Key Takeaways

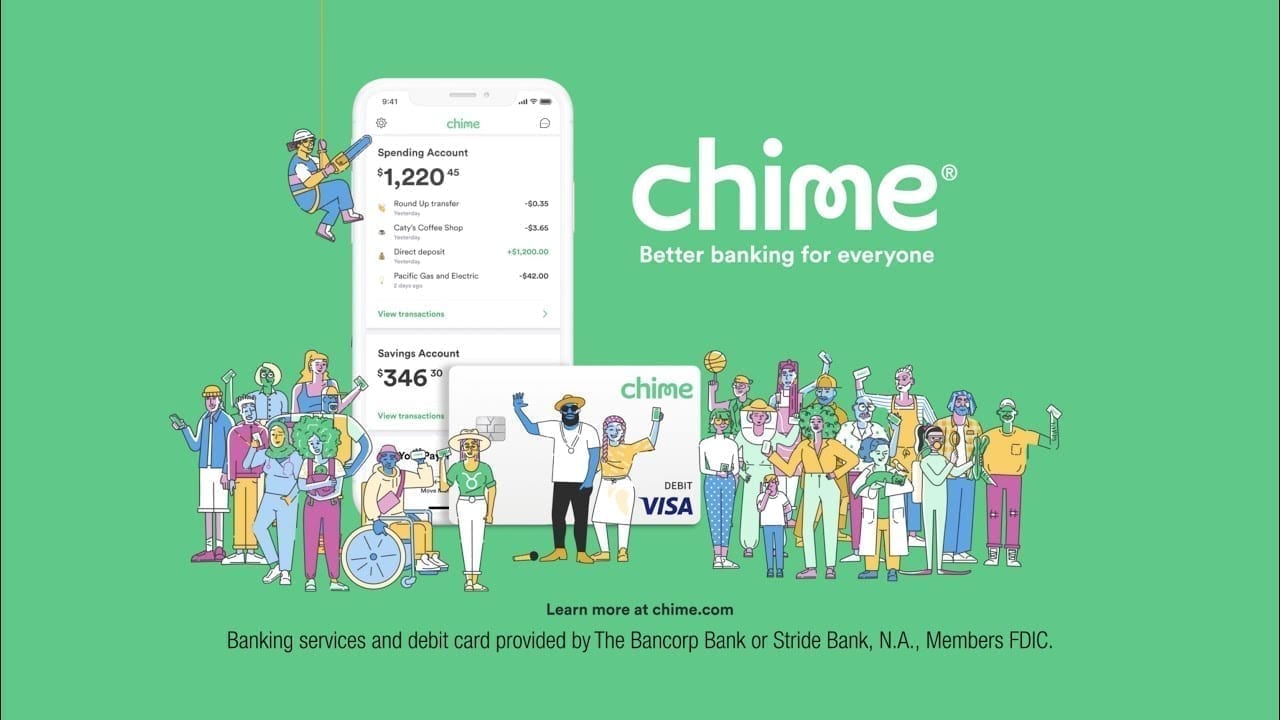

- Chime is one of the most unique banks, as they don’t have any physical locations. What makes their 12 million customers love them, though, is the absence of banking fees

- Chime is great for those who want direct deposits from employers, those who have little to no credit history, prefer to use their smartphone to manage finances, and those whose bank account total falls under $100 occasionally or frequently.

- Chime offers a ‘Credit Builder’ credit card for those who need to start building credit or those who need to recover from poor credit history.

- Chimes’ initial customer support was a bit lacking, but they have bounced back with incredibly strong and reliable customer support.

Americans absolutely love using their smartphones to take care of everyday business. For example, even before the pandemic of 2020 confined millions to their homes, consumers were doing an increasing amount of online banking. The increase is simply because of mobile’s ease and convenience.

Table of Contents

ToggleThe Rise of Online Banking in the U.S.

Once Covid-19 broke loose, however, the rise in demand for “touchless” payment solutions instantly gained a great deal of steam. Consumers became understandably wary of writing or receiving handwritten checks or handling paper currency and coins that came from no-one-really-knows-where.

Many turned to online banking institutions to solve one problem — enabling a more comprehensive range of touchless payments — and stuck around once they experienced the increased convenience, competitive interest rates, and the absence of annoying account maintenance fees.

