Like it or not, financial pitfalls are a part of life. Financial mistakes can happen even with the best of intentions. However, it is not all about making mistakes. In fact, the opportunities you don’t take advantage of are part of the reason you are killing your savings.

Even so, it’s never too late to learn from these mistakes, and it’s never too soon to avoid them. With that said, in this article, we’ll look at 25 ways you’re killing your savings and how to avoid them.

Table of Contents

ToggleTop Ways You’re Killing Your Savings

1. Delaying financial planning.

All of us have been guilty of putting off things until another day, whether it was starting a workout regimen or saving money. The problem with the “I’ll do that later” philosophy? You may never follow through — despite your best intentions.

Additionally, you may have missed some opportunities to plan your financial future. And, even worse, you’re missing out on the power of compounding.

Consider, for example, investing $1,000 and earning a 7% return annually. Your account would be valued at $1,070 after year one if you earned $70. Your account would be worth $1,144.90 in year two after earning $74.90. By year three, you would have earned $80.14, bringing your total to $1,225.04.

In time, this can snowball and potentially add up to a large amount if your account continues to grow in this manner.

Simply put, putting off financial chores only contributes to an ever-growing to-do list. Delaying time-sensitive tasks like paying off debt or planning for retirement could cost you more in the long run.

How can you avoid procrastination? Make managing your finances easier by breaking them down into manageable chunks. While you don’t have to organize your finances overnight, ignoring your to-do list won’t make it disappear. Consider setting aside time once a week or once a month to monitor your finances and accomplish important tasks.

2. Frivolous and excessive spending.

Losing one dollar at a time can result in a lot of financial losses. You may not think it’s a big deal to order a double-mocha cappuccino, go out to dinner, or watch a pay-per-view movie. But it adds up.

Consider this. Americans spend an average of $2,375 per year on dining and takeout. These funds could be used to pay off a credit card debt or pad your savings.

It’s very important to avoid this mistake if you are experiencing financial hardship. When a few dollars separate you from foreclosure or bankruptcy, every dollar counts. If you aren’t in that bad of financial shape, consider dining out or getting takeout less often. When you do, look for deals or have lunch instead of dinner.

3. Living beyond your means.

Chances are you’re living above your means if you’re sweating over money. To be sure though, take a look at these five signs that you’re heading for trouble.

