For three years in a row, American adults have the same top financial regret. A May 2018 survey from Bankrate looks at the top financial regrets among Americans and how they deal with those financial regrets. By looking at the most common regrets, we know where we can best focus our future efforts on our investments, bank accounts, and beyond.

Table of Contents

ToggleThe top financial regrets of Americans

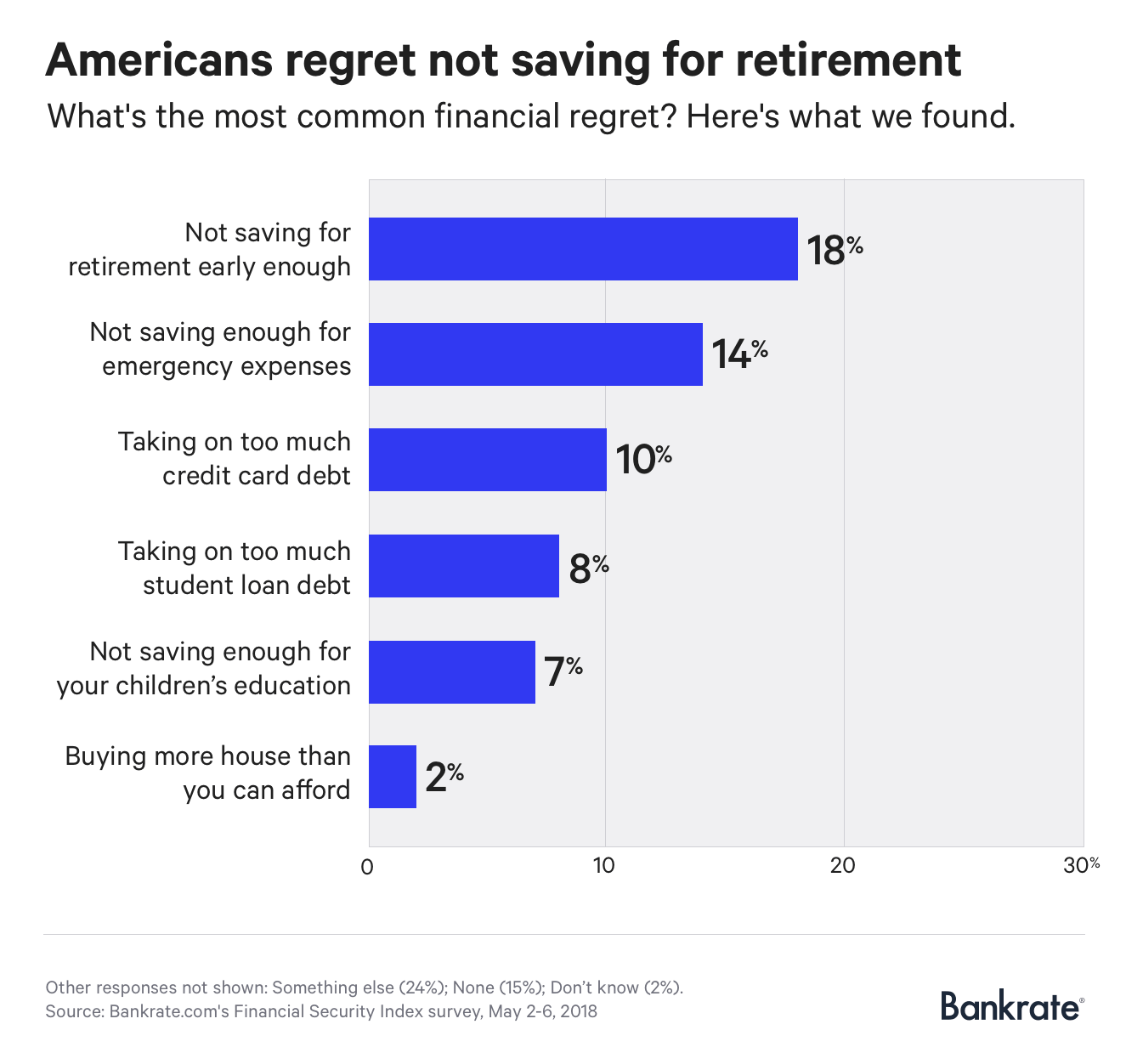

The number one financial regret among Americans is not saving for retirement early enough. This financial regret claims the top spot for the third year in a row in Bankrate’s annual Financial Security Index survey. This answer was number one for 18% of respondents.

Number two on the list is not saving enough for emergency expenses, with 14% of respondents most regretful about this. For workers in any profession, an emergency fund is an important part of maintaining financial stability. For freelancers and entrepreneurs, it is best to save at least six to 12 months of expenses in emergency savings.

The third most common regret is taking on too much credit card debt, with 10% of responses marking this as number one. This is no surprise, as Americans have over $1 trillion in credit card debt. The average household holds $8,600 in credit card debt.

Number four on the list is taking on too much student loan debt, a top regret for 8% of respondents. Americans have nearly $1.5 trillion in student loan debt. 44.2 million Americans have student loans, according to Student Loan Hero data.

The fifth most common financial regret is not saving enough for a child’s education, coming in with 7%. Both number four and five on this list share a commonality: they relate to a high cost of college. Number one and number five also have a big common trait: they both involve savings. These two topics are an important part of Americans’ biggest financial struggles.

Last on the top financial regrets list is buying more house than you can afford, with two percent of respondents choosing this answer. Like college, housing costs generally go up, up, up over time. In some areas, buying even a modest home takes up a huge portion of take-home pay.

