How do retirement investors know what to select when choosing ETFs? Retirement investors rely on a steady income and lower volatility. Defensive ETFs can help maintain capital during uncertain times and provide regular dividend payouts. The list draws on data and key performance indicators to rank funds that have a history of reliable returns and risk control. The evaluation uses a set of clearly defined criteria to assess each offering. These criteria include:

- Expense Ratio

- Dividend Yield

- Assets Under Management (AUM)

- Historical Performance

- Tracking Accuracy

Each ETF is reviewed based on these factors, ensuring that investors receive a balanced view for long-term retirement strategies.

Table of Contents

ToggleTop 13 Defensive ETFs For Retirement

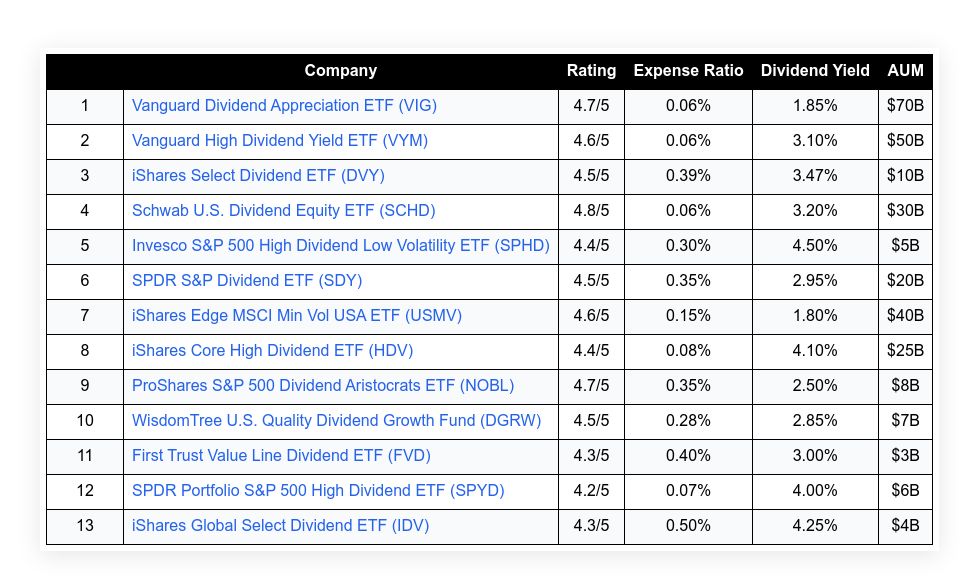

| Company | Rating | Expense Ratio | Dividend Yield | AUM | |

|---|---|---|---|---|---|

| 1 | Vanguard Dividend Appreciation ETF (VIG) | 4.7/5 | 0.06% | 1.85% | $70B |

| 2 | Vanguard High Dividend Yield ETF (VYM) | 4.6/5 | 0.06% | 3.10% | $50B |

| 3 | iShares Select Dividend ETF (DVY) | 4.5/5 | 0.39% | 3.47% | $10B |

| 4 | Schwab U.S. Dividend Equity ETF (SCHD) | 4.8/5 | 0.06% | 3.20% | $30B |

| 5 | Invesco S&P 500 High Dividend Low Volatility ETF (SPHD) | 4.4/5 | 0.30% | 4.50% | $5B |

| 6 | SPDR S&P Dividend ETF (SDY) | 4.5/5 | 0.35% | 2.95% | $20B |

| 7 | iShares Edge MSCI Min Vol USA ETF (USMV) | 4.6/5 | 0.15% | 1.80% | $40B |

| 8 | iShares Core High Dividend ETF (HDV) | 4.4/5 | 0.08% | 4.10% | $25B |

| 9 | ProShares S&P 500 Dividend Aristocrats ETF (NOBL) | 4.7/5 | 0.35% | 2.50% | $8B |

| 10 | WisdomTree U.S. Quality Dividend Growth Fund (DGRW) | 4.5/5 | 0.28% | 2.85% | $7B |

| 11 | First Trust Value Line Dividend ETF (FVD) | 4.3/5 | 0.40% | 3.00% | $3B |

| 12 | SPDR Portfolio S&P 500 High Dividend ETF (SPYD) | 4.2/5 | 0.07% | 4.00% | $6B |

| 13 | iShares Global Select Dividend ETF (IDV) | 4.3/5 | 0.50% | 4.25% | $4B |

Vanguard Dividend Appreciation ETF (VIG)

Vanguard Dividend Appreciation ETF (VIG) is favored for its focus on companies with a record of growing dividend payments. The fund provides investors with broad exposure to quality companies that tend to perform steadily. Its low expense ratio and stringent selection process contribute to long-term stability. Official figures show consistent growth in assets, with a reliable dividend yield that can meet retirement income needs. With a disciplined approach in stock selection, VIG offers a blend of stability and growth potential. Its historical performance reflects prudent risk management, while the portfolio remains diversified across several sectors.