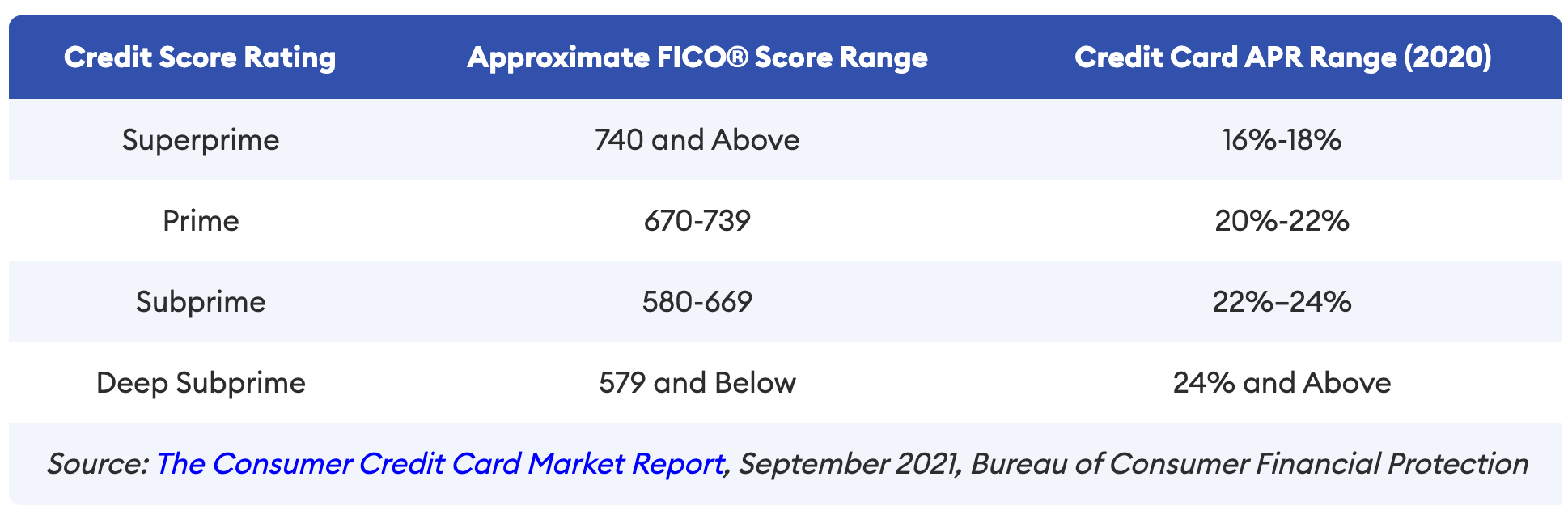

- Your credit score is 579 or lower. In this case, additional credit is difficult to get at a reasonable interest rate as this is below the average.

- The amount of money you save is less than 5% of your gross income. It’s likely that you’re over your head if this is the case. A person who spends more than he or she earns is definitely in over their head.

- You have a rising credit card balance. It is very likely that you will end up in debt if you only pay the minimum each month on your credit card balances or if you only contribute a small amount to the principal balance.

- You spend more than 28% of your income on housing. Determine how much of your monthly income goes toward mortgage payments, property taxes, and insurance. You may be overextending yourself if it exceeds 28% of your gross income.

- You are drowning in bills. You may be overstretched if your monthly income is sliced and diced to cover dozens of unnecessary installment purchases.

Do not mistake living below your means for being a cheapskate or skipping out on life’s experiences. Instead, it “simply means that you’re spending less or equal than you’re making each month,” explains Deanna Ritchie in a previous Due article. “As a result, you aren’t putting yourself into debt by living off of plastic. And more importantly, this will help you create a more stable financial future.”

“Of course, living within your means requires discipline and a little sacrifice,” adds Deanna.

4. Lending friends and family money who won’t pay you back.

Of course, covering a friend’s dinner is very different from helping to pay their rent. Even if you have the money currently, you’re playing with fire if they have a poor track record when it comes to managing their finances.

For example, what if they don’t pay you back and you lose your job or have a medical expenses? The cash you were supposed to have will run out. If you can’t find the money from other sources, you may be forced to borrow it.

Helping someone out can take many forms. It may be as simple as bringing them lunch until they are stable or helping them update their résumés.

According to Bankrate: 60 percent of Americans have helped out a friend or family member by lending cash with the expectation of being paid back, while 17 percent have lent their credit card and 21 percent have co-signed for a financial product like a loan or rental

5. Not having an emergency fund.

“An emergency fund pertains to the amount set aside to maintain financial security,” explains Chris Porteous in a previous Due article. “In essence, this is the portion of your savings that you should only spend for emergencies.”

This money can be used for urgent expenses during times of financial hardship. By creating a safety net, you prevent yourself from withdrawing money from your primary savings account. As a result, you are prevented from relying on costly alternatives such as bank loans, payday loans, or credit cards. “Hence, your retirement fund will remain untouched.”

Most emergency funds consist of liquid assets. These are assets that are easily convertible into cash. In order to cover urgent expenses, you must have the means to do so. Some examples are your investments in financial markets and your receivables from debtors. Even when earnings are inconsistent, they provide an instant cushion to keep you afloat.

“When you build an emergency fund, do not save a considerable portion of your income right away.” Chris adds. “Only set aside the amount that will not hurt your financial growth since you have constant expenses.” However, make sure you have enough money to handle future mishaps. This may include unplanned hospitalizations, unannounced layoffs, and property damage.

6. Lack of a budget for each month.

Perhaps the most common money mistake is not sticking to a budget. In fact, according to a survey by loan servicing company OppLoans, 73% of Americans do not regularly adhere to a budget.

Why’s that concerning? We often burn holes in our pockets with little luxuries that we don’t even notice. These could include gym memberships, nights out, and impulsive purchases. There is nothing wrong with making these purchases every now and then. It becomes problematic when they become a habit and don’t fit within your monthly budget.

