For years retailers lobbied Congress to regulate the fees, known as “interchange” or “swipe fees,” that Visa and MasterCard, as well as their issuing financial institutions, charged merchants whenever credit cards were used. In this pos we will teach you what your business needs to understand about Regulated and Unregulated Debit for Merchant Card Processing.

Following the financial crisis in 2008, retailers got their wish with the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.

Dodd-Frank would drastically change the financial regulatory environment, such as debit interchange regulation. This was a part of the Durbin Amendment in Dodd-Frank. It has affected many merchants since going into effect on October 1st, 2011. These are specifically when it comes to regulated and unregulated debit and prepaid cards.

Table of Contents

ToggleWhat’s the Difference Between Regulated and Unregulated Debit?

Describing the difference between regulated and unregulated debit isn’t that difficult to explain. The Durbin Amendment has established two ratings for banks that are based on their assets.

If the card issuing bank is regulated, also known as an exempt bank, it means that their assets equal more than $10 billion. However, if the card issuing bank is non-regulated, aka a non-exempt bank, then they have assets under $10 billion.

That affects merchants because it means that you will have to pay a different fee based on the bank that issued the debit card.

The Complication for Merchants

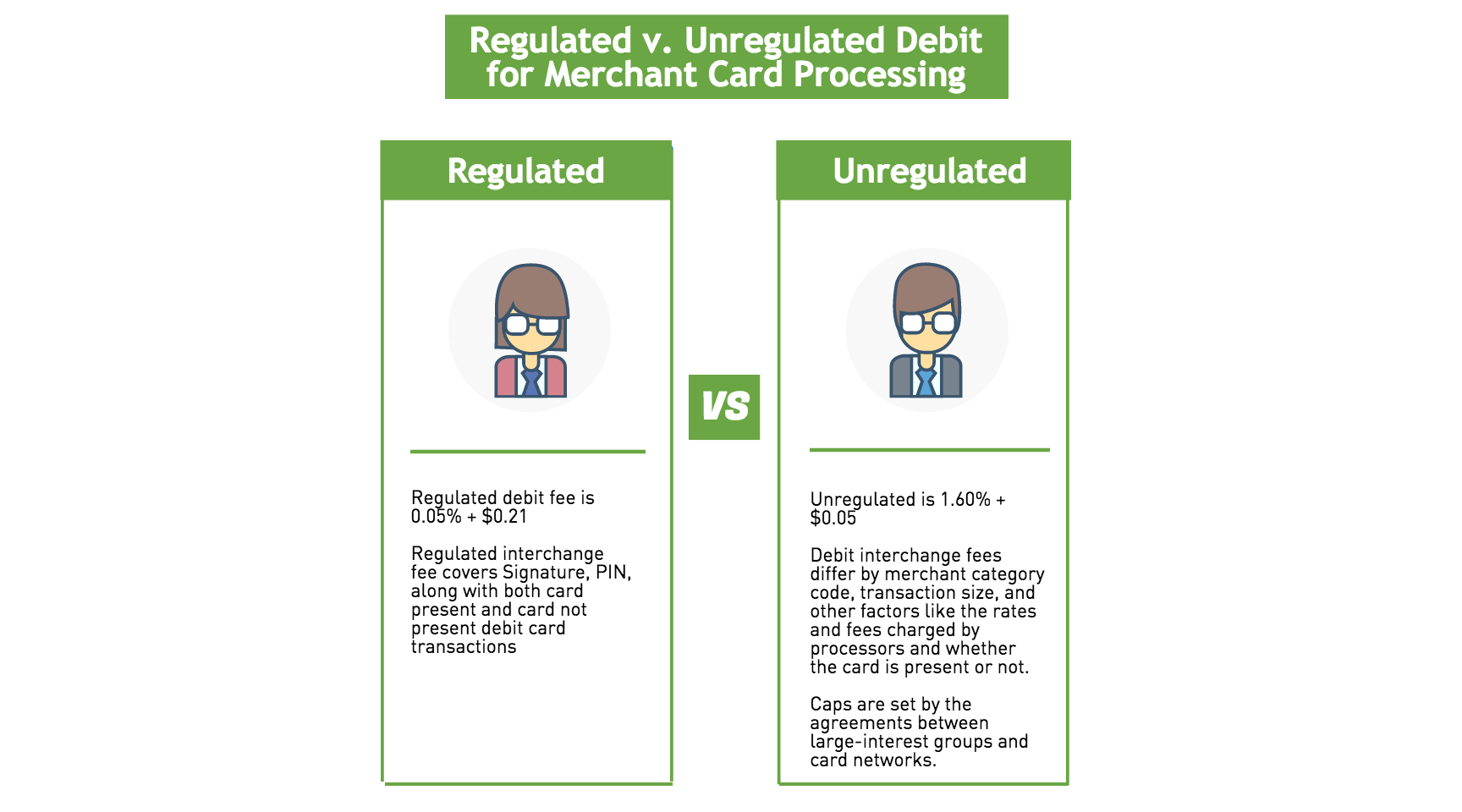

The regulated debit fee is 0.05% + $0.21, while the unregulated is 1.60% + $0.05. Before the Durbin Amendment the fee was 1.190% + $0.10/.

The regulated interchange fee covers Signature, PIN, along with both card present and card not present debit card transactions. For a $10 sale, which is the minimum for credit card purchases, on a Visa Debit Card there are three possible interchange rates: Regulated, Small Ticket, and PIN.

The interchange fee for a regulated debit card would be $0.225 for a $10 sale. Small Ticket, which has the same interchange fee as unregulated debit, would be $0.21. And, since PIN has a 0.80% + $0.185 interchange, the interchange fee would be $0.265.

Overall, this has lowered the fees that banks have been able to profit from debit cards. However, since card networks have pretty much gotten rid of small ticket discount rates, some merchants that have under $10/ticket in sales could pay higher fees. The reason? Banks and networks have had to increase the minimum fees to the maximum that are allowed by Durbin in order to minimize any lost revenue.

It’s a little more complex with unregulated debit are a little more complicated, however. Debit interchange fees differ by merchant category code, transaction size, and other factors like the rates and fees charged by processors and whether the card is present or not. There are some debit networks that cap the maximum fee that a business pays, but there are also networks that have no cap for merchant credit card processing. This means that the caps are set by the agreements between large-interest groups and card networks.

The Effects on Merchants