Online Banking Today

Today, digital banking represents a strong option for those looking to open a second or third account. Still, it also serves the interests of lower-income consumers who have been turned down by traditional brick-and-mortar banks or (worse) had their economic struggles compounded by overdraft fees, minimum balance requirements, and extended delays on deposit availability.

While it may be difficult for some to develop trust in a banking solution that does not offer any face-to-face branch locations, most consumers appear to be willing to part with a physical presence in exchange for what they really want — a free, no-hassle banking experience.

Today, online banking has developed to the point that many who initially opened an online account as a secondary instrument wonder whether they need to maintain their other accounts. As a result, more than 196 million Americans now use digital banking solutions, which is predicted to exceed 200 million in 2022. As you might expect, digital banking solutions are particularly popular with younger consumers who grew up in the age of the internet.

Banking with Chime in a Nutshell

Chime offers individual consumers a serious, customer-focused challenge to traditional accounts. This includes the checking account, savings account, and Visa debit card services through its partner banks. But, first, you just have to get used to the idea of a banking relationship that does not include brick-and-mortar branch locations.

If you can do that, you might do well to consider joining more than 12 million customers who agree that the tradeoff is more than worth the absence of banking fees. Customers also indicate that they appreciate having the opportunity to establish or improve their credit rating. Additionally, they can effortlessly build up a savings account.

Background Information

For starters, Chime is not technically a bank. Instead, it’s a financial technology (fintech) company. It was founded in 2013 by CEO Chris Britt and CTO Ryan King on the relatively simple idea that online financial mechanisms had evolved to the point where there was no longer any reason that routine banking services should be anything other than helpful, simple, and, best of all, free.

The people at Chime believe that their success stems from profiting alongside members instead of profiting from them.

Chime has leveraged its fintech expertise to develop a financial model for the banking industry that doesn’t rely on overdrafts, monthly service, minimum balance, or other bothersome fees to shore up its bottom line. Instead, it partners with regional banks to offer financial products that center on a customer-first approach.

Because it does not build, operate, staff, or insure any branch locations, Chime can provide competitive, low-cost checking, savings, and debit card products to consumers who aren’t finding what they need at traditional banks or just want the added convenience and ease digital banking offers.

Additional Background Information

Of course, customers do well to keep in mind that the “no branch locations” edge has the potential to cut both ways. It provides a cost-cutting advantage that many customers will readily appreciate. Still, it may not appeal to those who place a high value on face-to-face contact with a local banking professional.

Assuming that you don’t spend a lot of your spare time chatting up bankers and don’t mind the absence of a bricks-and-mortar branch location, this might just be a good bet for meeting your basic banking needs at little to no cost.

Before jumping in with both feet, potential customers must know what they can and cannot expect. Chime excels at giving its customers a single checking account, one savings account, and a Visa debit card. It also offers a secured credit card known as Credit Builder as well. If that’s all you need to take care of your routine financial transactions, then you’re in business.

On the other hand, you should be aware that you won’t be allowed to open a joint account. Chime also does not offer any accounts for small businesses, nor does it provide any of the investment or wealth management services you might expect from your local bank.

The company prides itself in specializing in making financial services available to consumers who need access to basic banking services. Still, neither has to have a strong credit history nor is trying to establish one.

As a result, Account-holders gain access to the world of financial services without having to worry about getting repeatedly hit with fees or other restrictions. In addition, they seek to “drive innovation, inclusion, and access” across the financial services industry by moving all of their services online.

Digital Banking with Chime: A Simplified Decision-Making Matrix

An account might be an excellent choice for your individual banking needs if:

- You need basic individual banking services but have little or no credit history.

- You prefer to manage day-to-day financial transactions using your smartphone.

- Your checking account balance often drops below $100.

- You want to set up a direct deposit arrangement with your employer.

- You’d like to be able to spend your paycheck a few days earlier than usual.

- You could use a little help building up your savings account.

- You’re tired of being hit with miscellaneous banking fees.

Below probably isn’t for you if you:

- Place a high value on face-to-face customer service and branch offices.

- You don’t need a checking account, just savings.

