A growing share of workers are anxious about finding steady work and paying their bills, according to labor analysts and financial counselors. The concern reaches recent graduates, mid‑career employees, and families juggling rising costs. The complaint is simple and blunt: job searches feel longer, and debt feels heavier.

At the heart of the worry is a mismatch. Many people are applying for similar roles, while employers post fewer openings or raise requirements. At the same time, higher borrowing costs make debt harder to manage. As one summary put it:

“Many feel frustrated by a tough job market and worried about debt, experts said.”

The mood is not all gloom. Some sectors keep hiring, and promotions still happen. But the stress is real, and it is reshaping how people spend, save, and plan their next move.

Table of Contents

ToggleThe Mood On The Ground

Career coaches report that candidates submit dozens of applications without a reply. Entry‑level roles often ask for prior experience. Mid‑career workers say they face more rounds of interviews and longer waits for decisions.

Financial advisors say the phones are ringing more. Clients ask how to prioritize credit card bills, student loans, and rent. The common advice is to keep cash on hand and talk early with lenders. The tone is cautious but practical.

Why The Job Hunt Feels Hard

Hiring tends to ebb and flow by season and industry. Retail and logistics add more roles late in the year. Tech and media can pause hiring during budget resets. Candidates notice these shifts fast.

Employers also test new screening tools. Automated systems filter resumes by keywords. That can save time but may miss qualified people whose resumes use different terms. It can also push candidates to tailor each application, which slows the process.

Hybrid work adds another twist. Remote roles attract national interest, so a single job can draw thousands of applicants. That raises the bar for interviews and lengthens timelines.

The Weight Of Debt

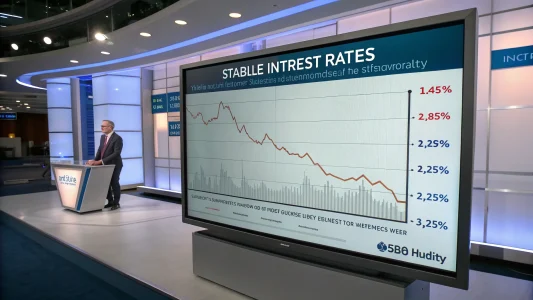

Debt concerns come from many directions. Credit card rates climbed with interest rate hikes. Car loans cost more each month. After a pandemic pause, federal student loan payments restarted, squeezing take‑home pay.

Advisors suggest building a simple plan. Put essentials first: housing, food, utilities, and transport. Then rank debts by either balance or interest rate and stick to the order. Small wins matter and reduce stress.

- Call lenders to ask about hardship options or payment plans.

- Automate minimums to avoid fees and hits to credit.

- Use a separate account for bills to prevent overspending.

Who Is Feeling It Most

New graduates face a classic catch‑22. They need experience to get hired, but need a job to gain experience. Many turn to short‑term contracts or certificates to stand out. That can help, but it adds costs and may not lead to a full‑time role.

Parents caring for children or older relatives face scheduling limits. Shift work can clash with school hours or appointments. Without flexible options, some step back from the labor force, which reduces household income and savings.

Workers in shrinking niches feel stuck. If their skills tie to a narrow tool or process, they must retrain. That takes time and money many do not have.

What Employers And Policymakers Can Do

Hiring managers can ease the gridlock. Clear pay ranges, shorter application forms, and fewer interview rounds help both sides. Skills‑based hiring can open doors for capable candidates without perfect resumes.

Public programs can help too. Job centers, short courses, and paid apprenticeships speed up reentry. Childcare support and transit discounts can lift participation. Debt relief tools, like income‑based student loan plans, offer a safety valve.

Signals To Watch

Job postings, quit rates, and average hours worked offer early clues. Rising postings suggest broader demand. Lower quits may signal caution among workers. Shorter hours can hint at softening orders.

On the debt side, watch late payment rates and savings levels. If more people fall behind, retailers and lenders feel it next. If savings improve, stress may ease.

The message from workers and advisors is plain: the job search is slower, and debt is heavier. Yet there are practical steps that help. Tighter resumes, direct networking, and transparent hiring can trim the wait. Smarter budgeting and flexible repayment plans can steady the month. The next few quarters will show whether hiring picks up and whether rates settle. Until then, people are doing what they always do in a squeeze—cutting costs, keeping receipts, and staying ready for the call that changes the week.