Today we’re going to teach you everything you need to know about teaching your kids healthy financial habits with Greenlight. Although healthy financial habits, like saving money and budgeting, can be valuable life skills, these behaviors aren’t exactly easy to develop. Sadly, most parents don’t teach kids financial habits.

In fact, a LendingClub survey released in 2021 found the following:

- 54% of Americans (125 Million adults) live paycheck to paycheck, with little or no savings set aside for emergencies.

- Nearly 40 percent of those with annual incomes over $100,000 live paycheck-to-paycheck, including 12 percent struggling to pay their bills.

- Fifty-three percent of those who make between $50,000 and $100,000 annually live paycheck-to-paycheck, with 18 percent struggling to pay their bills.

- Seventy-two percent of those who make less than $50,000 per year live paycheck-to-paycheck, with 33 percent struggling to pay their bills.

While there can be valid reasons for families succumbing to financial trouble, kids should still be taught about financial habits at a young age.

According to Dr. David Whitebread and Dr. Sue Bingham, the majority of our habits are set by age 7, particularly around money. Planning ahead, setting a budget, delaying gratification, and returning borrowed goods are examples of habits we develop in childhood. And, these will then be woven into our adult lives.

But, how exactly can you instill healthy financial habits in your children? Well, your mileage may vary. But, you probably can’t go wrong with the following;

- Help them understand the difference between wants and needs.

- Offer allowances in exchange for chores. They’ll learn the value of their labor and how to use this money.

- Having your children add up their purchases every week after getting an allowance is a great way to educate them on money management.

- Help them establish savings goals. You may also need to assist them in breaking these goals down into more manageable pieces.

- Offer incentives, such as matching contributions.

- Show them where to stash their money, such as a piggy bank, savings account, or kid-friendly debit card.

Table of Contents

ToggleWhat is a Debit Card for Kids?

While all of the above are excellent starting points, I want to hone in on the kid-friendly debit card. As someone whose parents had unhealthy financial habits, I didn’t feel like I was in the right position about educating anyone else on how to manage their money.

But, thanks to a kid-friendly debit card, this is no longer a concern. So, let’s quickly explain what debit cards for kids are.

Legally, minors cannot enter into legal contracts due to their lack of capacity. Because of this, children aren’t able to open bank accounts until they reach the age of majority in the state they reside in. In most cases, this is 18 years old.

However, it’s still possible for parents to offer their kids a bank account with a linked debit card.

- Use your own bank account to open a sub-account. With this, your kids can use the card while you maintain control over the account. Your child will still likely need to be at least 13 years old to receive a debit card under this scenario.

- Open a joint bank account. With this option, you and your child have ownership over the bank account. Therefore, the assets inside the account also belong to both of you.

- Opening a debit card for teens (minors). This allows you to teach your kids about money while being able to monitor your kids’ spending and money decisions. What’s more, you can set customized spending controls, receive purchase notifications purchases, merchant blocking, and ATM and daily spending limits

Thanks to parental controls, debit cards for kids are similar to prepaid debit cards. Often you cannot do this with free debit cards or traditional banks.

What is Greenlight?

Founder and CEO Tim Sheehan thought it would help his children to have a consistent allowance so that they could learn the responsibility of money. However, he never had enough money to provide this for them.

As with any successful business idea, Tim believed that many other parents had the same pain point. His ultimate goal was to make it as easy as possible to give his children money while teaching them the importance of financial responsibility.

So, in 2014, he launched Greenlight.

Your child’s Greenlight account works like a bank account but under parent control. When you enroll your child in this program, they receive a debit card with a PIN. While they can make purchases, the debit card doesn’t earn cashback or be used at ATMs.

By utilizing Greenlight, parents can determine which stores or types of stores their children are allowed to go to. More importantly, the spending limits can teach them the basics of saving. And, Greenlight also offers investment opportunities as well. Very similar to Chime for adults.

How Does Greenlight Work?

A Greenlight debit card for kids is exactly what it sounds like. It’s a debit card designed just for kids.

More specifically, with the Greenlight app, you can load money onto the debit card so your kids can use it. Transfers can be done manually or set up automatically weekly. And, as the parent, you set the terms. For example, you can add money to the account for completing chores or getting good grades. Additionally, you can add money to the card in case of an emergency.

Parents and kids both have access to the Greenlight app. However, the information they see when they log in is different for each group. A parent can monitor a child’s account to see what’s going on, including the balance and purchases. You can approve all trades if investments are involved.

