Security is on the top of minds of any business that is conducting transactions, especially when they are online payments or mobile payments. While some security measures seem like common sense, the world of fraud and financial crime have grown with many creative methods for stealing money that you may not have thought of but need to know about. We put together this SlideShare presentation on security measures to ensure that you take as many safety precautions as possible when handling your transactions.

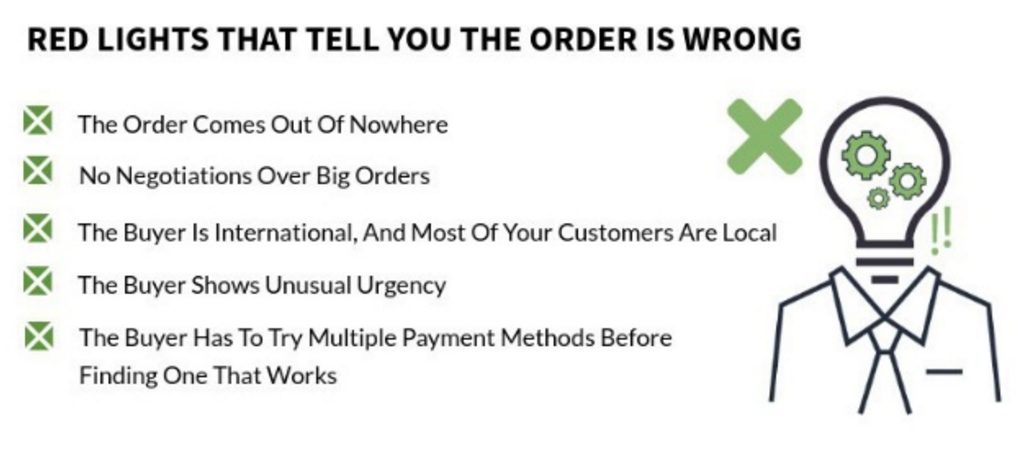

First, there are a number of red flags to look out for with online payments, including when an order comes from nowhere, no negotiations on big orders, an international buyer when you primarily deal in local customers, a buyer with high urgency to complete transaction, and a buyer who tries multiple payment methods before finding one that works.

Second, take some security precautions that have been known to slow or discourage criminals. Verify any change to a vendor’s payment location and confirm it’s really them before transferring any funds.

Be wary from any requests that come from free, Web-based email accounts. Register Internet domains that are slightly different from your actual company domain. Create an intrusion detection system in your systems that uses rules to flag any suspicious emails or activity. Don’t post any personal or financial data on your company website or on social media sites.

Always use a two-step verification process for online payments, especially wire transfers. Lastly, know your customers’ purchase habits so you can spot any dramatic changes in behavior that may indicate a fraudster that has gotten into that customer’s account.

For more information on the type of security recommendations you can implement for your business to secure your online transactions, check out our security recommendations SlideShare presentation.