“Do you need to track every single dollar coming in and out? Absolutely not,” says Aja Evans, a licensed mental health counselor who specializes in financial therapy. “A budget is for making sure you have a plan or understand where your money is going.”

Along with the hassle of tracking expenses, budgeting is “hard for people psychologically,” because they associate them with self-denial. Budgets aren’t just about restrictions, Evans says. Additionally, you can prioritize things you enjoy, like dining out or vacationing.

7. Putting off retirement savings until later in life.

As Millennials and Gen Z workers enter the job market, they are more concerned with paying off their student loans than saving for retirement. After all, in the early years of one’s career, 65 may seem far away. In the long run, however, money saved early will grow into a much larger nest egg.

As an example, let’s say that start contributing $2,000 annually to an IRA with a 6 percent annual return at age 25. At 65, your investment will be worth $328,095 (40 x $2.000).

What if you started your $2,000 annual contribution at 30? After investing $70,000 (35 times $2,000), you’ll only receive $236,242.

Overall, the sooner you start saving, the better.

8. Inadequate insurance coverage.

Insurance pays for contingencies because people don’t want to spend money on anything without a guarantee of return.

It is possible to ruin your finances without insurance if you do not have enough cash to cover a large medical bill, car accident, house fire, or theft. It’s a small price to pay for ample protection.

Conversely, paying for redundant or unnecessary insurance coverage can drain your bank account. You may be able to secure rental car insurance through your credit card or auto insurance, for example.

9. Lifestyle inflation.

With an increase in income, you tend to spend more on your lifestyle. Often, you don’t even notice this type of waste of money until it’s too late.

To be fair, when you can afford certain items, it may be worth spending more on them. The long-term cost of well-made clothes is lower than that of cheap ones, for instance.

You can often live comfortably even when you make less money if you buy things and live the way you did when you made less money. It will not make you happier or enhance your quality of life if you increase your spending.

Spend your extra income on things you really need instead of on fancier things. Among the possibilities are saving more, increasing your retirement contributions, or paying off debt. If all that’s in order, consider buying an annuity.

With annuities, you can save your money tax-deferred until you receive retirement income. You won’t have to worry about outliving your retirement savings with them. In addition, they can provide for your family after you die or for your own long-term care if the need arises.

10. Repaying the wrong debt first.

When you have student loans, a car payment, credit card debt, and a mortgage, it can be difficult to know where to start. In spite of this, financial advisors caution you to prioritize paying off your debts carefully.

It is more common for people to pay extra on their mortgage, which has a 3% interest rate. In contrast, they don’t pay high-interest rates on their student loans or car loans.

Whenever you plan to pay off your debt, start by writing down all your balances and the interest rates associated with them. Debt with the highest interest rate should be tackled first, such as credit cards, before moving on to the debt with lower interest rates.

If you are experiencing [credit card] debt, you need to handle it urgently, possibly even delaying retirement contributions while you get your balances under control. When you pay off your debts, you will not only improve your credit score, but you will also have more money to invest and save. In particular, this is true when the average credit card interest rate is 23.77%, according to Forbes Advisor.

11. Your free time is not being used to earn money.

Your bank account isn’t the only reason you should make money in your free time. A little extra income can be the difference between achieving your long-term financial goals and not achieving them. In addition, it gives you the extra funds to treat yourself when it’s time.

Also, don’t think you can just make money on the side of your wallet. You can enhance your career prospects by having a side hustle, which will impress potential employers as this can develop your money skills.

It doesn’t matter if it’s pet sitting, starting and running your own business, selling photos online, or any other passive income idea, every little bit helps.

12. Buying new cars without considering used cars.

A new car’s value drops the minute you drive it off the lot. It differs from car model, make, upkeep, and other factors, but the depreciation rate of a new car can be as high as 20% (or even more) after one year and reach around 40% after five years.

For this reason, used cars may be a good option if you need new wheels. Depreciation has already been paid for by the previous owner – not you. If you sell your vehicle after three to six years, you’ll gain more money than if you sell it after one to three.

13. Using home equity as a piggy bank.

The act of refinancing and withdrawing cash from your house means you are giving away ownership to another person. If you’re able to lower your rate or refinance and pay off high-interest debt, refinancing might make sense.