What will your kids see? In addition to seeing their balances and setting goals, they can learn important lessons. Using a mobile app, they will be able to learn even more about financial management.

The Federal Deposit Insurance Corp. (FDIC) insures spending and savings on Greenlight cards up to $250,000 per account. So, it’s safe and sound.

Investment-wise, Greenlight is registered with the Securities and Exchange Commission (SEC). It’s also a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). While this won’t protect you and your child from poor financial decisions, it does protect you in case Greenlight goes belly up.

Greenlight Plans

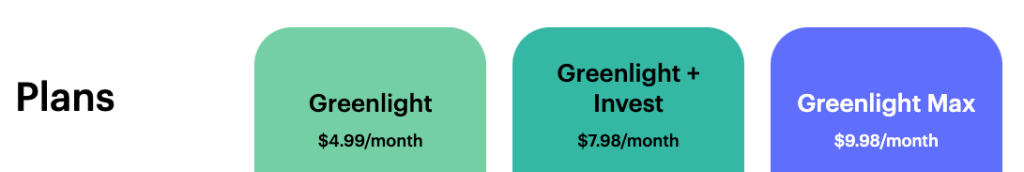

Greenlight offers the following three plans;

Basic Greenlight Plan

At $4.99 a month, this is Greenlight’s basic plan. With this package, you can get up to five kids the Greenlight debit card. Also available is the Greenlight app, which allows kids and parents to interact in different ways. Kids can also set their own financial goals and see their spending and saving balances using this plan. Parents can also see how the allowance is spent and other income sources.

The plan also includes;

- Educational app

- Core financial tools

- Granular parental controls (store-level and category-level)

- Greenlight Savings Reward (up to 1% interest on Savings)

- Possibility to earn, save, spend, invest, and give

Greenlight + Invest

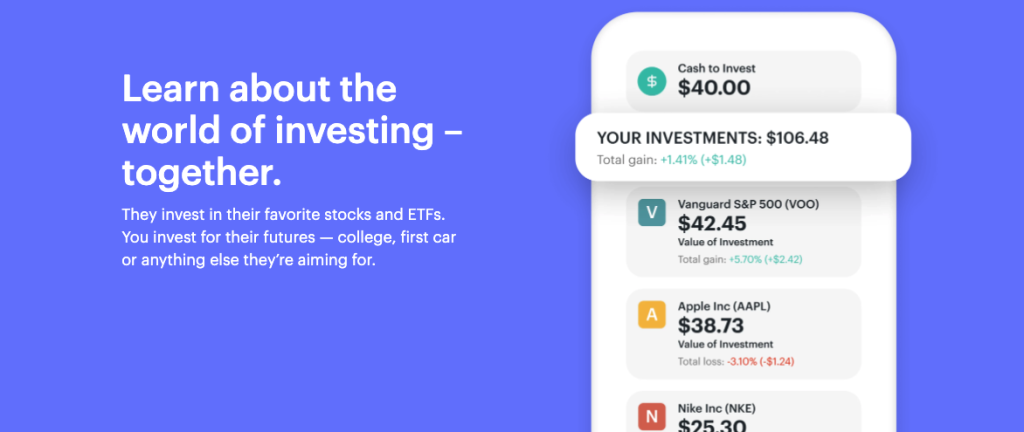

Aside from all the tools accessible through the Greenlight plan, Greenlight Invest also gives your kids a chance to invest. Through the platform, kids can begin learning about investing money with just $1. Each trade must be approved by you and there are no charge fees for trading.

Additionally, Greenlight allows kids to purchase fractional shares of their favorite companies. This can be a good plan for your family if your children are old enough to start making their own investment choices, although it does come with a monthly fee of $7.98.

Greenlight Max

In addition to the Greenlight debit card, kids can also participate in investing and access financial management learning resources. The Greenlight Max card comes with additional benefits, including priority customer support.

However, there are other benefits as well;

- Identity theft protection. It keeps an eye on your identity and sends you alerts about threats to your identity.

- Cell phone protection. You can protect up to five kids’ cell phones from damage or loss.

- Purchase protection. Damaged or stolen items that have been paid for with Greenlight can be repaired or replaced.

Families seeking comprehensive protection and access to financial resources could benefit from this plan, which costs $9.98 per month.

Signup for Greenlight Kids Card Today

Why You Should Consider Greenlight

The main reason why Greenlight is worth the cost? Kids learn financial responsibility through it.

Having financial management tools in the app gives kids valuable lessons in money management. As an example, children can use the Greenlight debit card to prevent overspending and learn how to manage their money responsibly.

