Credit card processing fees are a necessary evil that are determined by a variety of factors. These factors are typically your industry, the type of transaction, the credit card types, and processing volume. These components are used to determine a tiered pricing model for a merchant account.

While most processors offer different pricing models, the most opaque and expensive discoveries are in the tiered pricing model.

To save some of that hard-earned money your business has made, here’s a brief overview of tiered pricing, why it sucks, and what you can do about it.

Table of Contents

ToggleBreaking Down Tiered Pricing

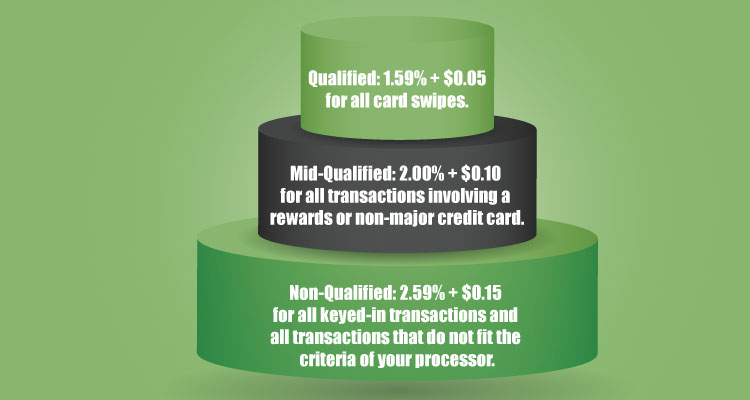

Tiered pricing, which is also known as bundled pricing, is a merchant account structure that categorizes transactions into tiers — with each tier corresponding to a fee — in order to assess charges.

To make things even more confusing, these charges are not standard across all processors. The most common tiers are qualified, mid-qualified, and non-qualified.

The easiest way to identify a tiered pricing model is to look for the qualified, mid-qualified and non-qualified rate tiers that the pricing model is named after. Just remember, often these terms are abbreviated, merely as, “qual,” “mqual” and “nqual.”

Based on these three tiers, a tiered pricing model could look like this:

- Qualified: 1.59 percent + $0.05 for all card swipes.

- Mid-Qualified: 2.00 percent + $0.10 for all transactions involving a rewards or non-major credit card.

- Non-Qualified: 2.59 percent + $0.15 for all keyed-in transactions and all transactions that do not fit the criteria of your processor.

The main issue with this model is that you may be given a too-good-to-be-true rate. That’s for merchants who fall into the qualified tier. Most businesses fall into the mid – and non-qualified tiers.

To make matters worse, the criteria and rates for each of these tiers are subjective, so not only are you now paying more money, you may have no way in which to rectify the matter.

Another concern regarding tiered pricing is that Visa and MasterCard have lengthy lists of interchange category fees.

For example, if a customer used their Visa with a United Airlines rewards program for a $100 purchase, then there would be 2.4 percent + $0.10 per transaction fee, which equate to $2.50 for that purchase.

Here’s where tiered pricing gets really tricky.

Since the merchant processor has to make a profit, they pass along higher rates to business owners. So, in the case of that $100 purchase, the merchant will lose money for qualified rates and they would barely break-even with mid-qualified.

The only way for the merchant to make a profit is to tack on a non-qualified fee to the charge.

This means that you’re paying a little more than that initial $2.50. For instance, if you’re non-qualified rate came out to 3.56 percent + $0.38, you end up end up paying $3.94 to accept that credit card.

That may not sound like much, but it can quickly add-up and ultimately make a dent into your profits.

Why Tiered Pricing Sucks

We covered the two biggest complaints regarding tiered pricing. Here’s a closer look at why businesses aren’t fans of this pricing model:

- It’s expensive. You could save up to 50 percent by switching to a more competitive model.

- It’s inconsistent. The tiers aren’t the same among processors.

- It’s not transparent. Interchange fees are hidden.

- Fluctuations. Processors can change the criteria for rates whenever they like without notifying you.

- Bundling interchange fees. Since you’re not paying interchange fees directly with tiered pricing, the processor does so for you. This means that it classifies these interchange fees under its own rate structure. It then assigns individual interchange categories to its qualified, mid-qualified or non-qualified pricing tiers.

- Processors keep refunds. When there’s a refund from a customer, you should receive a portion of the interchange fees paid on the original transaction. With tiered pricing, however, the processor keeps these credits as additional revenue.

- Lost Durbin savings. Under the Durbin Amendment to The Dodd-Frank Wall Street Reform and Consumer Protection Act, banks can only charge 0.05 percent plus $0.21 for interchange fees. However, that doesn’t apply to processors.

What You Can Do About Tiered Pricing

Unfortunately, because tiered pricing has been establish. It’s controlled by individual credit card processors. There really isn’t much that you can do when it comes to receiving more favorable rates.

That Doesn’t Mean These Rates Are Set-In-Stone.

Educate yourself on the criteria used for each tier. Carefully review your statements each month, and contact your processor to find out if the criteria have changed. Being vigilant and knowledgeable could help you negotiate lower rates.

The best course of action eliminates the tiered system altogether. By working with a processor that offers alternative pricing models — preferably interchange plus and flat rates. These rates are typically less expensive and more transparent than tiered pricing.

Thanks to more competition within the credit card processing industry, interchange plus rates are essentially available to everyone.

One Final Note

Don’t let a sales rep from a processor trick you into thinking that the tiered pricing model is your only option. It’s not. Before settling on a processor, do your homework and compare multiple processors that offer a variety pricing models that best fit your business.