As a new investor, you will want to look to add short-term bonds to your portfolio. Here’s a selection of bond funds offering moderate yields while aiming to reduce interest rate risks. The list emphasizes funds that feature steady performance, low fees, and reliable management.

Each entry is chosen for its ease of access and strong track record with a balanced mix of return and risk. The criteria used in this evaluation include:

- Expense Ratio

- Average Yield

- Duration of Funds

- Risk Level

- Fund Manager Expertise

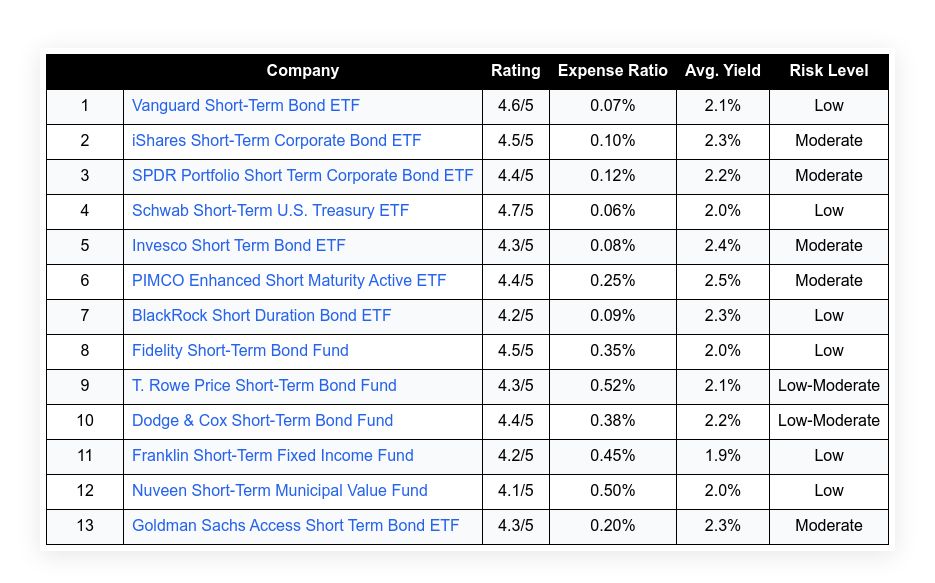

The following table and detailed reviews break down each fund’s performance metrics and key strengths. This guide is intended to help beginners understand the features that make these bond funds attractive for risk-averse portfolios.

Table of Contents

ToggleTop 13 Short-Term Bonds For Beginners

| Company | Rating | Expense Ratio | Avg. Yield | Risk Level | |

|---|---|---|---|---|---|

| 1 | Vanguard Short-Term Bond ETF | 4.6/5 | 0.07% | 2.1% | Low |

| 2 | iShares Short-Term Corporate Bond ETF | 4.5/5 | 0.10% | 2.3% | Moderate |

| 3 | SPDR Portfolio Short Term Corporate Bond ETF | 4.4/5 | 0.12% | 2.2% | Moderate |

| 4 | Schwab Short-Term U.S. Treasury ETF | 4.7/5 | 0.06% | 2.0% | Low |

| 5 | Invesco Short Term Bond ETF | 4.3/5 | 0.08% | 2.4% | Moderate |

| 6 | PIMCO Enhanced Short Maturity Active ETF | 4.4/5 | 0.25% | 2.5% | Moderate |

| 7 | BlackRock Short Duration Bond ETF | 4.2/5 | 0.09% | 2.3% | Low |

| 8 | Fidelity Short-Term Bond Fund | 4.5/5 | 0.35% | 2.0% | Low |

| 9 | T. Rowe Price Short-Term Bond Fund | 4.3/5 | 0.52% | 2.1% | Low-Moderate |

| 10 | Dodge & Cox Short-Term Bond Fund | 4.4/5 | 0.38% | 2.2% | Low-Moderate |

| 11 | Franklin Short-Term Fixed Income Fund | 4.2/5 | 0.45% | 1.9% | Low |

| 12 | Nuveen Short-Term Municipal Value Fund | 4.1/5 | 0.50% | 2.0% | Low |

| 13 | Goldman Sachs Access Short Term Bond ETF | 4.3/5 | 0.20% | 2.3% | Moderate |

Vanguard Short-Term Bond ETF

Vanguard Short-Term Bond ETF is known for its steady performance and low fees. The fund is backed by a strong management team that focuses on balancing risk and return. It appeals to new investors seeking low volatility and reliable income.

