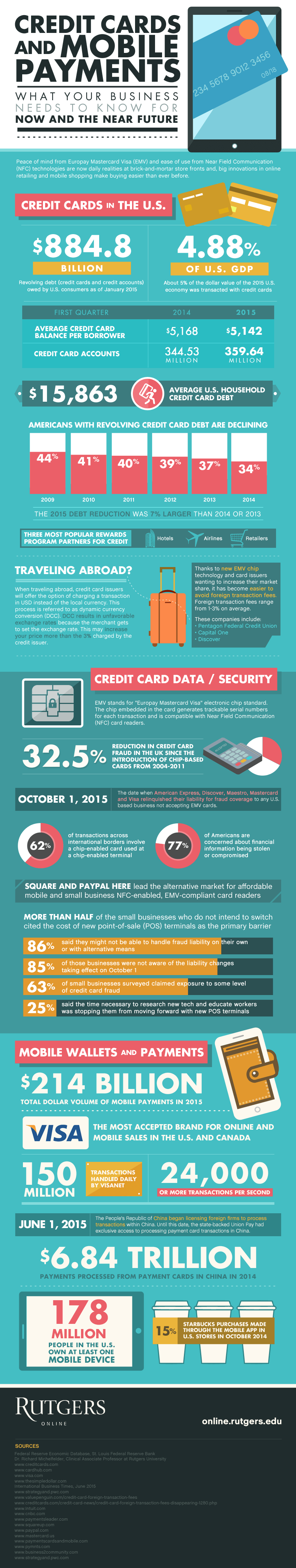

Your business may already be accepting credit cards — which is great — however, you may not know everything about the changes in how online and mobile payments are altering the way we do business. The additional ways of collecting payments can potentially offer you new growth both now and in the future. The new growth comes when you are able to offer numerous ways in which customers can pay you. You can then expedite the purchases because of the ease of payment. This new dimension is especially becoming crucial with the demands and the buying power of the Millennials.

The Rutgers University Bachelor of Arts in Business Administration program recently put together an infographic to help businesses better understand how these payment methods are changing how they do business. You may already be familiar with Europay Mastercard Visa (EMV), standards and Near Field Communication (NFC) technology. However, there are other crucial areas that the infographics below will point out. These are important to think about as you strategize and your response to varieties of effective ways to take payments.

[Related: Credit card giants Mastercard and Visa agree $30m settlement amount for merchant charges]

Table of Contents

ToggleCredit Cards and Debt

Credit cards are the norm in the U.S.; they account for $884.8 billion of revolving debt as of January 2015. With this, it’s making up nearly 5 percent of the dollar value of the U.S.

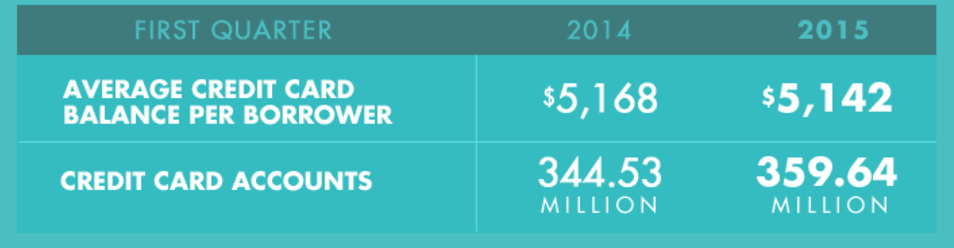

The average U.S. household carries credit card debt of nearly $16,000. The number of credit cards went from 344.53 million in 2014 to 359.64 million in 2015. However, the number of Americas with revolving credit card debt is declining.

Also, it is worth noting that consumers are using their credit cards abroad, more than ever before, because the new EMV chip technology helps them avoid foreign transaction fees. For businesses and consumers, there is also the option of charging a transaction abroad in U.S. currency rather than local currency, which helps the merchant, but tends to end up in more charges for the credit card user. This little jab from the credit card companies seems to be something that consumers may not have caught onto yet.