Alternatively, you can open a home equity line of credit (HELOC). A HELOC, is a revolving credit line secured by your home that can be used for large expenses or to consolidate higher-interest rate debt from other loans, such as credit cards. In addition to having a lower interest rate than some other common types of loans, a HELOC may also be tax deductible.

14. Not diversifying your investments.

In the event that all of your savings are invested in one type of investment and it performs poorly, you will lose money. The best thing to do is to spread your money among a few different accounts. Your investment portfolios should be managed by the same financial planner or held in the same blanket account – with varying levels of risk and reward.

Using this strategy, you can grow your wealth while maintaining stability in lower-risk investments while capturing some of the benefits of riskier investments.

15. Not paying your bills on time.

Late fees, damaged credit scores, and other negative financial consequences may result from falling behind or missing bill payments. Your credit score can be damaged if you fail to meet your monthly obligations as well. In some cases, as little as two late payments can result in a permanent mark on your credit report.

The easiest solution? Streamline the process of paying your monthly bills by setting up an automatic payment through your online checking account, brokerage account, or mutual fund.

Consumer Affairs reports that “Less than a third (32%) of respondents were able to save money consistently, while just over a quarter (26%) were able to invest. About a fifth said their ability to afford bills worsened due to inflation.”

16. Missing out on your employer matching contributions.

Do you max out your workplace retirement plan (401k, etc)? Is your employer offering a matching contribution?

It applies specifically to you if you answered yes to both questions.

Why? It is possible that you are missing out on free money. Moreover, it could be free money accumulating over a 30-year period.

There are many types of workplace retirement plans out there, such as 401k plans, 403b plans, and 457 plans. Even so, 17% of employees have access to employer-sponsored benefits but do not contribute. MagnifyMoney found that 12% of employees who do not return company matching funds leave the funds on the table, totaling 17.5 million people.

Considering opting into an auto-escalation feature at your employer can increase your retirement savings. As a result of this feature, your savings rate will automatically be boosted each year by 1% or 2%.

For anyone under the age of 50 in 2023, the contribution limit will be $22,500. A contribution limit of $30,000 applies to people 50 and older. Having an employer who matches your contributions AND maxing out your 401k plan before the end of the year can also present a problem. After maxing out your 401k plan, you must stop contributing. If you stop contributing, your employer will not match your contributions.

17. Having an unpayable credit card bill.

When you use your credit card as free money instead of using what you have, you are on the fast track to financial ruin. In this regard, treat your credit card just as you would a debit card.

Have you been thinking about getting that new iPhone? Rather than putting it straight on your credit card, only use it if you’re confident you’ll be able to pay for it immediately. After all, even at a somewhat reasonable 16.99% APR, a $1,000 balance would result in monthly interest charges of $14.06.

Likewise, buying now, and paying later services like Klarna is a also big no-no. According to a Consumer Reports survey, 11 percent of people who use buy now, pay later services miss at least one payment, often because they lose track of when it’s due or don’t know when it’s due. Others said they thought they’d set up automatic payments only to discover they weren’t. They later discovered that their payments had still gone through, even though they thought they had canceled their purchase.

In addition to late fees and interest charges, people who miss buy now, pay later payments may have their credit history affected.

Furthermore, 5 percent of people who used a buy now, pay later service said they couldn’t otherwise afford the purchase. That can cause trouble: People say they miss payments mostly because they thought they had the money but didn’t.

TL;DR: Make sure you only purchase what you can afford.

Having the ability to pay off your credit card or other credit every month is essential. Having missed payments on your credit report can adversely affect your ability to obtain loans or mortgages in the future.

18. You are not monitoring your credit scores and reports.

Have you ever thought about how your credit score can affect your life? A credit score is important when you want to borrow money, buy a house, or even rent an apartment. If you discover any problems or errors with your credit profile, you can work with your lenders to correct them.

Because of their importance, it’s vital that you regularly check your credit score.

Additionally, Equifax® credit reports are free each year if you create a myEquifax account. To get your free Equifax credit report and VantageScore® 3.0 credit score based on Equifax data, click “Get my free credit score” on your myEquifax dashboard. Credit scores come in many forms, including VantageScores.