- Are looking for advice on wealth management.

Mission Statement

Chime was founded in 2013 with a core commitment to provide its customers with increased financial access and peace of mind. The founders see digital banking as the obvious future of finance. And, they are betting heavily that creating a new type of online bank account will help its members get ahead and represent a powerful win-win solution.

The overall goal is to make money management simple, secure, and helpful for an increased number of consumers.

Chime’s mission extends to its corporate ethos as well. Management believes that it’s possible to create a digital assets company where people love to work and do their personal banking. As a result, Chime operates with a high value placed on transparency, relationships, growth, and impact.

Why Consumers Might Be Interested in Digital Banking Services

Chime endeavors to keep things simple by offering its customers a single checking account, one savings account, and a Visa debit card. They also provide a specialized account called the Credit Builder for those with previous credit-related issues or people wanting to build or improve credit.

You can readily see this philosophy of simplicity reflected in the application process and the design of the website and its smartphone app for iOS and Android. Unlike other online financial services, it’s difficult to imagine anyone getting lost or confused by any of the customer-facing interfaces.

Simplicity and Convenience

This level of simplicity in banking might not appeal to every customer, of course. But, keeping everything simple also allows Chime to tie all account holder activity up in one intuitive, easy-to-use smartphone app.

In essence, accounts represent the logical next step for accessibility. Of course, this is a given since consumers take care of an increasing number of day-to-day financial activities using their smartphones.

The app is specifically targeted at people who prefer more convenient options. These include taking care of their banking and financial transactions on the go. Therefore, Chime took pains to design its app such that it is simple and easy to use. And, it’s free of legalese and other complications.

The app automatically delivers account balance information every day and notifies the account holder whenever a transaction takes place. Messaging is clear, unambiguous, and concise, allowing account holders to get back to whatever they were doing quickly.

Digital Accounts Explained

The Spending Account for Checking

-

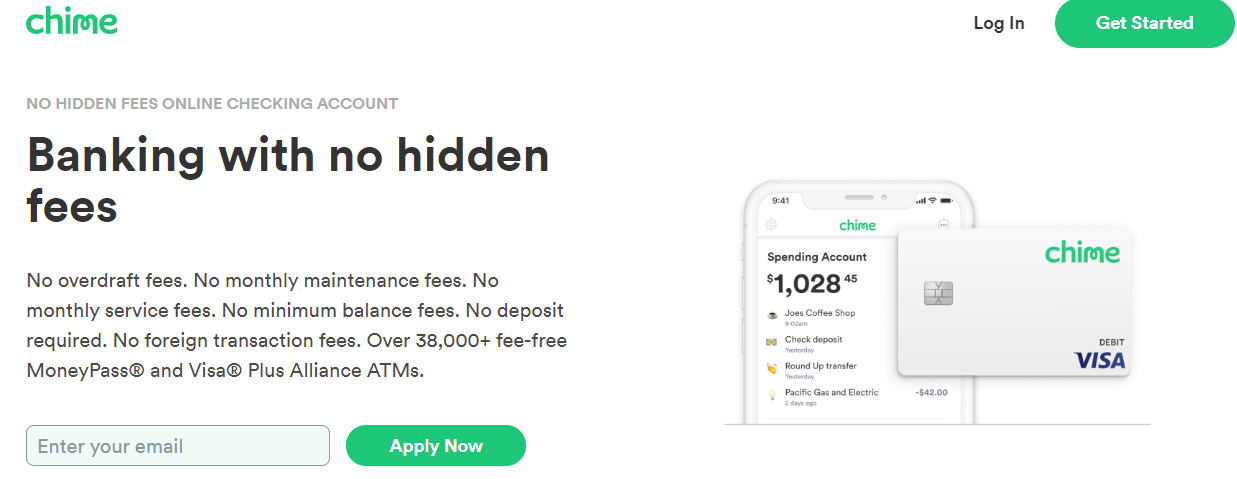

Chime checking accounts don’t incur most fees.

Unlike other free checking accounts, this checking account, or “Spending Account,” requires no minimum balance. One of its more popular features is the absence of most fees usually associated with traditional checking accounts.