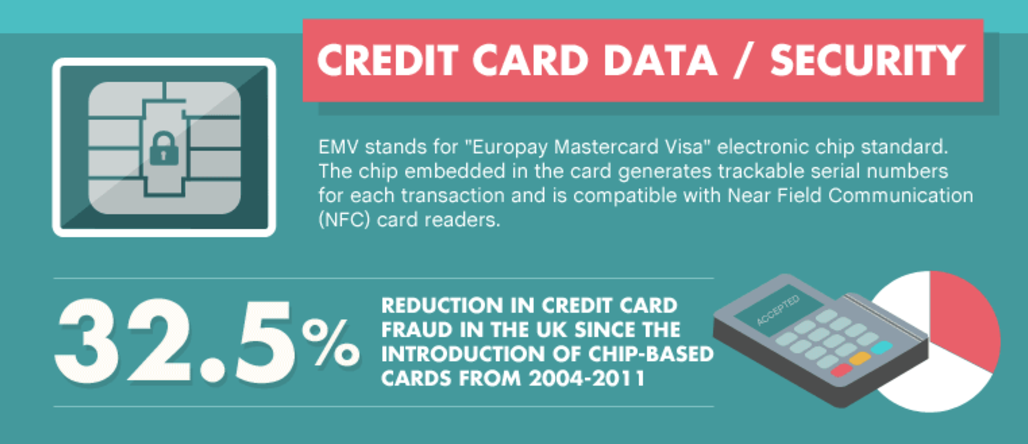

EMV

EMV plays another important role in terms of credit card data and security. The research shows that card security is working better; statistics show credit card fraud in the UK has decreased by 32.5 percent since chip-based cards were introduced. The majority of Americans are concerned about information being stolen. Thus, EMV cards are becoming a way to alleviate this concern. The technology implementation used in the chip is beginning to be used in other vulnerable credit areas as well, and we should see the decline of fraud continue — although it sure seems like one area of fraud gets fixed and the hackers are right there figuring out new and improved ways to cause trouble for commerce.

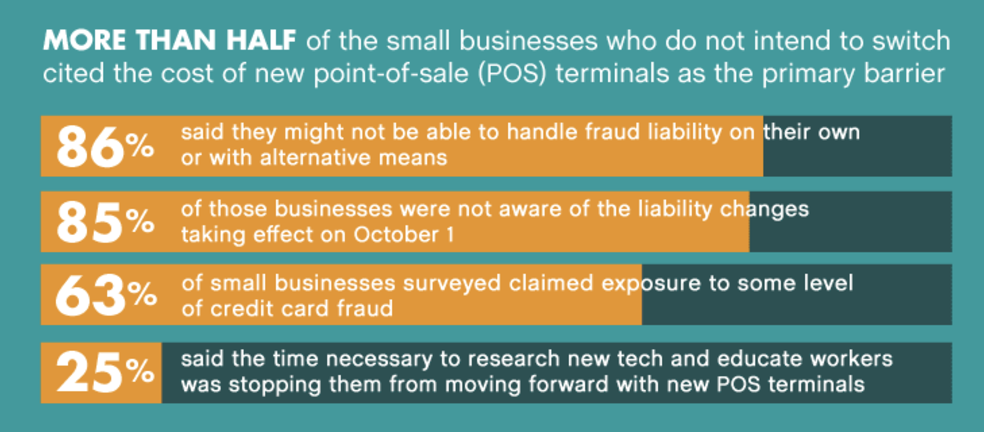

Another area of growth in mobile payments has been accomplished with Square and PayPal. These two companies have been leading the way with affordable NFC-enabled tech and EMV-compliant card readers that help small business owners and merchants take advantage of this opportunity to serve customers through the mobile environment. However, these merchants are still concerned about fraud while others were not aware of the liability changes that went into effect on October 1st, 2015. The changes basically say that the credit card companies will no longer be liable for fraud from any U.S. businesses who don’t start using the EMV cards.

POS Terminals

Yet, according to research, it would be in businesses best interest to start considering the switch to new POS terminals that offer this technology because mobile payment volume in 2015 topped $214 billion with 150 million transactions handled daily by Visanet, which equates to more than 24,000 transactions per second, illustrating the real opportunity to sell more in this payments area. There are 178 million people in the U.S. that have at least one mobile device. That’s enormous potential for businesses that provide for mobile payments as well as mobile wallet features.

China

Another area of opportunity is the ability to accept and process payments in China. In 2014, $6.84 trillion payments from payment cards were processed in China with significant future growth predicted. It’s an area that many merchants and small businesses may want to take advantage of as part of their overall payments strategies.

Check out the infographic below to learn about how you can look at the payment environment to achieve future growth.

Special thanks to Rutgers for the image.