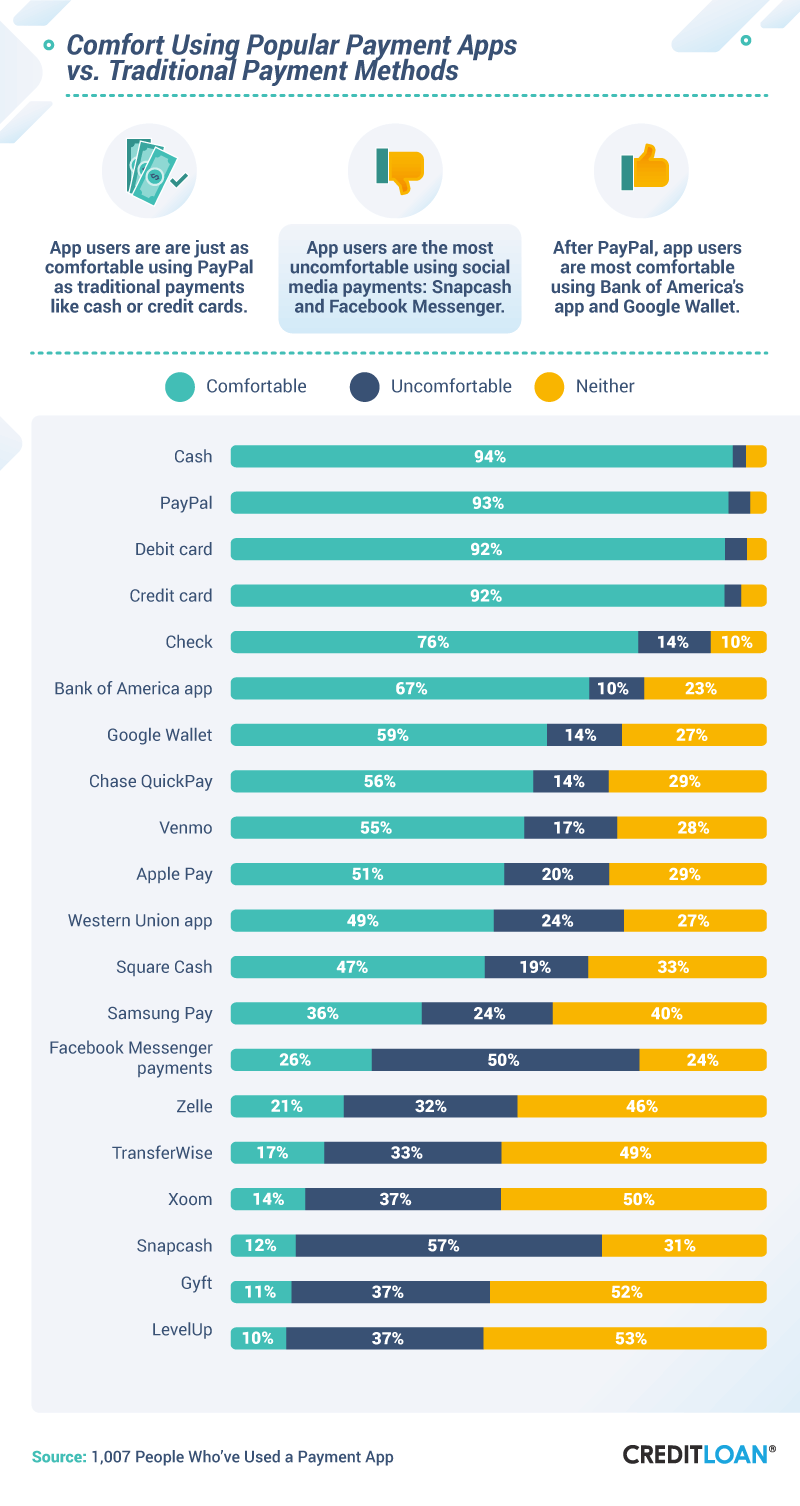

One of the biggest hurdles facing digital payments and money apps is security and security perceptions. The CreditLoan survey found that people are generally more comfortable with cash than any other payment method. While PayPal, debit cards, and credit cards are right on its tail, cash still edges out digital payments in terms of user comfort.

This preference of being more comfortable with cash likely stems from a string of well-publicized security breaches over the last decade. Payment system hacks at Home Depot, Target, and TJ Maxx are just a few examples of user data leaks for one reason or another. But do keep in mind that when you use a credit card or debit card, your liability for fraud is limited by law and your card issuer. In most cases, you have $0 liability for any unauthorized credit card charges.

Also, remember that the worse breaches had nothing to do with payments. Yahoo leaked user data for 3 billion accounts and the infamous Equifax breach exposed everything needed for identity theft on virtually every American who has had a credit card or loan in the last decade.

What’s next in money preferences?

Cash is not going away, but it certainly has some challengers. From cryptocurrencies like Bitcoin to the trusted credit and debit card, cash may be on the way out. I know that I, for one, have walked away from restaurants that don’t take a card. Like many Millennials, I don’t regularly use cash and sometimes don’t carry it at all.

If the current trend continues, we may see cash continue to fall with a growing preference for noncash payments. In the digital payment world, credit and debit cards have a big head start, but they may lose ground to payment apps in the coming years. Only time will tell the future of money preferences and digital payments.