After returning from the grocery store last week, I went to turn on my laptop. To my dismiss, it was now nothing more than a paperweight. In other words, it crashed and I needed a replacement.

As a non-techy, I get confused and overwhelmed with terms like CPU, GPU, and RAM. I get the basics well enough. But, I just need a laptop to surf, check my email, watch Netflix, and write. So, I really could do without the jargon.

After doing some research and price comparisons, I found exactly what I needed. The final question? Did I want to purchase a warranty?

Generally speaking, most laptops have a one-year warranty. However, if you want to avoid unexpected costs of repairs or replacing your laptop completely, it may be worth purchasing an extended warranty. I’m an Apple guy, that can be pretty pricy.

Oddly enough this whole minor debacle made me think about the main topic on Due: annuities.

Table of Contents

ToggleTable of Contents: Annuity 101 Guide For Non Jargoned Consumers

- What Exactly Are Annuities?

– Annuities can be complex. - Annuities – The Main Types Explained

– Fixed vs. Variable Annuities

– Fixed Annuities

– Immediate vs. Deferred Annuities

– Which Type of Annuity is Best? - Why You Need a Guaranteed Income in Retirement

- The Major Pros and Cons of Annuities

- Frequently Asked Questions About Annuities

– How Much Will an Annuity Set You Back?

– Is an Annuity Right For You?

– What to Consider When Thinking About Purchasing an Annuity?

– What Are The Key Annuity Terms

While this may sound like a stretch, annuities offer a different type of guarantee. What’s more, just like I don’t want to have time for tech terminology, annuities are considered so complex that only experts know exactly what they are.

Well, I have some good news for you. Annuities aren’t as complicated as you believe. And, to demonstrate that, here’s an annuity 101 guide for all of the non-jargoned consumers out there.

What Exactly Are Annuities?

“The insurance companies that create annuities often make them seem like investments,” writes Ron Lieber in The New York Times. “But really they’re more like insurance.”

Annuities, at their most simplistic, offer a guarantee. “If you turn over some money, you’ll be guaranteed to get all that money back — plus usually a certain amount more,” adds Lieber. “Or you turn over some money and you’ll be guaranteed a regular check for a certain period.”

“Like insurance to stave off financial disaster, an annuity is something you purchase to guarantee that you won’t run out of money if you live a long time,” he clarifies. Having such assurances is appealing. “After all, we don’t know how our investments will perform: This year may be the first in a while that your stock and bond index funds both lose money.”

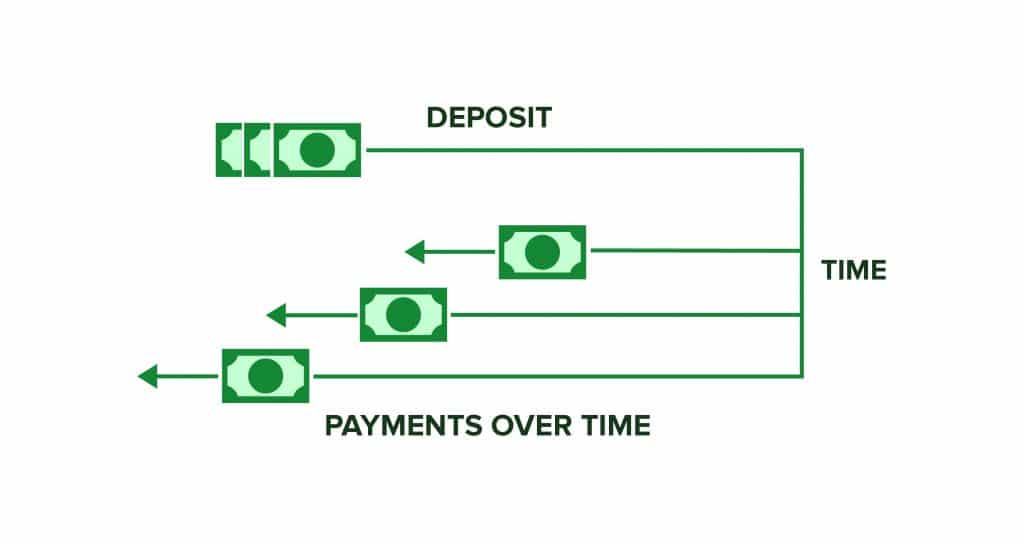

To sum up, an annuity is a contract between you and an insurance company. In exchange for either a single payment or periodic payments known as premiums, the insurance company promises to make periodic payments to you. You can receive these payments either immediately or at some point in the future.

What’s more, it’s possible to save for retirement through annuity contracts. Or, you can also use this method to create another retirement income source. And, it’s even plausible for some contracts to achieve both goals.

So far good, right?

Annuities can be complex.