The only fee that may occur is one for the use of out-of-network ATMs. For many consumers, the absence of most checking account fees is the primary source of great appeal.

- In 2019, traditional banking institutions charged more than $11 billion in checking overdraft fees. In addition, there is an exponential and ongoing increase in online purchases and the tech-heavy development of the digital economy. Consequently, Chime does not see much future for the willingness of customers to continue to accept this traditional banking practice.

-

Direct deposits are available for spending sooner than usual.

Many traditional banking institutions hold direct deposits, like paychecks, tax refunds, and more. This can last upwards of five to seven days. However, for consumers relying on their direct deposit checks to pay bills, just a day or two can make all the difference between meeting obligations in a timely fashion or getting hit with yet another overdraft fee.

Aware of this all-too-common problem, Chime allows its account holders to speed up the process. Once an account holder has set up their Spending Account for direct deposit, those funds can be withdrawn as soon as they are deposited without the standard “clearing” delay.

- Bonus: Depending on customer transaction history, paychecks can also be made available when an employer initiates a direct deposit transaction instead of waiting for that transaction to appear. For customers, this can mean having the ability to access funds several days ahead of what they’ve been accustomed to with a traditional bank.

-

Spending Accounts allow for small overdrafts without fees.

Comedians have made plenty of jokes based on the real-world oddity of a bank charging overdraft fees to customers they are perfectly aware have no money. For account holders struggling to stay afloat, though, these fees are no joke. Spending accounts can be set up to make sure this doesn’t happen.

Suppose an account holder receives $200 or more in direct deposits every month, making them eligible to apply for the innovative SpotMe service. The SpotMe service will automatically cover up to a $20 overdraft on the debit card without charging a fee. As account holders build up their account and direct deposit history, the amount of overdraft protection can be raised up to $200. SpotMe limits are posted in the app but only cover debit card transactions for now.

-

Yes, paper-based checks are still a thing.

The Spending Account is ideal for anyone interested in gradually moving away from manually writing out paper checks to pay bills. Still, there are at least a few instances when having the ability to cut a check is necessary.

A Spending Account holder can use the smartphone mobile app to cut a paper check and mail it directly to the intended recipient. Over time, this service can help consumers transition entirely away from the hassle and expense of ordering, writing, and mailing checks.

The Savings Account

-

Savings accounts also don’t charge any fees.

Many consumers are familiar with banks that require a minimum deposit in savings accounts to avoid monthly recurring fees. Chime does away with minimum balances and fees on its savings accounts. Significantly, they also provide customers with tools to help them build up their savings account with little to no effort. (See below.)

-

There are services to help consumers gradually build up their savings account.

Many consumers struggle to build up their savings account, and Chime offers two innovative programs that help address this reality. First, rounding up purchases and pulling a predetermined percentage of direct deposit money before it’s spent facilitates gradual increases to savings by allowing customers to set aside money passively.

-

Save When You Spend.

Many consumers are already familiar with rounding up purchases to the nearest dollar as a means of supporting charitable causes. The Save When You Spend feature works in much the same way. Chime will automatically round up those amounts and funnel the difference to your savings account as you use your debit card for everyday expenses.

While those amounts may not seem like much individually, they tend to add up over time. But, most importantly, they allow consumers to save money without feeling it.

-

Save When You Get Paid.

Sometimes the secret to saving lies in setting money aside before it ever lands in your checking account. For example, Chime allows its customers to set up direct deposits from their employer. And, it will enable them to earmark up to 10% of paychecks totaling $500 or more to savings.

By automatically moving money before it’s been spent, consumers learn money management skills. This includes budgeting their daily lives around what remains rather than what’s been earned.

-

The high-yield savings account accrues interest at a competitive rate of 0.50% APY.

There is no limit on the amount of interest an account holder can earn. The absence of expenditures on branch locations shows up in an ability to offer a competitive interest rate on savings accounts in addition to not charging any fees.

The ‘Credit Builder’ Secured Credit Card

True to its corporate mission of opening up financial services to those who have previously experienced credit-related issues, Chime also offers a secured credit card.

Applicants must already have or open a Spending (checking) Account before applying for the secured credit card. The Credit Builder features no annual fee or interest, no credit check during the application process, and no minimum security deposit.

