If you are considering a backdoor Roth IRA, chances are your income has put you over the threshold of making a direct contribution. So when you can’t just walk in the front door with your Roth money, what do you do?

Luckily, there is another way for getting money in your Roth IRA, even when your income is over the limit. This method is known as a Backdoor Roth IRA. Instead of making a direct contribution, you will have to follow a few extra steps and complete some tax forms.

Before you sneak in the back, getting a better understanding of how this process works will help ease the process. This will also help your situation come tax time.

Table of Contents

ToggleUnderstand the tax differences between traditional and Roth IRA’s

Roth IRA‘s are taxed differently than other IRAs. The tax treatment on these accounts is the main reason they are so popular. Understanding the differences in taxation on these accounts is necessary for wanting to complete a backdoor Roth conversion.

When you make contributions to other retirement accounts (like the traditional IRA, SEP IRA, or employer plans like a 401k or 403b) you will deduct this money when you file your taxes. This lowers your taxable income and provides you with tax savings, today.

Roth accounts, on the other hand, do NOT get deducted at tax-time. These contributions are considered “after-tax”, which means they were made with money that you paid income taxes on. You pay taxes today and do not see any savings on your tax bill when you contribute to a Roth.

Don’t be fooled though, the tax-perks of the Roth IRA really show themselves once you are able to withdraw the money, ideally in retirement. Since you already paid income taxes on your Roth contributions, the full balance of your Roth IRA is yours! You will not owe any more taxes on the money in this account!

Traditional, SEP, and Rollover IRA’s that were receiving tax benefits at the contribution stage will now owe taxes when the money is withdrawn. When you take money out of these accounts in retirement it will be taxed as income. This means you’ll likely have to allocate some of each withdrawal to go towards taxes. How much that will be will be completely dependent on whatever tax code we have at that point in time!

Know your Modified Adjusted Gross Income or MAGI

To know if you can contribute directly to a Roth IRA or not, you will need to know your MAGI, or modified adjusted gross income. This amount basically looks at your entire income, without any deductions. You might have to do a little math to arrive at what your MAGI actually is.

The first step is to find out your Adjusted Gross Income, or AGI. You can find this on 2019’s taxes by looking at line 8b of your 1040 form. For 2020 taxes, your AGI will end up on line 11.

To get your MAGI, you will add back certain deductions. This includes interest from savings bonds, excluded foreign income, Social Security payment deductions, and probably the most important- your retirement account contributions.

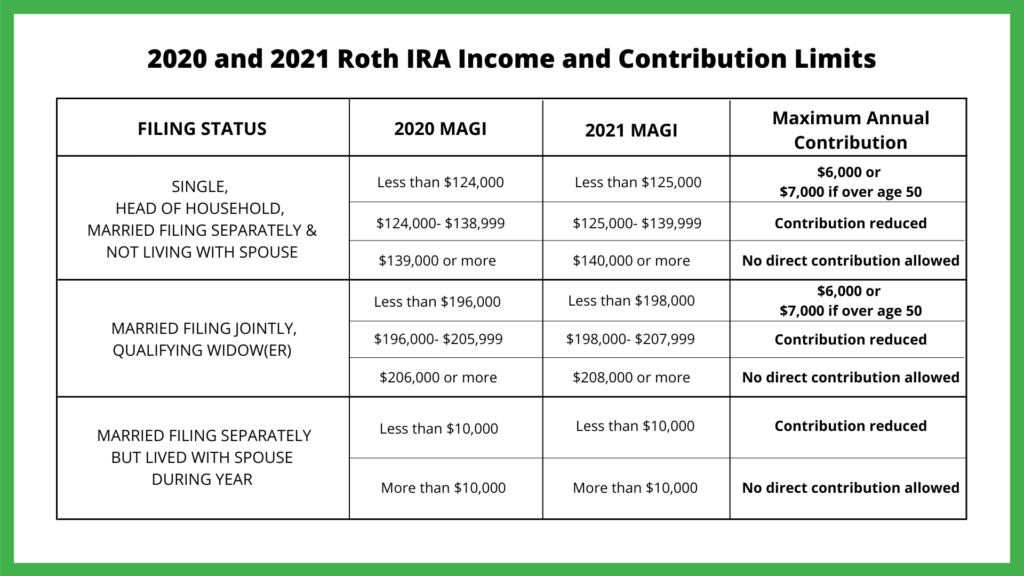

Once you have your MAGI, you can refer to the table below to see where you lie in the phase-out stage.

The income limits when a backdoor Roth IRA is necessary

The Roth IRA income limits had a slight increase for 2021. If you are a single filer and your MAGI is under $125,000, you don’t have to worry about any of this, and you can contribute to a Roth IRA directly. When your MAGI is between $125,000 and $139,999, you will have a calculated reduced contribution amount. If your MAGI is over $140,000 you are unable to contribute directly. This is where the backdoor process comes into play.

When you are married filing jointly or a qualifying widow(er) the phase-outs begin if your MAGI is $198,000 or higher. If your MAGI is between $198,000 and $207,999, you will see a reduced contribution. Passing over $208,000 means you are not allowed to make a direct contribution.