Other benefits of Greenlight include;

- The best parental controls in the industry. Parental controls for spending and ATM withdrawals are granular in Greenlight, which is unique in the market. There is no other card that can deliver such detailed insights and control as Greenlight.

- Chore and allowance management. Through the in-app assignment, tracking, assessment, and automated allowance payments, the Greenlight app helps you stay on top of chores and allowance.

- Investment platform. As part of its service, Greenlight offers an investment platform so parents can approve individual stock and ETF transactions.

- Parent-paid interest. Parents have the opportunity to pay interest on savings goals set by their children, Greenlight encourages them to save and teaches the concept of compound interest.

- Savings rewards and interest. As a reward for saving, Greenlight offers interest. Usually, this is 1 to 2% depending on the plan).

- Cashback. Kids can earn 1% cashback on their Greenlight card purchases if they choose the Greenlight Max product.

- Flat monthly fee for up to five kids. With Greenlight, you can give up to five children a card. There is an additional monthly fee for each additional child.

- Real-time alerts and requests for spending and ATM withdrawals. It offers in-app notifications of spending activity and requests for additional funds in kids’ Spend Anywhere accounts in real-time.

What Greenlight Can Do Better

- The monthly fee on Investing plan. Parents who do not require the controls and insights offered by the Greenlight debit card could instead opt for a more affordable custodial account, such as Acorns Family ($5/mo). Additionally, you can use BusyKid debit cards for only $19.99/year (though $7.99 per extra card per year with other fees). Compared to the Greenlight + Invest plan’s fee, it has fewer features but comes at a lower price.

- Transfers of allowances must be approved (not automated). Let’s say that you log in to pay your child for completing chores. You’ll see how the transfer of funds is automatic without prior approval required. As a result, the payment will go through regardless. That’s not exactly teaching them responsibility if they didn’t do their chores. In some cases, a manual transfer option would be more beneficial.

- Reload cash options. At this time, Greenlight does not allow you to reload your card with cash from participating retailers. The availability of this service, even for a fee, can promote access to financial services among underserved populations. Famzoo, for example, allows this at locations like Walmart or Target, although retailers on the Mastercard Reload network charge a fee for the service.

- Loans to parents and children. With options like Famzoo and BusyKid, parents can lend their children money (with interest or without) to pay for larger purchases a child cannot afford on their own. If you learn about credit in this way, you can move on to a credit card or other loan product outside of the home safely.

How to Get Started With Greenlight

Here is the information you’ll need to get started with Greenlight;

- Mailing and email address

- Mobile number

- Information that identifies you, including your name, birth date, and Social Security number

- Names of the children

- A valid bank account or debit card

On Greenlight’s website, click on the “Get Started” button as soon as you have this information. After entering your phone number, you will be taken to the checkout process. You will be taken to a page asking you if you are the child or the parent/guardian. A confirmation code will be sent to you once you verify that you’re a parent. By entering the code, you can create a Greenlight account.

Afterward, you’ll be able to pick your plan and then download the app and add the kids. There’s a 30-day trial with Greenlight, and you can cancel anytime.

Is Greenlight Worth the Cost?

It is important to be financially literate. You should guide your children toward a successful financial future by teaching them strong financial habits. Taking the time to learn the ropes may take a little effort, and in this case, $4.99/month. Nevertheless, it will be worthwhile.

Overall, in order to teach your kids financial literacy, Greenlight is a great way for you to give them the responsibility of an allowance while still keeping your eye on them.

Signup for Greenlight Kids Card Today

Frequently Asked Questions About the Greenlight Debit Card

1. Is there a minimum age to use Greenlight debit card, Greenlight + Invest, or Greenlight Max?

Both Greenlight debit cards and Invest features are available to people of all ages. But younger kids may need additional guidance from an adult.

2. Can I use the Greenlight debit card anywhere?

Since the card uses the Mastercard payment network, it is accepted wherever Mastercard is accepted. The Greenlight card is also accepted internationally and does not charge foreign transaction fees.

Moreover, the app works with both Apple and Google Pay.

3. What are my funding options for the Greenlight Card?

To load your parent wallet, you’ll either use a debit card or ACH transfer from your checking account for free. Credit cards cannot be used to load Greenlight.

The money for your child’s prepaid account can be transferred from your Parent Account or deposited directly by their employer.

4. Is Greenlight safe?

With Greenlight, you can turn off the card in the app, in addition to a variety of security features. Fingerprint and face recognition are also available. Children can be monitored and limits set by their parents.

In the event the company fails, your money is insured by the FDIC and SIPC.