Now, here’s where annuities can get tricky. Just like the various operating systems, you must choose from when buying a laptop, there are different types of annuities. In fact, “different types of annuities are so unlike that they should be considered entirely different products,” says Kerry Pechter, author of Annuities for Dummies. “A lot of annuity marketers wish they could get rid of the word “annuity” entirely because it only adds to the confusion about these unusual products, which I think of as the duck-billed platypuses of the financial world.”

Annuities – The Main Types Explained

Most people buy annuities as a way to supplement their pension and social security income during retirement. Why? It provides guaranteed lifetime income. So, if these other income streams dry out, they’ll still have money to live off of.

As such, I think we should only focus on the four main types of annuities that will help you achieve this peace of mind.

Fixed vs. Variable Annuities

When it comes to annuities they can be either fixed or variable. But, what’s the difference between them?

Fixed Annuities

Perhaps the most well-known and common type of annuity is the fixed annuity. Here a buyer purchases a fixed annuity. In return, the insurance company guarantees that the person who bought the annuity will receive a specific payment at a future date. The date could be decades down the road, but with an immediate annuity, it might be right now.

How is the insurance company able to deliver this return? The insurer invests the money in safe investments, such as U.S. Treasury securities and highly rated corporate bonds.

The drawback with fixed annuities is that the returns on these investments won’t make you Elon Musk-rich. But, they’re safe and predictable. As such, this makes fixed annuities an attractive option if you aren’t a risk-taker and are looking for regular monthly payments.

Also, fixed annuities can lose purchasing power thanks to inflation. But, there are some annuity contracts to do plan for inflation.

Variable Annuities

An insurer invests in various mutual funds with a variable annuity. The buyer, however, can choose the investments. The growth of the account depends on the performance of those funds. And, the payout of a variable annuity can be fixed or can change with the performance of the account.

Variable annuities are more suitable for those who are willing to take on a certain amount of risk in the hope of generating larger profits. Experienced investors who are familiar with the risks of mutual funds and the risks associated with them are often the best candidates for variable annuities.

Immediate vs. Deferred Annuities

In terms of when the payments begin, annuities are usually immediate or deferred. In fact, one of the first questions to ask before purchasing an annuity is if you want to receive regular income right away or at a later time.

To help you answer that question, let’s quickly look at the advantages and disadvantages of each.

Deferred payments allow the money in the account to grow over time. Similar to a 401(k) or IRA, the annuity can continue to accumulate earnings tax-free until you start receiving payments. If that amount continues to build up, it could result in higher future payments. According to annuity terminology, this time period is referred to as the accumulation period or accumulation phase.

Immediate annuities are exactly as the name implies. Once the buyer pays the insurance company with one lump sum payment, they can begin receiving money.

Finally, both deferred and immediate annuities can be fixed or variable.

Which Type of Annuity is Best?

That depends on your finances and retirement goals. But, one thing to consider is the duration of payments. Usually, shorter periods result in higher monthly payments. On the flip-side, that money won’t be available later in life. But, this could be with exploring if you want to do something like pay off your mortgage.

Another consideration? Your marital status.

In the case of married couples, they can choose a payment plan that pays them money for the rest of their lives — or the rest of their spouse’s. With the latter, the annuity is known as a joint and survivor annuity.

A joint and surviving plan usually means a lower monthly payment. But, it guarantees protection for both partners no matter what.

Here are a few of the best annuity companies we’ve put together to help you find which is best.

Why You Need a Guaranteed Income in Retirement

An annuity will help you prepare for whatever life may throw at you. After all, how many of us could have predicted the Great Recession or the COVID-19 pandemic? Additionally, annuities provide increased flexibility after retirement compared to Social Security or traditional 401(k)s or IRAs.

Also, an annuity avoids the need to withdraw a fixed amount annually as you would with an IRA. And, even better, it doesn’t expose you to potential market risks.

As if that weren’t enough, the guaranteed income that annuities provide can help you pay for essentials like;

- Daily expenses such as groceries, utilities, or pickleball costs.

- Emergency expenses like an urgent medical procedure.

- Going on a vacation, like a Viking River Cruise from Rome to Athens.

- Leaving a legacy to your children, grandchildren, or a favorite charity.

The Major Pros and Cons of Annuities

“Annuities have two primary selling points. First, they provide guarantees — guaranteed rates of returns, guaranteed lifetime income, or guaranteed death benefits — that other types of financial products don’t,” says Pechter. That’s why only insurance companies are allowed to issue annuities. “Second, annuities offer certain tax advantages. They can offer the same or similar tax advantages as employer-sponsored retirement plans or IRAs.”

Moreover, annuities can provide a reliable source of income for retirement. Another benefit of annuities is that you don’t have to worry about outliving your savings, which is crucial for anyone living in a post-pension.

“But, as is true of many things, the virtues of annuities are also their drawbacks,” adds Pechter. “Annuities cost more than other types of investments.” There are never any freebies, and a contract offer guaranteed principal, income, or accumulation will always have hefty fees compared to an investment that requires the investor to take on all the risks.

