When you think about Delaware and Japan, you probably don’t think about things they have in common.

However, one of the smallest states in the United States and the country of Japan do have something in common when it comes to fintech and using technology to make a difference. These are both places running blockchain trials.

In the name of financial innovation, both Delaware and Japan are looking at ways to use the blockchain to advantage. There have been a lot of interesting developments in recent years. And one of the most interest is the way blockchain could revolutionize the way we do business.

Here’s what’s going on right now:

Table of Contents

ToggleBlockchain Trials in Delaware

In Delaware, according to the Wharton business school at the University of Pennsylvania, blockchain trials are all about updating the financial industry.

Even though Delaware only has about a million people, it is one of the central places for corporate finance. The majority of Fortune 500 companies make their homes in Delaware, and most IPOs choose to domicile there, according to Wharton.

So, what is Delaware up to?

Well, Delaware is running trials related to using smart contracts to settle financial transactions, particularly those related to stocks. According to the report from Wharton, the idea is to allow trades to settle instantly, as well as combine the steps of incorporation and stock issuance.

Right now, the steps of incorporation and stock issuance are separate. This doesn’t make sense, reports Wharton. The two things are basically the same. Using a distributed ledger through blockchain, the two steps could be combined. It would simplify the process, making it faster and less expensive.

On top of that, Delaware’s blockchain trials have the potential to completely overhaul the system in Wall Street. Trades could be settled quicker and easier, with increased accuracy. The idea is to try using the distributed ledger system to take care of these transactions with the help of smart contracts that manage everything.

Bringing Banking Up to Speed

It’s not just Wall Street that could benefit if Delaware’s blockchain trials are successful. The entire financial industry could be transformed, according to the Wharton article.

Part of the issue is that fintech has been adopted on a large scale when it comes to consumer-facing products and services. Think about all the ways banks are striving to make your life easier: the apps, the bill pay, the money transfers.

But, even though fintech seems apparent from a consumer standpoint, the story is different at the backend. According to Wharton’s report, many banks are still mired in old technology as they run their systems behind the scenes. If these Delaware blockchain trials go well, though, things could change.

Banks could use blockchain technologies to manage many more transactions and settle transactions faster. With the help of blockchain applications, settlements could be less expensive and the process easier.

The hope is that Delaware’s trials will go well and within 20 or so years the entire financial industry will be transformed.

Regulatory Hurdles

According to Wharton, the biggest issue is the fact that permissionless distributed ledgers mean that it’s not possible to know who’s on the other side of the transactions. Banks have been wary of adopting blockchain technologies in some cases because they are worried that they could end up in trouble with the government for aiding money laundering.

However, just because it’s blockchain doesn’t mean it always has to be a cover for something shady. It’s possible to use distributed ledgers in a permissioned way. That way, it’s possible to create smart contracts and other blockchain applications and transactions with knowledge of the other party. It’s something that can be done.

An increasing number of states are adopting rules that allow for blockchain transactions, including classifying blockchain applications and intelligent signatures as electronic signatures. This makes them legally recognized and binding.

If Delaware’s blockchain trials go well, the entire financial industry (and other industries as well) could see major changes toward transparency, speed, and ease.

Japan’s Blockchain Trials

In Japan, the major banking association is set to experiment with blockchain technology this coming fall, according to an article from Nikkei.

The Japanese Bankers Association (JBA) is planning to provide a platform that allows members to test out different blockchain technologies in an effort to see how they work. These trials include smart contracts for settlements and faster bank transfers.

Right now, transfers between banks can be costly. It can also take a bit of time. With the help of blockchain technologies, all of these could be speeded up.