“The Durbin Amendment benefited many larger merchants, however, especially those that sell big-ticket items, as it cut the average swipe fee they pay almost in half,” writes Margarette Burnette in an article for NerdWallet.

But, how has it impacted small businesses?

- Some retailers are now paying less in debit card swipe fees. For example, before the amendment, retailers paid an average of 44 cents for debit card transactions. The valuation was around 38 dollars. Durbin states that for a typical $38 purchase, the maximum fee would be approximately 24 cents, which would be 45% less.

- For merchants that process smaller debit card purchases they may be experiencing higher costs. Prior to Durbin, banks and card issuers based their transaction fees on a variable percentage of the purchase value. This meant that merchants paid smaller fees on smaller purchases and larger fees on larger purchases.

- Visa and MasterCard began charging the maximum amount for smaller transactions following the new rules. For instance, instead of paying a 6-cent interchange fee for a $3.50 charge for coffee and a doughnut, the shop owner now has a fee of 22 cents.

- Merchants have fewer free business checking accounts to choose from since banks have eliminated them to help recoup revenue losses

How Can Your Business Save Money on Debit Payments

Businesses need to do their homework by looking for the best debit card rates.

- The regulated and unregulated debit is based on factors like the size of their business.

- They may be based on the type of card that was used for the purchase.

- The processing of the card; CP or CNP.

The first place to start is by working with a trusted processor that adheres to the latest regulations. Make sure they have a knowledgeable team that can assist you with any questions or concerns. We’ve put together a handy list of 101 payments companies to get you started.

You should take the following steps to ensure that you have the lowest rates possible;

- Insist on a interchange pricing model. As explained by Philip Baker on CardPaymentOptions, “if a provider quotes you a flat rate of 0.5% for all debit swipes, that might sound like a fair deal” since “you’ll be saving on most of your exempt transactions.” But, the “processor’s 0.5% rate would potentially be a huge markup over regulated debit cards, all of which process at 0.05% plus $0.21. Under this model, you’ll almost never benefit from accepting regulated debit cards. You should know which one are more commonly used by consumers than exempt debit cards.”

- Know your merchant code. This will determine the fees that are applicable to your business. Your provider should share this information with you.

- Compare interchange rates. Exempt cards have varying interchange fees. Make sure that you compare between signature and PIN networks in order to find the lowest interchange fee.

- Establish rules on how your accept cards. If your customers use a card from a large, national bank then you should process it as a signature debit transaction. If your customers use small, local bank cards then you should encourage whichever debit method has the lowest exempt rates.