A significant shift in the artificial intelligence landscape has caused substantial market turbulence, with NVIDIA experiencing a staggering $450 billion reduction in market value. This decline exceeds the individual market capitalizations of major corporations like Netflix, Home Depot, and Salesforce.

The catalyst for this market reaction stems from the emergence of Deepsea, a Chinese AI company that has claimed the top position on the App Store. Technical analysts suggest that Deepsea’s technology performs better than OpenAI’s offerings. This development is particularly notable because Deepsea achieved this breakthrough with a modest investment of $6 million using older computer chips.

Table of Contents

ToggleImpact on Major Tech Companies

This development has created ripple effects throughout the technology sector, particularly affecting companies that have made substantial investments in AI infrastructure:

- NVIDIA faces questions about the necessity of its specialized AI chips

- Microsoft and Meta, major NVIDIA customers, experience significant market pressure

- The “Magnificent 7” tech stocks face potential reevaluation of their market positions

View this post on Instagram

Market Implications

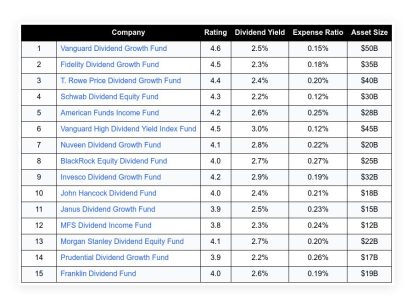

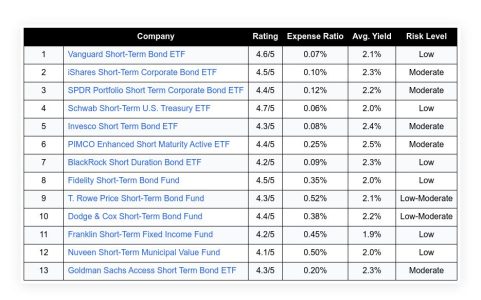

The market response has been swift and comprehensive, affecting multiple asset classes. While stocks and cryptocurrencies face downward pressure, bonds and alternative investments have shown strength. This market behavior highlights the importance of portfolio diversification in managing investment risk.

The situation raises several critical questions about the future of AI development and market leadership. Billionaire tech investor Marc Andreessen has identified this moment as a pivotal point that could reshape the future of AI technology.

National Security Considerations

The developments have broader implications beyond the financial markets. Former President Trump previously emphasized that AI leadership is crucial for both economic prosperity and national security. The emergence of competitive Chinese AI technology has intensified discussions about the global AI technology race and its strategic implications.

This market correction prompts investors to reassess their assumptions about technological leadership in the AI sector and the substantial valuations assigned to companies operating in this space. The situation demonstrates how technological breakthroughs can rapidly reshape market dynamics and industry leadership positions.

Frequently Asked Questions

Q: What caused the significant drop in NVIDIA’s market value?

The emergence of Deepsea, a Chinese AI company that developed competitive AI technology using older chips and a fraction of the investment, caused investors to question the necessity of NVIDIA’s expensive specialized AI chips.

Q: How does this development affect the global AI competition?

This breakthrough suggests a potential shift in the global AI technology balance, challenging the assumed U.S. leadership in AI development and raising questions about long-term competitive dynamics in the sector.

Q: What are the investment implications of these developments?

The situation emphasizes the importance of maintaining a diversified investment portfolio, as demonstrated by the varying performance across different asset classes during this market adjustment.