The other central selling point for consumers with past credit problems is that their average credit score increases by approximately 30 points just for opening a Credit Builder account. As a cardholder uses their secured card over time and builds a payment history, that rating will continue to go up.

Credit Builder customers boost their credit rating by quickly moving the amount of money they want to spend from their Spending Account into Credit Builder. Customers remain in complete control of how often and how much money they move onto their secured card.

Additional “Credit Builder” Card Benefits

Next, after moving the necessary funds, customers use their secured credit card at any location that accepts Visa. Then, Chime turns around and reports card activity to the major credit reporting agencies, namely Transunion, Experian, and Equifax. Customers can sit back and watch their ratings rise. And, they can do so as they go about their business buying gas, groceries, and other everyday items.

Using the app, secured cardholders can also enable the Safer Credit Building feature. Doing so guarantees that the outstanding Credit Builder balance will be paid in full every month, providing yet another shot in the arm to that individual’s credit rating. Chime makes sure that this zero-balance information also gets sent to credit reporting agencies.

Credit Builder cards can be used at thousands of in-network ATMs across the country to make cash advance withdrawals. Customers can tap into their previously secured balance without paying fees or interest. The app contains an ATM Map that is regularly updated and allows customers to find the closest in-network ATM in their area.

Chime’s Network of ATMs

Does it cost traditional banking institutions $5 or more to process the bits and bytes of digital information generated by an out-of-network ATM transaction? No, of course, it doesn’t. Everyone intuitively knows this.

Consumers, for their part, have grown increasingly tired of what they perceive to be getting gouged every time they use an out-of-network ATM. So the founding partners decided to tackle this annoying issue head-on.

Chime has established partnerships that offer consumers fee-free access to more than 60,000 ATMs in stores they are likely to drive by or stop in every day through its relationship with its banking institutions. Chime-affiliated ATMs are located in stores such as Walgreens, CVS, and 7-Eleven. In addition, customers never have to wonder where the closest fee-free ATM is situated as the smartphone app includes an ATM locator.

Support

In Chime’s early years, customer support often fell short. Since then, they’ve sought to address this by adding a customer support line, chatbot, mobile chat, and email service. The good news is that the online banking experience is so simple. Moreover, it’s so smooth that support issues should be fairly few and far between for most customers.

Your best bet as a customer is to start with the Chimebot. It is available online to answer frequently-asked questions and connect you to an agent for routine troubleshooting. You can also learn more about services offered by following the company on socials. These socials include Facebook, Twitter, and Instagram, though, obviously, you would not want to use those channels to discuss personal account issues.

Frequently-Asked Questions about Chime

Is Chime a ripoff?

No. Chime is not operating a scam or some elaborate fly-by-night financial scheme. More than 12 million account holders trust that partner banks fully back their financial assets. Partner banks as of this writing are Stride Bank, N.A. (FDIC #4091), and The Bancorp Bank (FDIC # 35444). Those banks, in turn, are backed by the Federal Deposit Insurance Corporation (FDIC) up to the maximum allowable $250,000 per account.

Best described as a financial technology company, Chime takes full advantage of evolving electronic banking technologies. These digital technologies make it possible to provide routine banking services at a much lower cost than traditional, more mechanical banking mechanisms. Rather than pocket the difference, Chime prefers to eliminate fees based on outdated methodologies. The company has been around since 2013 and isn’t going anywhere.

Is Chime bank legitimate?

While Chime is not a bank, it is an entirely legitimate financial technology company. It was founded in 2013 and, as of August 2021, had more than twelve million account holders. The FDIC insures all accounts up to the maximum allowable amount. The maximum amount covered is $250,000 per depositor in the event of a bank failure. Partner banks as of this writing are Stride Bank, N.A. (FDIC #4091), and The Bancorp Bank (FDIC # 35444).

Chime believes in profiting alongside its customers rather than profiting from them. Unfortunately, many longtime consumers of banking services are not accustomed to this approach and understandably suffer from Too Good To Be True Syndrome or other suspicions.

This is understandable as traditional banking practices have been profiting from customers for so long that this new model initially makes no sense to them. Many account holders dipped their toes in the waters of digital banking out of a desire to take all available Covid-19 precautions only to take the full-body plunge after several months of fee-free service.