The fund offers attractive yields while keeping the cost low. Its broad diversification and strategic allocation to short-duration bonds help reduce exposure to interest rate shifts.

Expense Ratio: 0.07%

Average Yield: 2.1%

Duration: Short-term

Risk Level: Low

Fund Manager Expertise: High

| Summary of Online Reviews |

|---|

| “Investors appreciate its stability,” and “exceptional cost control.” |

iShares Short-Term Corporate Bond ETF

This bond fund emphasizes corporate debt with short maturities. New investors value its balance of risk and return. Managed by a globally recognized firm, the fund presents a mix of high-quality corporate bonds. It offers competitive yields and maintains a careful asset allocation.

The fund is ideal for those who prefer stability with moderate income returns. Its structure supports diversification while keeping the portfolio liquid.

Expense Ratio: 0.10%

Average Yield: 2.3%

Duration: Short-term

Risk Level: Moderate

Fund Manager Expertise: High

| Summary of Online Reviews |

|---|

| “Trusted for its reliable yield.” and “strong performance track record.” |

SPDR Portfolio Short Term Corporate Bond ETF

Many beginners prefer this bond fund for its efficient management and clear focus on short-term corporate debt. It is managed by a leading asset advisor, ensuring disciplined risk management.

The fund balances competitive yield with controlled volatility, making it suitable for cautious portfolios. Investors find its clear investment approach and low fees appealing for building steady income.

Expense Ratio: 0.12%

Average Yield: 2.2%

Duration: Short-term

Risk Level: Moderate

Fund Manager Expertise: High

| Summary of Online Reviews |

|---|

| “Balanced approach to risk and yield.” with “clear fund oversight.” |

Schwab Short-Term U.S. Treasury ETF

This fund focuses on U.S. Treasury bonds with short maturities. It is designed for cost-aware beginners who seek safety and liquidity. With an emphasis on government-backed securities, the fund offers a dependable income stream.

The provider is known for clear pricing and efficient execution. Investors appreciate the fund’s low fees and minimal risk while maintaining steady returns.

Expense Ratio: 0.06%

Average Yield: 2.0%

Duration: Short-term

Risk Level: Low

Fund Manager Expertise: High

| Summary of Online Reviews |

|---|

| “Loved for its low cost and safety,” and “consistent yield performance.” |

Invesco Short Term Bond ETF

Invesco Short Term Bond ETF is built for investors who want steady income with moderate risk. The fund is managed by a seasoned team focusing on liquid bonds. Its competitive yield and streamlined expense structure meet the needs of risk-sensitive portfolios.

Its disciplined allocation ensures controlled exposure, appealing to those beginning their investment journey. The fund offers a balanced mix while keeping fees in check.

Expense Ratio: 0.08%

Average Yield: 2.4%

Duration: Short-term

Risk Level: Moderate

Fund Manager Expertise: High

| Summary of Online Reviews |

|---|

| “A solid pick for short-duration bonds,” with “balanced cost and return.” |

PIMCO Enhanced Short Maturity Active ETF

PIMCO Enhanced Short Maturity Active ETF is managed by one of the leading global fixed income experts. This fund offers an active approach to investing in short-term bonds. It focuses on quality and liquidity to provide competitive income. Its active management style garners favor from investors who appreciate tactical adjustments. The product offers a fine blend of stability and growth potential in volatile markets.

Expense Ratio: 0.25%

Average Yield: 2.5%

Duration: Short-term

Risk Level: Moderate

Fund Manager Expertise: Very High

| Summary of Online Reviews |

|---|

| “Well-regarded for its active management,” and “effective risk controls.” |

BlackRock Short Duration Bond ETF

This fund offers exposure to short-duration bonds while maintaining a focus on quality. Managed by BlackRock, it is structured to balance yield with income preservation. The product suits investors looking for lower volatility options.

Its portfolio design minimizes risk while delivering moderate returns. Buyers find the fund’s transparent approach and competitive cost structure appealing.

