Going from employee to business owner can be scary. You want to make sure you are setting up everything right so that it doesn’t all fall apart later. When running a business there are times when you should rely on a lawyer. However, when you are forming a business you can skip the legal fees.

It takes a bit of time, but it is easy to create and file the necessary documents to form a legal entity. When I was just a student working at a law firm; I was assigned to register a client’s business with the state. The client was charged $80 an hour for my work while I earn $12 an hour. I wasn’t given any direction and had to figure it out on my own. If I can do it, so can you. Here are the six steps you need to register your legal entity with the state and remain in good standing.

[heading title=”1. Decide on the type of legal entity” type=”h1″ font_size=”” margin_top=”30″ margin_bottom=”30″ color=””]

There are four main types of legal entities you can choose from, and they each have their benefits.

Sole Proprietorship is the default where you and your businesses are one and the same for tax purposes.

A limited liability company which is better known as an L.L.C allows your personal assets to be protected should something happen to the business. Since LLC’s are state entities, the rules and regulations vary by state.

An S-Corp is similar to an LLC in that it provides “pass through” profits. However, the corporation itself is required to file a tax return.

A C-Corp, on the other hand, has the profits taxed twice, once via business taxes and again when paying yourself from the corporation. For small businesses, this double taxation can be a heavy burden.

The type of legal entity will work best depends on your business.

[heading title=”2. Visit Your State’s Secretary of State Website” type=”h1″ font_size=”” margin_top=”30″ margin_bottom=”30″ color=””]

The Secretary of State’s website will outline the filing requirements and fees associated with registering your legal entity (business). The requirements and information provided can vary by state, but typically there will be a “corporations” section available.

After finding the appropriate forms you will need to fill out, you will want to run a name search. You will need to search through the state’s existing corporations to ensure the name you want for your business is available. If someone already has the name, your application to register your business will be turned down.

[heading title=”Get an Employer Identification Number (EIN)” type=”h1″ font_size=”” margin_top=”30″ margin_bottom=”30″ color=””]

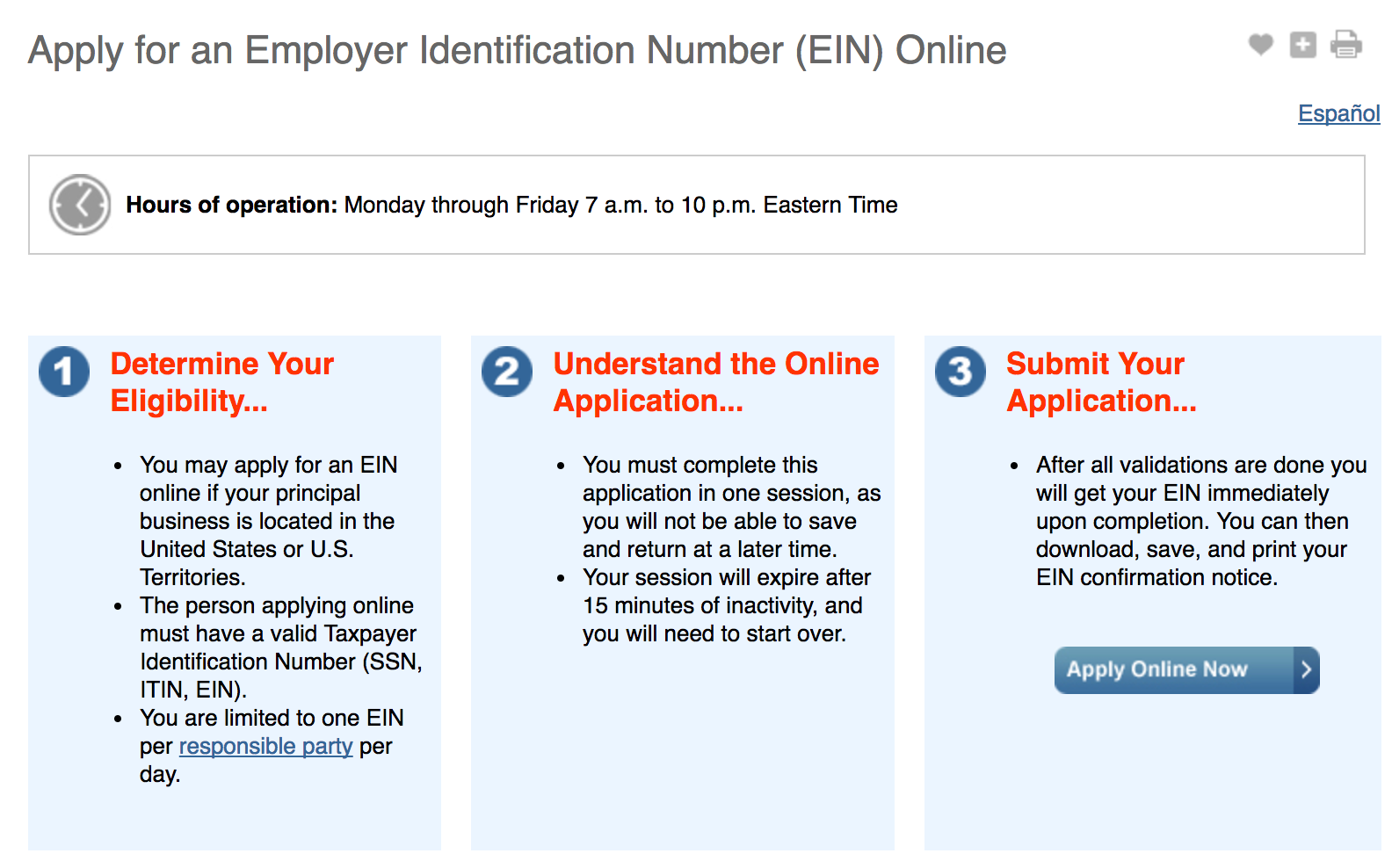

An EIN is your business’s version of a social security number. You can apply for and receive an EIN in about 15 minutes on the IRS’ website. Some states will require you have an EIN before registering your business with the state.

[heading title=”Research Other Articles of Incorporation or Articles of Organization” type=”h1″ font_size=”” margin_top=”30″ margin_bottom=”30″ color=””]

The filing documents needed to register your business are typically either articles of incorporation or articles of organization. The filing documents will need you to provide the name of your company, address, business owner, and a few other things sometimes including a description of your business. There is no need to come up with the description from scratch.

Using the corporation search on your Secretary of State’s website, pull up similar business’ articles of organization and see what they used as a description. After you’ve researched a few, draft the description of your business. The description of your business does not need to be particularly long or detailed.

[heading title=”Submit the Forms and the Required Fees” type=”h1″ font_size=”” margin_top=”30″ margin_bottom=”30″ color=””]

Follow the instructions for submission of your registration documents and the required fees. Some states will allow you to submit the registration documents online; others may require you to mail in the documents. If no other businesses are operating under the name you have chosen and you have adhered to rules and regulations that apply to your type of business activity, the state will likely accept your registration.

[heading title=”Keep Up with Annual Report Requirements” type=”h1″ font_size=”” margin_top=”30″ margin_bottom=”30″ color=””]

To maintain your business registration, you will need to comply with annual report requirements. The State uses the annual report to ensure all information about the company is up to date. Annual reports typically have a fee associated with filing, but is important to keep up with annual reports. Falling behind on annual reports could result in the administrative dissolution of your company. It is a lot less work and less expensive to keep up with annual reports than it is to reinstate a dissolved company.