What’s the catch with Chime?

There is no “catch” with Chime. Consumers might like to be aware that this company does not operate any branch locations with in-person service. For customers who rarely (if ever) spend time inside a bricks-and-mortar bank, this might not be that big a deal. Chime also does not offer some of the more traditional banking services such as investment advising or wealth management.

The only other big thing to know is that this company does not permit joint accounts or offer banking solutions targeted to small businesses. Every account is tied to an individual consumer, not a married couple, small business, or any other institution.

Credit reporting, too, is tied to the individual. But, again, this doesn’t qualify as a “catch” so much as it is something everyone needs to be aware of before applying for an account.

Can you get scammed on Chime?

Chime is not a scam and operates with a refreshing amount of transparency. The founders were interested in developing a profitable enterprise, yes, but not at the expense of its account holders. Many traditional banking and financial services reap huge dividends by burying their account fee structures in the fine print.

In 2019 alone, traditional banking institutions charged more than $11 billion in checking overdraft fees. So, the founders discarded this model as antiquated from the get-go.

Your accounts should be regarded as being equally secure as you would expect with any other financial institution. However, it is certainly possible for customers to incur financial losses via the same means they could potentially encounter elsewhere.

Typical financial vulnerabilities include consumer carelessness with account information and incidents of identity theft. These can also include accountholders responding to email phishing scams, human engineering, and so forth.

Consumers who are already accustomed to taking standard precautions for guarding their personal and financial information shouldn’t experience any losses or other security issues.

Is Chime a safe bank?

Chime’s partner banking institutions — Stride Bank, N.A. (FDIC #4091) or The Bancorp Bank (FDIC # 35444) — are secure and insured by the FDIC up to the maximum allowable amount of $250,000 per depositor in the event of a bank failure.

If a customer’s debit card or Credit Builder secured card is stolen or used to make unauthorized purchases, the cardholder’s account is protected by Visa’s Zero Liability Policy.

Why are user accounts sometimes canceled or frozen?

Whenever Chime detects the possibility of fraudulent activity, it responds by freezing access to the affected accounts. This practice safeguards account holder assets by making them temporarily inaccessible. Accounts will remain frozen during the process of investigation. Chime also reserves the right to close accounts it suspects are being used for purposes that violate its customer service agreement.

Is Chime a good bank?

While Chime is not technically a bank, it is currently the largest digital financial technology services company in the U.S. It dominates the digital banking services market, and there are several good reasons for this. Most notably, consumers tend to go with this company because they like the number of features it offers.

Chime appeals to consumers by not charging fees, but testimonials from existing customers consistently point to three additional reasons why it has taken a commanding lead:

-

The Credit Builder Secured Card.

Consumers with past credit problems or no credit history like having the ability to build (or rebuild) their credit rating. This is because they can do so as they go about the usual business of life. Trips to the gas station, grocery store, restaurants, movies, and so on are included. And, they allow customers to move money onto their secured credit card ahead of time.

They can also buy what they need while knowing that their prompt payment history is being reported to the major credit bureaus.

-

Timely Access to Direct Deposits.

Many consumers — especially those who have had credit issues in the past, are accustomed to days going by before they can spend their paychecks. Traditional banking institutions typically place a hold on checks until they clear. Then, the money does show up in the customer’s account.

But, it can take up to five days or even more for the asterisk next to that amount to disappear. In addition, Account-holders routinely have access to direct deposits when they are initiated by an employer, the IRS, or anyone else.

-

Spot Me Service.

Many consumers who are struggling in the lower- to middle-income bracket are familiar with the practice of being charged more money. And, this is done when it is obvious that they don’t have any. But, unique in the banking industry, Chime allows its account holders to set up Spot Me service.

This helps to cover accidental overdrafts without incurring any fees. The limit for Spot Me service begins at $20. But, it can be boosted to as high as $200, depending on the individual account holder’s history of activity.

Is Chime bank a real bank?

Technically speaking, Chime is a financial technology company, not a bank. However, customers can engage in all traditional activities — checking, savings, debit card, credit card — customarily associated with consumer-level banking.