“Second, tax advantages tend to come with strings attached,” he says. “You can’t always access your money as easily from an annuity contract.” You also pay ordinary income tax rates on withdrawals of annuity assets, which tend to be higher than capital gains tax rates on assets grown in taxable accounts.

Furthermore, there is something called “opportunity cost.” Many potential customers cite this as a major disadvantage to annuities. An example of this would be not being able to pursue a more aggressive investment strategy if you can absorb market losses, like a young investor.

Frequently Asked Questions About Annuities

How Much Will an Annuity Set You Back?

Until you begin making withdrawals from an annuity, you don’t have to pay taxes on anything that you’ve gained. But the investments you make in annuities are made after-tax dollars. That means you can’t deduct your contributions to an annuity from your taxable income.

There are no contribution limits for annuities, unlike IRAs and 401(k)s, which offer tax-deferred growth. You can therefore put away more money with an annuity than with other types of plans. There are still limits if you invest in an annuity through a qualified plan, such as an IRA.

Taking money out of an annuity is taxed at ordinary income rates, not at lower capital gains rates, which is a downside. Also, you will be subject to a 10% tax penalty if you withdraw money before turning 59 ½.

IRAs and 401(k)s do not offer any additional tax advantages to investors who purchase annuities within them.

Is an Annuity Right For You?

“To be honest, anyone can purchase an annuity,” notes Due founder and CEO John Rampton. “But, that doesn’t mean that it’s always going to be the right fit for your retirement plans. It’s kind of like insisting that you still squeeze into a pair of skinny jeans.”

“Annuities are ideal if you’re you’re healthy and expect to live a long and meaningful life,” he adds. “If so, then annuities ensure that you will not outlive your savings.”

How about if you’re ill? You probably don’t want to purchase an annuity. A medical condition may reduce your life expectancy or cause your savings to be outlived due to high medical costs, which is particularly true if you have a medical condition.

Another determinant can be age. The younger you are, the more time you have to recover potential losses if you invest in stocks and riskier options. Annuities, however, may provide some much-needed safety and predictability if you’re nearing retirement.

One other major factor should be considered as well; what other retirement options you have.

“If you’ve maxed out other tax-advantaged retirement plans like a 401(k) or IRA, and you have the extra money to spare, then an annuity’s tax-free growth can make a lot of sense,” John states.

“If you’re still on the fence, then there’s some good news for you,” he continues. “Almost all annuity contracts offer a free lock period. In most cases, they allow you, the purchaser, between 10 and 30 days to consider the terms of the contract.” If you don’t like what you see, you can cancel the contract and get your money back.

What to Consider When Thinking About Purchasing an Annuity?

It’s important to know what the contract’s features are, how much it’ll cost, and what restrictions it brings. Similarly, considering annuities as an alternative to non-insurance retirement-saving plans could help you determine whether annuities are right for you.

And, definitely don’t overlook the company that you’re purchasing the annuity from. You want to buy the annuity from a legit and reputable company that has a solid financial history. I mean you wouldn’t buy a laptop from some stranger on the street, right?

What Are The Key Annuity Terms

While not an extensive list by any means, the following is a glossary of the key annuity terms that you should know.

- Accumulation period – A period in which an annuity’s cash value increases before payments are issued to the annuity owner.

- Annuitant – The owner of the annuity contract or the person, such as an heir who will receive payments.

- Annuitization – The conversion of annuity benefits into monthly, quarterly, or annual payments.

- Beneficiary – Upon the death of the contract owner or annuitant, the person designated by the owner to receive any payments due.

- Contract owner – This is the person paying the premium. Owners are able to withdraw, make investment decisions, change beneficiaries, surrender contracts and convert deferred contracts into immediate income streams. Annuities can be owned by more than one person..

- Deferred annuity – An annuity in which the payout phase is postponed until a future date. Single premiums, multiple premiums,, or regular contributions can be used to pay for the annuity contract.

- Fixed annuity – The contract owner receives a fixed rate of interest through the accumulation phase of a deferred annuity.

- Free-look period. A new contract can be canceled within 30 days of its issuance by the owner.

- Immediate annuity – Purchased with a single premium, this type of annuity generally begins paying after one to 13 months.

- Indexed annuity – An annuity in which the gains are indirectly linked to the performance of a market index, such as the S&P 500. Also, losses are limited by poor market performances.

- Payout phase – Payments made by immediate annuities or deferred annuities during which money has accumulated in a deferred annuity.

- Premiums – The money paid to buy an annuity.

- Surrender charge – The penalty that a contract owner must pay for withdrawing from the annuity before the surrender period is up.

- Variable annuity – An annuity whose value or income is subject to change since its performance depends on the value and performance of investments.