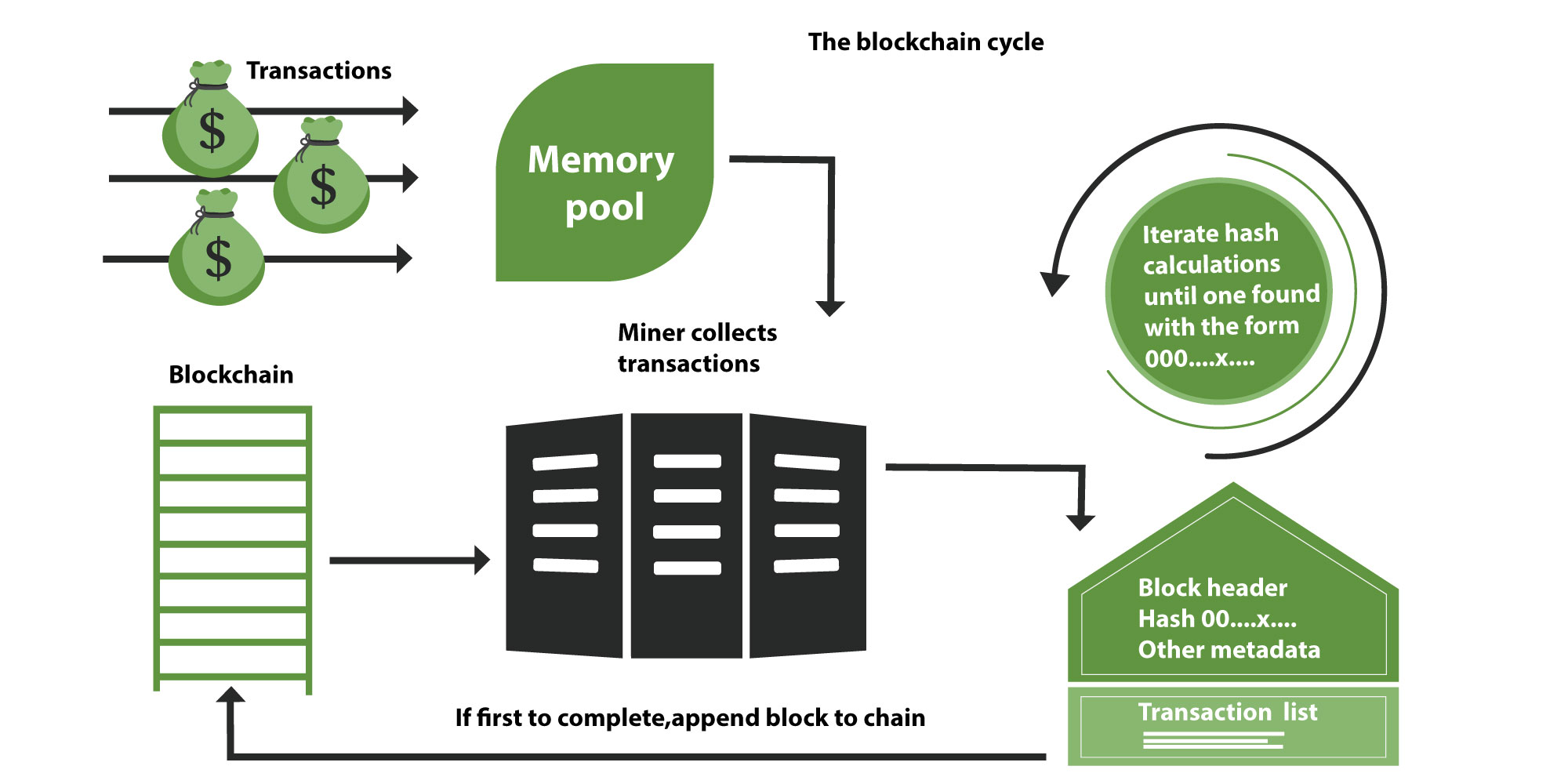

The idea is to potentially bypass the centralized system currently in use. Right now, says Nikkei, the transactions are recorded in a central database system of servers. However, because blockchain uses distributed ledger technology, it becomes decentralized. With the help of blockchain, costs related to developing and managing these central systems could be minimized.

In fact, reports Nikkei, some estimates think that the cost to maintain the system could fall to one-tenth the current cost. That’s a huge savings.

Plus, there’s a lot to be said for the speed at which the transactions would take place. Almost instant settlement is one of the features of blockchain technology.

Japan’s Big Banks Already in Blockchain Trials

The JBA’s efforts aren’t the only blockchain trials in Japan. While the JBA is receiving regulatory support from the Financial Services Agency and the Bank of Japan, the biggest banks are already experimenting.

According to Crypto Coin News, Japan’s megabanks have been running blockchain trials for a while. These banks have been using money transfer over blockchain. They are also interested in using bitcoin.

Indeed, bitFlyer, Japan’s largest bitcoin exchange, recently saw a proof-of-concept trial that saw 1,500 transactions per second, according to Crypto Coin News.

That’s not bad. And bitcoin has fairly wide acceptance in Japan. Major banks invest in bitFlyer. Plus, many stores in Japan accept the cryptocurrency. In fact, more than 250,000 stores in Japan are expected to accept bitcoin by the summer. This is the result of the fact that Japan just recognized bitcoin as a legal currency.

As more people adopt bitcoin, and with Japan driving this adoption, we could see more cryptocurrencies in addition to the other blockchain applications.

Bottom Line: Blockchain is Gaining Ground

With the blockchain trials going forward, the technology is gaining ground. And it’s not just about bitcoin and other cryptocurrencies.

There are different applications for blockchain technologies and applications. There is innovation happening all the time. As blockchain is better integrated into fintech, we are likely to see more interesting developments.

Already, major companies in the United States are looking for ways to use blockchain technology. And, if a major financial hub like Delaware shows successful implementation of the promise, everything else could follow.

Blockchain has the potential to help us manage our money differently. Global transactions could be taken care of quickly and easily. Costs could go down. There is a lot of potential for blockchain.

It all starts with these blockchain trials happening in different places in the world. it will be interesting to see what happens moving forward. As long as blockchain can be adapted somewhat to the regulatory environment, it should be able to transform the way we take care of financial business.