19. Living paycheck to paycheck.

The personal saving rate in the United States decreased from 7.5 percent in December 2021 to 3.4 percent in December 2022. Due to this, it should not be surprising to learn that many households live paycheck to paycheck. As a consequence, you cannot prepare for an unforeseen problem, which has the potential to become a disaster.

As a result of overspending, people are put in a precarious position, one where they can’t afford to miss a paycheck. In the event of an economic recession, you do not want to find yourself in this position. Thankfully, there will be very few options available to you if this happens.

The advice of many financial planners is to keep three months’ worth of expenses in a quick-access account. Changing economic conditions or loss of employment could drain your savings and place you in a debt cycle. If you don’t have a three-month buffer, you may lose your home.

20. Fad investments.

Even if cryptos or fad investments do make you a lot of money in a short period of time, the disruption to your investing strategy can cause you to lose money long-term. To put it another way, you should stick to investments that have a proven track record or only invest money you’re willing to lose.

Or, in the words of Paul Samuelson, “Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

21. Failing to file taxes or not paying them on time.

If you do not pay your tax debt, you will be charged penalties and interest every month. A lingering balance is going to cost you more money in the long run.

The good news? A tax debt reduction or installment agreement are two methods the IRS offers for settling delinquent balances. An experienced tax professional can guide you through the process, typically at no cost.

22. Loyalty to expensive energy and bank providers.

It is time to put an end to staying loyal to banks and energy providers. You might think you’re getting a great deal if you’ve been a customer for a long time. In most cases, it will be the exact opposite.

People tend to think that switching utilities are a hassle, so banks and other utility providers know this. As a result, they rely on your laziness to keep your business and your money.

However, switching bank accounts is mostly automated today. For new customers, some banks offer great cash rewards and interest rates on savings accounts. When you think you could find a better deal, it’s definitely worth shopping around.

23. Your career isn’t being maximized.

Your career is your most important financial asset. Since the average American can expect to earn around $1.7 million in their lifetime, it’s no wonder. That comes out to just under $42,000 per year. However, if you start at $40,000 today and earn 3% pay increases over 45 years, you will earn over $3.7 million.

In short, you can lose millions of dollars if you don’t work hard to maximize your income.

So, if you want to avoid this bad money mistake, you simply need to develop and implement a career plan to maximize your earnings. Also, do not quit your job without a backup plan. The stress of working at your current job is nothing compared to the stress of worrying about how you’ll pay for essential expenses.

24. Neglecting your health.

According to one study, medical reasons may account for two-thirds of bankruptcies in the United States. Even if that statistic is skewed, we all know how difficult it can be for families to pay for medical costs.