Expense Ratio: 0.09%

Average Yield: 2.3%

Duration: Short-term

Risk Level: Low

Fund Manager Expertise: High

| Summary of Online Reviews |

|---|

| “Consistently favored for steady returns.” with “low cost structure.” |

Fidelity Short-Term Bond Fund

The Fidelity Short-Term Bond Fund is designed for investors who need a safe introduction to fixed income. With a focus on short-term debt instruments, the fund offers stability and reliability. It prioritizes low cost while providing a consistent yield.

Its management has a strong record in fixed income, making it a wise choice for cautious investors. Transparency and ease of access are key strengths noted by many users.

Expense Ratio: 0.35%

Average Yield: 2.0%

Duration: Short-term

Risk Level: Low

Fund Manager Expertise: High

| Summary of Online Reviews |

|---|

| “Praised for its clear strategy and transparency,” and “efficient yield generation.” |

T. Rowe Price Short-Term Bond Fund

This fund combines a cautious approach with steady income generation. The management team prioritizes safety and low volatility. Benefiting from experienced leadership, the fund maintains a balanced portfolio of debt with short maturities. It is ideal for those settling into fixed income investments. Users appreciate its straightforward fee structure and reliable performance.

Expense Ratio: 0.52%

Average Yield: 2.1%

Duration: Short-term

Risk Level: Low-Moderate

Fund Manager Expertise: High

| Summary of Online Reviews |

|---|

| “Users enjoy its stability and clarity,” with “trustworthy management.” |

Dodge & Cox Short-Term Bond Fund

Dodge & Cox Short-Term Bond Fund is recognized for its prudent risk management. Its focus on quality fixed-income instruments makes it suitable for novices. The fund’s low expenses and experienced management help it maintain steady returns.

Investors note its careful debt selection and balanced portfolio. Its approach blends risk control with a desire for yield, making it a balanced option.

Expense Ratio: 0.38%

Average Yield: 2.2%

Duration: Short-term

Risk Level: Low-Moderate

Fund Manager Expertise: High

| Summary of Online Reviews |

|---|

| “Admired for its disciplined strategy,” and “balanced fee structure.” |

Franklin Short-Term Fixed Income Fund

Franklin Short-Term Fixed Income Fund offers stable returns with low market risk. It is designed to provide a consistent income through investments in short-term government and corporate bonds. The fund receives regular praise for its transparent fee structure and efficient management. It is a fitting choice for newcomers who desire a balance of yield and minimal risk.

Expense Ratio: 0.45%

Average Yield: 1.9%

Duration: Short-term

Risk Level: Low

Fund Manager Expertise: High

| Summary of Online Reviews |

|---|

| “Valued for its clarity and performance consistency,” with “friendly user feedback.” |

Nuveen Short-Term Municipal Value Fund

Nuveen Short-Term Municipal Value Fund focuses on tax-advantaged municipal bonds for investors. The fund is favored by those looking for income that is exempt from federal taxes.

Its portfolio emphasizes strong credit quality and short durations, keeping volatility to a minimum. New investors find its clear structure and tax benefits attractive. This fund is ideal for conservative portfolios that value steady dividend-like payments.

Expense Ratio: 0.50%

Average Yield: 2.0%

Duration: Short-term

Risk Level: Low

Fund Manager Expertise: High

| Summary of Online Reviews |

|---|

| “Highly rated for tax efficiency,” with “stable income performance.” |

Goldman Sachs Access Short Term Bond ETF

Goldman Sachs Access Short Term Bond ETF offers focused exposure to short-term fixed income instruments. Managed by an established global bank, the fund is built to deliver consistent income with controlled risks. Investors appreciate the balance of competitive yield and efficient cost management. Its disciplined asset selection and careful duration management create a suitable environment for new investors.

Expense Ratio: 0.20%

Average Yield: 2.3%

Duration: Short-term

Risk Level: Moderate

Fund Manager Expertise: Very High

| Summary of Online Reviews |

|---|

| “Well-received for its structured approach,” with “efficient yield management.” |

Final Thoughts

The list highlights options that offer low expense ratios and steady yields. Investors new to bonds can choose from varied strategies and risk levels. The funds presented provide clarity in pricing, reliable income options, and stable management.

Choosing the right fund depends on individual risk tolerance and desired yield levels. Each option here meets the needs of beginners who seek practical entry-level bond investments.