Here is the full results care of Bankrate:

How Americans respond to financial regrets

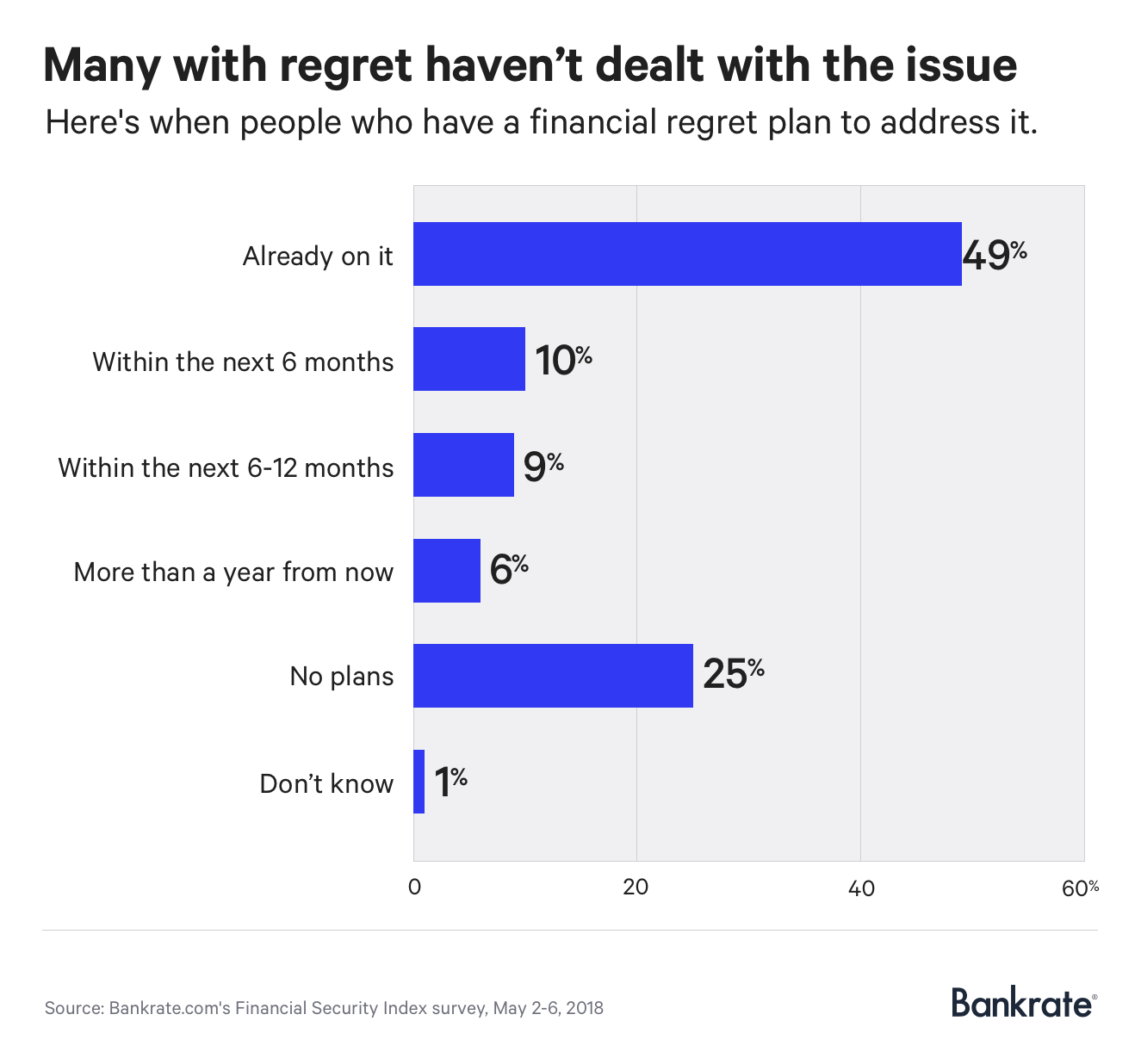

The list of common financial regrets does not yield many surprises to those who follow economic news, but how people respond to their biggest regrets is a bit more interesting. A full 25% have no plans to deal with their biggest financial regret and continue to go on living with it.

A nice relief, however, comes from the 49% who are already working on addressing their biggest financial regret. Whether it is debt, savings, or something else, a good budget and focus on finances can help overcome most money challenges.

While better than the quarter of Americans with no plans to address financial regrets, 19% plan to start work on their money problems within a year while six percent plan to do so later on in the future.

Only with a long-term focus on your finances can you rise above the statistics and go forward with no money regrets. While most of us would want to be wealthy someday, it takes a real effort to turn that dream into a reality.

Avoiding the biggest financial regrets

The best way to avoid many common financial regrets is simple: avoid going into debt. While it may not seem like a big deal swiping a credit card for a TV or choosing the expensive out-of-state school, credit card debt and student loan debt payments are a very real.

The next major focus to avoid a big regret is to save. Start with even $1 per week. No amount is too small. You can always increase it later. But if you don’t start saving, you will never build up savings to pay for a home, education, or retirement.

Thanks to the time value of money, the sooner you save, the better. Compound interest and compound investment values help your money grow over time. If your money has more time to grow, the impact of that growth is exponentially helpful.

Life a life free of financial regrets

Recovering from financial regrets is very difficult. Rather than turn around a difficult situation, avoid it from the start. That is one of the best paths to lifestyle satisfaction and a life free of financial strain and worry.