Expense Ratio: 0.06%

Dividend Yield: 1.85%

AUM: $70B

Historical Return: Solid over time

Risk Level: Low to moderate

| Summary of Online Reviews |

|---|

| “Investors appreciate the fund’s stable dividend growth.” and “its cost efficiency stands out.” |

Vanguard High Dividend Yield ETF (VYM)

Vanguard High Dividend Yield ETF (VYM) targets companies that provide higher dividend payouts. The fund is known for a mix of strong income generation and adherence to a disciplined investment approach. By focusing on financially solid firms, it helps investors pursue steady income while managing market uncertainties. VYM maintains low costs and offers a diversified range of sectors. Its portfolio performance demonstrates reliable dividend distributions over time. Investors looking for a source of retirement income have valued this ETF for its balance of yield and stability.

Expense Ratio: 0.06%

Dividend Yield: 3.10%

AUM: $50B

Historical Return: Consistent

Risk Level: Moderate

| Summary of Online Reviews |

|---|

| “The steady dividend focus appeals to many long-term investors.” and “its low cost is a major plus.” |

iShares Select Dividend ETF (DVY)

iShares Select Dividend ETF (DVY) features stocks with steady dividend payments. Managed by a major asset management firm, this ETF is recognized for its income focus and broad sector exposure. It applies strict selection rules to include companies with attractive yield profiles and dependable earnings. Investors find the balance between income and risk appealing, especially during market slowdowns. DVY has built a reputation for its dependable dividend record and stable returns over time. The fund presents a mix of mature firms that historically deliver earnings in challenging market conditions.

Expense Ratio: 0.39%

Dividend Yield: 3.47%

AUM: $10B

Historical Return: Steady

Risk Level: Moderate

| Summary of Online Reviews |

|---|

| “Investors praise its selection process that favors strong dividends,” and “a solid pick for retirement portfolios.” |

Schwab U.S. Dividend Equity ETF (SCHD)

Schwab U.S. Dividend Equity ETF (SCHD) is recognized for its low costs and focus on high-quality dividend-paying companies. The fund selects firms with strong earnings records and sustainable payout ratios. Its strategy mixes value and income while keeping fees minimal. This focus has helped SCHD build a reputation for stable returns and consistent dividend distributions. Investors looking for a steadier income stream in retirement appreciate the ETF’s disciplined approach. The fund is well-regarded for its transparent methodology and diversified sector exposure.

Expense Ratio: 0.06%

Dividend Yield: 3.20%

AUM: $30B

Historical Return: Consistent

Risk Level: Low to moderate

| Summary of Online Reviews |

|---|

| “It’s minimal cost and clear strategy wins over many long-term investors,” and “a favorite for income focus.” |

Invesco S&P 500 High Dividend Low Volatility ETF (SPHD)

Invesco S&P 500 High Dividend Low Volatility ETF (SPHD) is designed to combine the benefits of income and reduced price swings. This fund focuses on companies that produce attractive dividend yields and have less volatile stock prices. Its method provides investors with a way to enjoy regular income while carefully managing risk. SPHD’s portfolio is selected using clear statistical measures that support lower fluctuations. Such attributes make it appeal to those who plan for a secure retirement income. Its performance history reflects steady income with a careful balance of risk.

Expense Ratio: 0.30%

Dividend Yield: 4.50%

AUM: $5B

Historical Return: Stable

Risk Level: Low

| Summary of Online Reviews |

|---|

| “Many investors commend its stable approach in unpredictable markets,” and “offers a consistent income stream.” |

SPDR S&P Dividend ETF (SDY)

SPDR S&P Dividend ETF (SDY) focuses on companies with a long history of dividend increases. The strategy relies on a rigorous selection process that favors firms with proven track records of payouts. This ETF offers steady income, along with capital growth through income reinvestment. SDY stands out for its transparency and focus on established dividend payers. Veterans in retirement planning point to SDY as a reliable source to achieve both income and moderate capital gains. Its balanced approach helps reduce potential market shocks while maintaining a steady yield.

Expense Ratio: 0.35%

Dividend Yield: 2.95%

AUM: $20B

Historical Return: Steady

Risk Level: Moderate

| Summary of Online Reviews |

|---|

| “Investors value its long-standing record of dividend growth,” and “its focus on established companies is well received.” |

iShares Edge MSCI Min Vol USA ETF (USMV)

iShares Edge MSCI Min Vol USA ETF (USMV) is designed to lower risk by focusing on stocks with less volatility. The fund utilizes statistical models to construct a portfolio that can better withstand price fluctuations. Investors benefit from steady performance and a reduced risk of significant losses. The ETF has attracted those who appreciate a method that balances yield with a measured approach to risk. USMV is noted for its blend of large-cap stability and risk management. The fund’s strategy supports a smoother investment journey during retirement years.

Expense Ratio: 0.15%

Dividend Yield: 1.80%

AUM: $40B

Historical Return: Reliable

Risk Level: Low

| Summary of Online Reviews |

|---|

| “The low volatility approach gives investors added peace of mind.” and “its risk-adjusted returns are impressive.” |

iShares Core High Dividend ETF (HDV)

iShares Core High Dividend ETF (HDV) targets companies prized for their dividend payments. The ETF offers a focused portfolio with an emphasis on income generation. Its holdings are selected with strict standards, ensuring that only companies with a record of paying regular dividends are included. HDV appeals to investors who prioritize consistent cash flow and steady performance. Its blend of yield and prudent risk management helps it secure a place in many retirement plans. The fund’s performance and cost structure provide a sound option for investors seeking comfort in their income strategy.

