I’m sure that you’ve heard the old saying, “don’t put all your eggs in one basket.” Basically, it means don’t keep all your valuables in one place. In the event that you do and your basket is damaged, you’re out of luck.

The same is true for your investments. A retirement portfolio that consists entirely of stocks, bonds, or another commodity or asset class will suffer if something happens to the value of that particular investment.

Table of Contents

ToggleWhat is Diversification?

Simply put, you don’t want to be too reliant on a single investment type. As Ramit Sethi explains, “True diversification protects you from loss because, even if one [of] your investment holdings completely tanks, it won’t drag down the rest of your portfolio.

There are different types of assets that perform differently as an economy grows and shrinks, and they all offer different gains and losses:

- Over time, stocks offer the highest returns. During shorter periods, however, they can fluctuate wildly.

- As interest rates rise and fall, bonds may offer steadier returns with a fixed payout.

- Diversified funds typically hold many investments. But, a specific fund might hold only one type, like consumer goods companies. Accordingly, a fund’s diversification may be broad or narrow, depending on its management.

- As real estate appreciates over time, it can also generate income for the owner. The maintenance of physical real estate can be expensive, and commissions can be high as well.

- A savings account or a CD will grow steadily based on the interest rate or other contractual agreements.

- You can also increase your buying power and grow your portfolio through international investments.

- Cash provides security and stability.

- If you add annuities to your portfolio, you can either receive a lump sum or installment payments. During a market downturn, they can protect you from running out of money. A deferred annuity will pay out income at a later date; an immediate annuity pays out income right away.

There are some assets whose value rises rapidly and others whose value stays steady or falls. In time, leaders can become underachievers and vice versa. Diversification is appealing because these assets are not highly correlated with each other.

With major online brokerages, you can buy a broad range of investments at a low cost with zero commissions.

Don’t go overboard.

However, as I mentioned before, “a diversified portfolio shouldn’t contain too many options.” Adding new investments to your portfolio without knowing their purpose or holding multiple assets can be to track and monitor. Moreover, it does not help you diversify your portfolio.

In short, don’t overextend yourself. Ideally, a diversified portfolio consists of 15-30 different investments.

The Importance of Diversifying Your Retirement Portfolio

Your risk is minimized and your returns are maximized by diversifying your investments. Certain risks, like systematic risks, can’t be avoided. Unsystematic risks, like those in business and finance, can be hedged.

Additionally, if you manage your withdrawals smartly, a diversified retirement portfolio will allow you to enjoy your downtime for a much longer period of time. More importantly, you won’t outlive your money.

But let’s take a closer look at the benefits of diversification.

Variety of funds.

Different types of funds are often purchased by investors in order to diversify their portfolios. It is recommended that you begin with an index fund that matches the performance of the S&P 500 index. Then you can add a few more with varying levels of risk to that index fund.

Funds such as these could include:

- Bonds

- Shares in real estate investment trusts (REITs)

- Investment in overseas companies

- Shares of small, fast-growing companies

Under different market conditions, each of these fund types performs differently. Investing in them enables you to always have stocks that perform well, regardless of the current market conditions.

To get started, you can find information about mutual funds on websites like Morningstar. Typically, brokerages will also offer what is called a fund prospectus, which companies that sell stocks or bonds to the public must file with the Securities and Exchange Commission. A prospectus is an essential tool for making informed investment decisions.

Allocation of assets.

Diversification is most commonly achieved through asset allocation. It is possible to protect your portfolio from losing value by including a diverse range of investment assets in your portfolio. Examples would be stocks, bonds, cash, real estate, gold, and other commodities.

In a falling stock market, bond prices often rise as investors shift their money into less risky investments. As such, when the stock market drops, a portfolio including stocks and bonds will perform differently from one including only stocks.

There is a downside, however. Your portfolio won’t increase as quickly as it would with all stocks. Fortunately, it also protects you from major losses.

Asset class diversification.

Diversifying within asset classes is also a good idea.

During the dot-com bubble in 2000, investors who invested heavily in technology stocks suffered substantial losses when the market collapsed. In the same way, financial stocks were severely hit by the subprime mortgage crisis in late 2007 and early 2008. During those times, anyone who invested exclusively in these assets would have lost a lot of money.

In addition, putting all or most of your money in a single sector would be even riskier than doing the same for a single stock. When many employees of technology companies let their holdings become too concentrated in their employer’s stock in the late 1990s, that was what many investors did. But, a simple one-stock portfolio was comparable to flagpole sitters in the 1920s, sitting high in the air with a long, narrow pole.