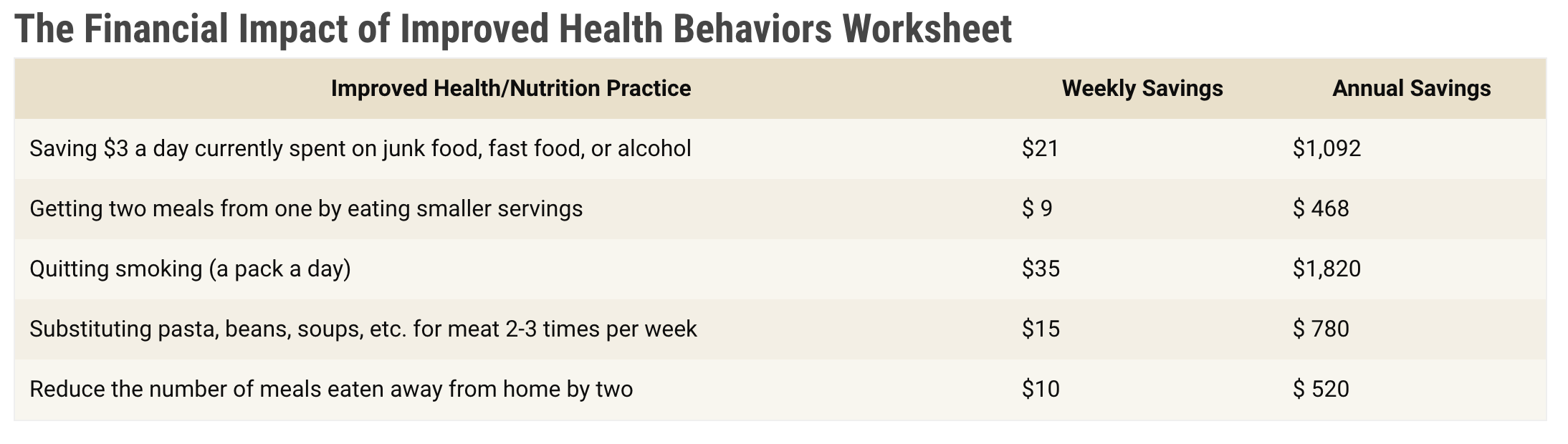

Aside from that, unhealthy habits cost a lot of money. For example, if you give up smoking or junk food for $10 a day, you can save $3,650 a year, plus interest. And, those are just the immediate savings.

Long-term savings can also be made over the course of a person’s life. Overweight people could save between $2,200 and $5,300 on their lifetime medical costs if they lost 10% of their weight. Increased medical costs can be reduced by thousands of dollars per year by delaying the onset of diabetes.

Additionally, employers are increasingly recognizing the benefits of healthy employees. In the end, healthy employees take fewer sick days, so the company pays less out of pocket for health insurance. As such, companies may offer financial bonuses for not smoking or discounts for gym memberships.

25. Reluctance to learn about finances.

Almost no personal finance education is offered in public schools, so many Americans rely on what they learned from their parents. Despite thinking you’ve got things under control, you can avoid many financial mistakes by learning financial literacy and best practices.

The good news? Learning how to become a financial master has never been so easy. Educating yourself is the best way to avoid making financial mistakes, whether you watch videos, read blogs, or listen to podcasts.

FAQs

What is a realistic budget?

Budgeting and planning your finances can be daunting. Taking the time to look back at your past spending habits is a real moment of honesty. Do it anyway.

To get started, try the 50/20/30 system.

Your money is divided into three categories: 50 percent for essential expenses (rent, utilities, car payment), 20 percent for savings, and 30 percent for flexible spending. That’s all there is to it. If you’re single and tend to spend most of your meals out rather than in, the flex percentage works well for you.

Is there a limit to how much debt one should have?

The answer depends on the situation. In contrast to credit card debt or what is often called “bad debt,” student loans are considered “good debt.” This is due to the fact that student loan debt has a lower interest rate and that getting a degree will lead to a higher-paying job.

Try to keep your credit usage to 30 percent or less. In general, your debt should be less than 20 percent (including car loans, real estate loans, and personal loans).

Are you still unsure? The following questions will help you gauge how you’re doing:

- Is it possible for you to make only the minimum payment?

- Do you skip some bills in order to pay others?

- Have you maxed out your credit cards?

- Are you living paycheck to paycheck?

You should come up with a dedicated plan if one or more of your credit cards are maxed out. Prioritize paying off the card with the highest interest rate first, and then pick off the rest one by one.

Does it matter if I don’t pay off my credit card every month?

The ability to lease a car, take out a loan, or rent an apartment requires a good credit score. All of these things are pretty essential. Credit collectors are trained to increase your anxiety levels to sky-high levels when you have bad credit.

Make sure you pay off your credit card each month. Get in touch with your creditor if the debt seems impossible to pay. Perhaps you can work out a revised payment plan and save a ton of money on interest.

What is the recommended amount of money I should have in my “Emergency Fund”?

According to financial circles, three to six months’ post-tax income is a good starting point. The ideal is six months, but most of us don’t have any emergency savings, so even half that is a reasonable start.

What is the right time to begin saving for retirement?

As soon as possible. As a result of compound interest, the earlier you start saving, the more you will accumulate.

In the absence of a 401k or similar model at your employer, consider setting up a personal retirement account. You must participate in your employer’s retirement plan if it is an option. As a side note, if they offer matching, make sure to take advantage of it every time.

It is also worth researching IRA options, including Roth IRAs as well as Traditional IRAs. You may also want to learn about mutual funds, bonds, and more if you’re more advanced in your retirement savings.