Expense Ratio: 0.08%

Dividend Yield: 4.10%

AUM: $25B

Historical Return: Consistent

Risk Level: Moderate

| Summary of Online Reviews |

|---|

| “Users appreciate its steady dividend income,” and “the fund performs reliably during market cycles.” |

ProShares S&P 500 Dividend Aristocrats ETF (NOBL)

ProShares S&P 500 Dividend Aristocrats ETF (NOBL) focuses on companies with a long record of increasing dividends. The ETF selects firms that have demonstrated resilience and consistent earnings. Its approach results in a portfolio that many retirement investors use to secure a steady income. NOBL combines the benefits of yield with the strength of companies that have a history of stability. Its low turnover and focus on proven dividend growth are well-received. The fund serves as a tool for those looking to mix income security with exposure to established market leaders.

Expense Ratio: 0.35%

Dividend Yield: 2.50%

AUM: $8B

Historical Return: Steady

Risk Level: Moderate

| Summary of Online Reviews |

|---|

| “The focus on dividend growth has resonated well with investors,” and “its track record offers added confidence.” |

WisdomTree U.S. Quality Dividend Growth Fund (DGRW)

WisdomTree U.S. Quality Dividend Growth Fund (DGRW) emphasizes a mix of quality and growing dividends. The ETF selects companies noted for solid balance sheets and consistent dividend increases. Its approach has earned favor among investors looking for a balance of income and potential growth. By weighting quality factors in its selection process, DGRW targets lower volatility while delivering steady yield enhancements. The fund’s portfolio is diversified across sectors to limit risks while offering an attractive dividend profile. Investors appreciate the clear focus and measured execution of its management.

Expense Ratio: 0.28%

Dividend Yield: 2.85%

AUM: $7B

Historical Return: Steady

Risk Level: Moderate

| Summary of Online Reviews |

|---|

| “Its focus on dividend quality stands out among peers,” and “investors appreciate its detailed approach.” |

First Trust Value Line Dividend ETF (FVD)

First Trust Value Line Dividend ETF (FVD) offers access to companies with strong dividend performance and reliable track records. The ETF utilizes a distinctive screening process that focuses on earnings stability and dividend consistency. Its low-cost structure and established methodology are valued by retirement investors seeking predictable income. FVD offers a diversified portfolio that spreads risk across multiple sectors, aiming to maintain a steady income. The fund has emerged as a stable option for those who prioritize a blend of income and conservative growth.

Expense Ratio: 0.40%

Dividend Yield: 3.00%

AUM: $3B

Historical Return: Steady

Risk Level: Moderate

| Summary of Online Reviews |

|---|

| “Its methodical stock selection provides confidence among users,” and “a solid option for those focused on income.” |

SPDR Portfolio S&P 500 High Dividend ETF (SPYD)

The SPDR Portfolio S&P 500 High Dividend ETF (SPYD) offers access to companies recognized for their generous dividend payouts. The ETF employs a transparent selection process that prioritizes high dividend yields among large-cap companies. It offers investors a combination of income generation with exposure to a broad market area. SPYD is suited for those who want steady returns with a controlled risk profile. This ETF benefits from a cost-effective structure and diversified holdings, making it a practical choice for retirement-focused strategies.

Expense Ratio: 0.07%

Dividend Yield: 4.00%

AUM: $6B

Historical Return: Reliable

Risk Level: Moderate

| Summary of Online Reviews |

|---|

| “Its high yield profile and low fees attract many income seekers,” and “a valued addition to retirement portfolios.” |

iShares Global Select Dividend ETF (IDV)

iShares Global Select Dividend ETF (IDV) provides international exposure, focusing on dividend quality. The ETF comprises companies from various regions with a proven track record of regular dividend payouts. It provides diversity that can help reduce overall portfolio volatility. This fund is chosen by investors who seek to balance global growth with stable income. The careful screening of multinational companies ensures that only those with dependable financial profiles are included. IDV serves as an effective tool for retirement investors seeking to diversify their income sources globally.

Expense Ratio: 0.50%

Dividend Yield: 4.25%

AUM: $4B

Historical Return: Steady

Risk Level: Moderate

| Summary of Online Reviews |

|---|

| “Investors appreciate its global diversification and focus on yield,” and “offers exposure to stable dividend payers outside the U.S.” |

Final Thoughts

The list highlights ETFs that emphasize income and lower risk. Each fund has unique strengths. Investors can compare expense ratios, dividend yields, and asset sizes to determine the best fit. Risk profiles and historical performance figures aid informed decision-making. Retirement strategies benefit from these funds, as they offer a mix of stability and income potential. Evaluating each ETF against personal goals and tolerance levels can lead to a more secure retirement portfolio.