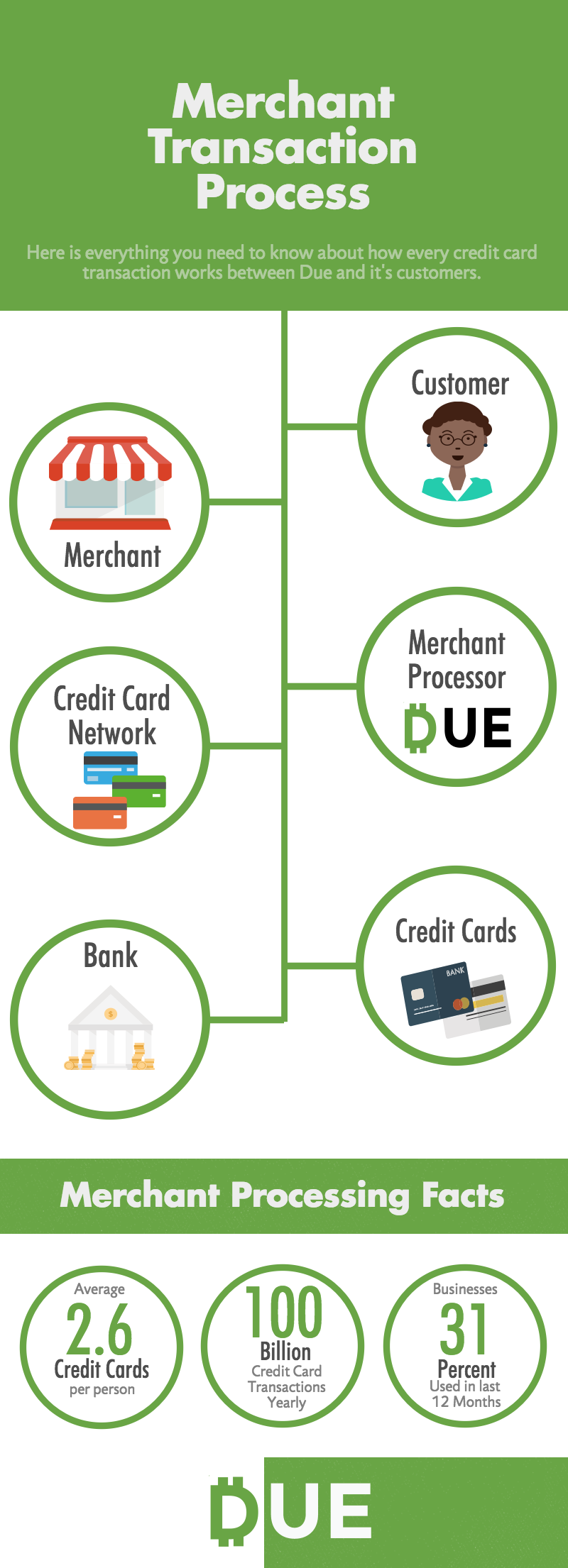

As a business owner, you know that accepting credit cards is an effective way to attract more customers who prefer using this payment type. And, if you didn’t know, there are plenty of statistics that prove the popularity of credit cards as a payment form among consumers and businesses. In this post we will teach you the merchant transaction process with our company Due.

Our infographic below (bottom of post) shows that the average person has 2.6 credit cards (Gallup).

There are approximately 100 billion credit card transactions per year (Gallup). And, 31 percent of business owners have used a credit card in the last 12 months (National Small Business Association).

Credit Card Forum offers a comprehensive list of interesting statistics related to credit card use:

- There were 775.4 payment (debit, credit, prepaid) cards actively being used in the U.S. in 2012 (Federal Reserve).

- There were 333 million U.S. Visa credit cards in circulation as of March 2016. Visa’s total purchase volume on U.S. credit cards was 1.412 trillion in the 12 months that ended June 30, 2016 (Visa Operational Performance Data).

- There were 195 million U.S. MasterCard credit cards in circulation as U.S. of June 2016. MasterCard’s total purchase volume on U.S. credit cards was $653 billion in 2015 (MasterCard Supplemental Performance Data).

- There were 57.6 million U.S. American Express credit cards in circulation as of December 2015. American Express’s total purchase volume on U.S. credit cards was $721 billion in 2015 (American Express 2015 annual report).

- Discover’s total U.S. credit card purchase volume was $135 billion in 2015 (Discover annual report 2015).

- Twenty-nine percent of cardholders are “transactors” (which means they pay off their balances in full each month) while 41.2 percent of cardholders could be described as “revolvers” (which means they carry a balance month to month) as of the second quarter of 2014 (American Bankers Association).

Despite these statistics on credit card use, you may still be unsure about how the merchant transaction process works or you may be concerned by some of the recent statistics related to credit card fraud:

- 17.6 million Americans (7 percent of all U.S. residents) were victims of identity theft in 2014 (up from 16.6 million in 2012); approximately 42 percent of 2014’s identity theft incidents involved stolen and misused credit card information; and 65 percent of the victims of credit card fraud experienced financial loss in 2014 (Bureau of Justice Statistics).

- 781 data breaches took place in 2015, with 160 of those involving debit/credit cards and exposing 800,000 records (Identity Theft Resource Center).

- 22 percent of U.S. adults say they were affected by stolen credit card information between October 2014 and October 2015 (Gallup).

To combat this fraud, EMV cards were introduced. Now, 87 percent of Americans are using these chip cards, as of September 2016 (up from 49 percent in 2015) (MasterCard). There were more than 700 million U.S. chip cards in circulation as of October 2016 (PYMNTS). While 88 percent of of MasterCards consumer credit cards had EMV chips, as of July 2016 (MasterCard) Visa has issued 363 million chip-enabled cards as of September 2016 (Visa).

Merchants are responding to this change in credit card use by rapidly adopting EMV. As of September 2015, approximately 300,000 U.S. merchant locations had EMV chip-enabled terminals (Visa). As of October 2016, two million business (33 percent of all U.S. merchants) have switched to EMV (MasterCard). As a result of implementing EMV, U.S. retailers have seen counterfeit fraud costs decrease 54 percent from the previous year while counterfeit fraud costs increased by 77 percent over the previous year among those merchants who haven’t yet upgraded (MasterCard).

Retailers are also realizing that payment technology is changing and more customers want to pay using their mobile phones. For example, 9.9 percent of mobile phone users made in in-store purchases with a mobile payment app in the 12 months preceding November 2015 while 8.3 percent sent money to friends and family within the U.S. through their mobile phones during the same time period (Federal Reserve Consumers and Mobile Financial Services 2016 Report).

Working with Due, you’ll discover that accepting credit cards is a convenient, cost-effective, and secure way to grow your business.

As the infographic illustrates, (below) there are multiple relationships involved in the merchant transaction process.

First: there is the relationship between the customer (consumer or business) and the merchant (that’s you).

Next: the merchant works with a merchant processing company (that’s us) that connects with the credit card network and bank that issues those credit cards.

Together, each of these stakeholders handle various aspects of the credit card transaction and participate in the compliance and security components that are so vital to ensuring the best credit card transaction process possible.

To learn more about how Due can help you facilitate an easy merchant transaction process, including adding EMV-enabled payments and taking advantage of other new types of payment technology, click on the infographic below.

The Merchant Transaction Process