Most customers find that they don’t miss those things once they’ve had an account for a few months, anyway. The majority of American consumers want free, no-hassle access to their accounts. Moreover, they want access to their checking and savings accounts, a debit card, and the ability to boost their credit rating.

All of these services are simple and straightforward. The actual banking services are provided by The Bancorp Bank or Stride Bank, N.A., Members FDIC.

Why is Chime different from a bank?

Chime is a financial technology platform. The entrepreneurs who founded the company in 2013 did so out of the conviction that banking technology had evolved. It had done so to the point that many of the fee-based checking and savings accounts were outdated. And, they were incredibly unhelpful to customers who had no credit or were seeking to establish credit.

Chime partners with banks that value fee-free services as a solid incentive to form a sizable base of customers and financial assets.

Additionally, Chime is different from traditional financial institutions. It has intentionally set aside a profit model that relies on fees, service charges, and other instruments. Frequently, these are things that come as an unpleasant surprise. Chime makes no pretense of offering everything a traditional bank can, such as investment advice, wealth management, and in-person customer service.

Instead, they zero in on four highly valued banking functions and leverage the financial technology developed to service those basic banking needs inexpensively.

Can I bank with Chime anywhere?

Yes. Chime is affiliated with a nationwide network of fee-free ATMs, and the debit card is accepted anywhere that takes Visa. If you plan to make a lot of cash deposits, you should be aware that these can only be transacted to your account at stores such as Walgreens, CVS, 7-Eleven, and many others. Cash deposits may incur a transaction fee, so you will want to ask about that ahead of time.

What kind of accounts can you open with Chime?

Chime offers a checking account, savings account, debit card service, and a secured credit card known as the Credit Builder. Every account holder is eligible to get one of each. It prides itself on the simplicity of its approach and all-in-one mobile app, so it keeps all of its accounts as simple as possible. Joint accounts and small business accounts are not available.

What if I’ve been denied accounts elsewhere?

That’s usually not a problem. In fact, Chime is an excellent option for consumers who have no credit or past credit history problems. If you’ve previously been denied service elsewhere, Chime just might offer you “second chance banking” services. These will allow you to access financial services and build (or rebuild) a credit rating.

The primary instrument for building or rebuilding a credit rating would be their Credit Builder secured credit card. Consumers with credit issues are attracted to this. This is because they can leverage their everyday purchases — gas, groceries, whatever — to send updated payoff information to three major credit bureaus.

What do I need to open an account?

Applicants must provide a Social Security number and a permanent home address when applying for an account. P.O. boxes are not acceptable. Applicants must also be U.S. citizens or residents and at least 18 years of age.

Will I be able to deposit checks using the mobile app?

Yes, but customers must first set up direct deposit on their paychecks for the remote check-deposit service to be available. Once direct deposit has been established, customers can use their phones to electronically deposit physical checks.

How do I get started with Chime?

The simplest way to get started is to enroll online or download the app for iOS or Android. First, you will need to enter the essential information you might expect, including name, location, date of birth, and Social Security number.

Once you have established your identity, you can connect to existing bank accounts. Then, you can begin transferring money into your new account if you wish. As soon as you open a Spending Account, you will be issued a Visa card that can be used wherever Visa is accepted. In addition, free card replacement services are provided if your card is lost or stolen.

Get Started with Digital Banking at Your Own Pace

Most U.S. consumers don’t particularly want to spend a lot of time thinking about banking. Or, they don’t want to take time out of their day to drive to the bank for something they should be able to take care of online. This evolving reality has helped to shape digital banking services. Instead, most people just want a simple, secure, direct way to spend, save, and build up their credit rating.

This is one company that doesn’t just accept this new state of affairs but actively embraces it. Chime tailors its four banking products to the needs of the majority of consumers. As a result, they have shifted the playing field. An increasing number of account holders are starting to ask themselves the “Why?” question when various charges show up on their traditional banking and checking accounts.

One of the best things about digital banking is that consumers can move into it at their own speed. But, unfortunately, many people hang onto their traditional checking and savings accounts while opening up their first digital banking account.

The people at Chime have done well to allow customers to bank digitally with a minimum of fuss. As a result, an increasing number of digital account holders find that they also want to embrace digital banking after a few short months.