When you are filing as married filing separately, things get a little more complicated. If you did not live with your spouse AT ALL during the tax year, you can contribute under the ‘single’ limitations. Living with your spouse at any time during the year means your contribution is automatically reduced. And when your MAGI is over a measly $10,000, you are also phased out from direct contributions completely.

Having a MAGI that is under the threshold means you can contribute directly to a Roth. If you are close to the threshold, remember to keep an eye on this figure for future contributions!

Are you unable to make a full contribution? You might want to consider a backdoor Roth contribution.

A backdoor Roth IRA is not an actual account

You should know that a “backdoor Roth IRA” is not an actual account you open. To complete a backdoor conversion though, you will need both a traditional IRA and a Roth IRA. It would be wise to open these at the same place, and to have your custodian or account manager help you with the process!

Instead of being able to put money directly into your Roth, you must first put your contribution in your traditional IRA. Then, you will complete a “conversion” for the full amount. The conversion is a taxable step, which ensures you’re paying income taxes on the money that’s going into your Roth. Then, your custodian or account manager will transfer the money into your Roth IRA.

The process of a backdoor Roth IRA conversion

Here are the broken-down steps for completing a backdoor Roth IRA conversion. This is not an easy-peasy thing most people are comfortable DIY-ing! Don’t be afraid to find a professional to help you out! Talking to a tax professional who knows your situation and can make accurate recommendations specific to you is ideal. Working with a financial advisor can also help you with the process, but unless they are also certified in taxes, they will probably suggest you speak to a tax professional as well.

-

Open a Traditional IRA and Roth IRA

You’ll need both of these accounts to complete the backdoor conversion. Open them at the same place, and set up your online access so you can easily view both accounts.

-

Fund Traditional IRA

Link up your bank account and fund your traditional IRA. If you were able to make a partial contribution to your Roth, only contribute the remaining amount for the year. If you were unable to make any contribution, you can make the full $6,000 contribution, or $7,000 if you are over age 50.

-

Ask custodian or account manager for conversion forms

Locate the forms online, or call up your custodian or account manager and ask! Talking to someone will help guarantee you get the correct form, and they might even be able to process it for you over the phone. If they can’t, you will have to fill out, sign, and submit your Roth conversion form.

-

Complete transfer from Traditional to Roth

The custodian will take care of this part, and transfer the money directly to your waiting Roth IRA! This process should only take a day or two. Try to complete your backdoor conversion as quickly as possible to avoid growth when it is in the traditional account. It’s not a huge deal if you do have some interest, you will just need to account for that on your taxes as well.

The other important reason to complete your conversion as quickly as possible is that you want your money invested! Avoid being in cash limbo, and complete your end of the paperwork as soon as possible. Once your money is inside your Roth, make sure you invest it!

-

Use Tax Form 8606 to Report Conversion

When you file your taxes, you will report your backdoor Roth conversion on Form 8606, Nondeductible IRAs. Make sure you understand how to fill out the form, and that you file it correctly! If you aren’t sure how to complete the form, consult a tax professional.

-

Pay any taxes owed

This form will feed into the rest of your tax situation, and it’s likely you will end up owing taxes on the conversion. Money put into a Roth IRA is taxed as income. You pay taxes for the contributions in the year they are made. If you are in a higher tax bracket, be prepared!

Why people want their money in Roth IRA’s

Is forgoing the tax savings now really worth it? Well, it depends on who you ask, and how much money they have.

The main argument against Roth is for those who expect to be in lower tax brackets when they retire. If you think you will be in a very low tax bracket when you’re pulling this money out, you might not end up paying much tax on your IRA withdrawals anyway. This means paying the taxes now on your Roth contributions might not be as worthwhile. However, this might also mean your retirement income is thin, and taxes might be the least of your worries.

Those who have substantial retirement savings might find themselves in higher tax brackets in retirement though, especially once Required Minimum Distributions kick in at age 70.5. This is when traditional and rollover IRA owners will be forced to take out a percentage of their retirement accounts, even if they don’t need the money. People in this category might benefit from paying taxes at today’s known, and historically low rate, even if they are in a higher bracket.

Whether or not you are in a high bracket come retirement time, possibly the greatest argument for having money in a Roth is that you’re done paying taxes. Especially considering we have no control over future brackets. What is deemed a “high” tax rate today could be considered “low” in the future! When we don’t know what tax rates will be and have seen them extremely high in the past, many like to air on the side of caution.

Regardless of the taxes you end up paying, one thing is certain. Having your money in a Roth IRA provides a certain sense of security. Knowing you don’t have to worry about paying taxes on the money in that account is a great feeling!

Is a backdoor Roth IRA conversion right for you?

If you are over the income threshold and adamant about getting your retirement savings in your Roth, then yes! In my opinion, the Roth IRA is one of the best accounts out there, and finding legal ways to continue funding this account is a good move for your future.

But remember, this is NOT a simple move. Make sure you do your research and consider investing in professional help to assist you with your backdoor Roth conversion!