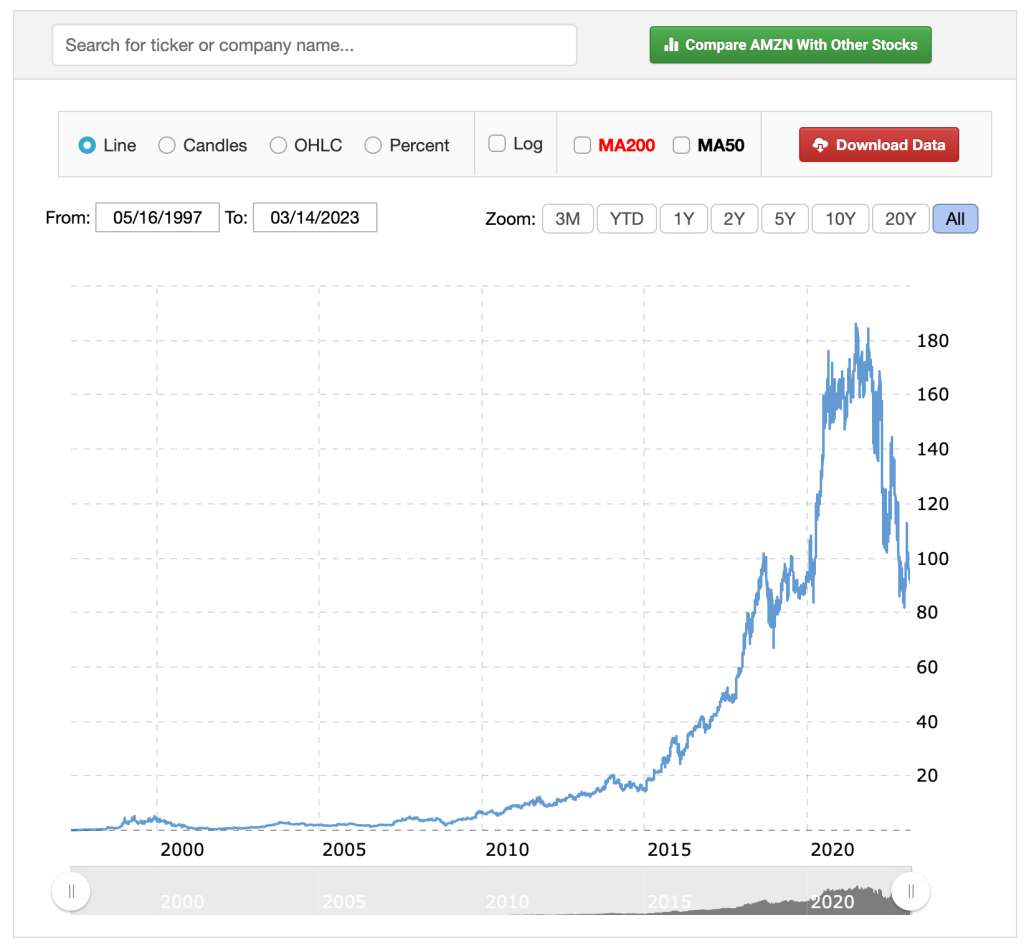

At the turn of the millennium, many people invested heavily in Amazon. At the end of December 2000, Amazon shares were trading for more than $100 per share. By October of the following year, they were below $6. Stocks like those were a cruel disappointment at that time if you were banking on them. In early 2023, the price is back up to $92.

Makes it possible to take advantage of compound interest.

The benefit of compound interest is available to investors when they select a mutual fund, for example, as an investment option. As a result, every investment generated interest on the principal amount and on the accumulated interest.

The fund holdings for both schemes should be different if you are investing in two different funds; otherwise, diversification is ineffective.

The more exposure, the greater the opportunity.

Investors may not be aware of certain assets, sectors, or stocks without diversified portfolio strategies. It is common for stocks to outperform each other during periods of rotation in the markets, in which one sector receives capital inflows while another suffers. Consequently, it is possible that the worst-performing market or sector could become one of the best in a year.

With that said, investors who only invested in US stocks would not benefit if international markets outperformed in the following years. It is always possible to expose a portfolio to sectors and markets with leadership through diversification.

Ensures long-term investment success.

Different sectors with high performance should be invested in by investors.

Why?

The investor is likely to earn higher returns on stocks if the market volatility is positive. Investors will be able to maximize mutual fund returns if it reduces debt.

Keeps your economic balance sheet in balance.

As we all know, assets and balance sheets are traditional financial statements. How does an economic balance sheet work?

The two main components of an individual’s assets are their financial capital and their human capital. An individual’s financial capital consists of both tangible (such as real estate) and intangible (such as stocks) assets. In investing, human capital is viewed as an implied asset; it is the present value of an investor’s future income adjusted for the probability of survival. On an individual’s Economic Balance sheet, these two components are combined to form assets.

Consider the following example to illustrate what human capital is and how it applies to investing.

An engineer working in oil and gas has extremely cyclical and volatile human capital that is heavily correlated with earnings in this sector. The engineer’s financial capital (i.e. their investment portfolio) would be balanced by a diversified portfolio that underweighted energy stocks and reduced overall risk on their net worth.

The sectors in which investors work and are familiar tend to have a bias, resulting in them overweighting that sector in their investments. Investing in a diversified portfolio helps investors complement their human capital with traditional assets.

Tax advantages.

Depending on the type of retirement account, different tax advantages can be gained in retirement. You must diversify your accounts just as you must diversify your investments in order to reduce your tax burden.

“Every dollar you lose to taxes is one less dollar in your pocket,” Maria Bruno, Vanguard’s head of U.S. wealth planning research, told USA Today. “Holding different account types helps manage uncertainty around future tax rates because we don’t know in 20 to 30 years, what the tax regime will be or what your personal tax rate might look like.”

So, in addition to investment diversification, you should also consider tax, or balance sheet, diversification. By using different types of accounts, you can maximize tax savings when you retire by spending money from various accounts.

Accordingly, you should have money in three different types of investment accounts:

- Brokerage accounts, for example, are fully taxable, and dividends, interest earnings, and capital gains are taxed annually. After age 73, they aren’t required to make minimum distributions. Generally, capital gains are taxed at a lower rate than ordinary income when withdrawn from these accounts.

- A tax-deferred account, such as a 401(k) or IRA, is funded with money you haven’t paid taxes on and grows tax-free until you withdraw it. Taxes are imposed on withdrawals as ordinary income.

- A tax-free account, such as a Roth IRA, is funded with after-tax funds, so withdrawals or earnings will not be taxed.

Guaranteed lifetime income.

In addition to building a lifetime income stream, annuities provide an insurance element to your retirement savings. If you outlive your investments, an annuity can help ensure your family has income if you die too young.

An annuity that guarantees lifetime income is an important component of your retirement portfolio. Combined with other investments, guaranteed lifetime income can contribute to your retirement income while reducing the risk that you will run out of funds.

It is also possible to lock in a variety of features and payout rates by purchasing a series of smaller lifetime income annuities over time.

Streamlines portfolio monitoring.

Because not all investments will perform badly at the same time, a diversified portfolio is more stable. In the case of equity shares, you will have to spend a lot of time analyzing the market movement and determining what your next steps should be.

In the same way, if your sole investment is in low-risk mutual funds, you will be concerned about increasing returns. As a result of diversifying, you will spend less time on the portfolio and will have less maintenance to do.

FAQs

1. Exactly why does diversification matter?

You can reduce your chances of experiencing losses by diversifying your investments. Spreading your investments across different assets reduces the likelihood that one negative event will wipe out your entire portfolio. A diversified portfolio preserves your capital and increases your risk-adjusted returns by investing in a variety of assets and companies.

2. When it comes to investing, what does diversification mean?

In diversification, funds are allocated across various vehicles, industries, companies, and other categories to mitigate risk and maximize returns.

3. What is an example of a diversified investment?

Different asset classes, such as stocks, bonds, and other securities, are included in a diversified investment portfolio. It doesn’t stop there, though. By purchasing shares in a variety of companies and asset classes, these vehicles diversify their portfolios.

In a diversified portfolio, stocks from retail, transportation, and consumer staple companies may be included with bonds from corporate and government issues. It is also possible to diversify further by opening money market accounts and keeping cash on hand.

4. When you diversify your investments, what happens?

In order to maximize your returns, diversify your investments to reduce your exposure to risk. While you can’t completely eliminate some risks, such as systematic ones, you can reduce unsystematic risks, such as business or financial risks.

5. Is there a right level of investment diversity?

Your risk tolerance and specific goals will determine how much diversification you need. As such, it is impossible to define a “correct” form of diversification. You can, however, over-diversify, or over-spread your investments.

In addition to making it harder to track and manage your money, holding more than five or six different types of assets may not help you achieve the purpose of diversification, which is to manage the risks you take to earn a reasonable return, by constantly adding new investments to your portfolio.

Working with a third-party professional can help you measure the “right” amount of diversification for you. To reach your long-term investing goals, you can work with a qualified investment advisor to determine how much risk is appropriate for you.