From the 17th century, the term broke referred to being without money.

More specifically, the word derives from the old sense of impoverished, which signifies helplessness, shame, or embarrassment. People are not born broke, but they make decisions based on their actions, not as a result of circumstances.

To put it another way, it’s a thing that happens to you. You go broke, busted, or even bankrupt — the ‘rupt’ comes from an Italian word for broken. In the Victorian era, you were said to be ruined.

Despite the fact that the phrase this is why I’m broke has been used in colloquial speech and writing for centuries, it emerged as a meme in late 1990s and early 2000s in online forums. Today, the phrase is used humorously when describing the reasons why people are in debt.

However, being broke is not synonymous with being poor, nor does it mean you don’t have any money. Going broke means you lost money you once had, whereas being poor means that you never had money to begin with.

Table of Contents

ToggleIn America, what does it mean to be broke?

In a survey conducted in 2019, 86% of Americans said that they were either broke or had been in the past. According to 28% of millennials, overspending on food led them to that point.

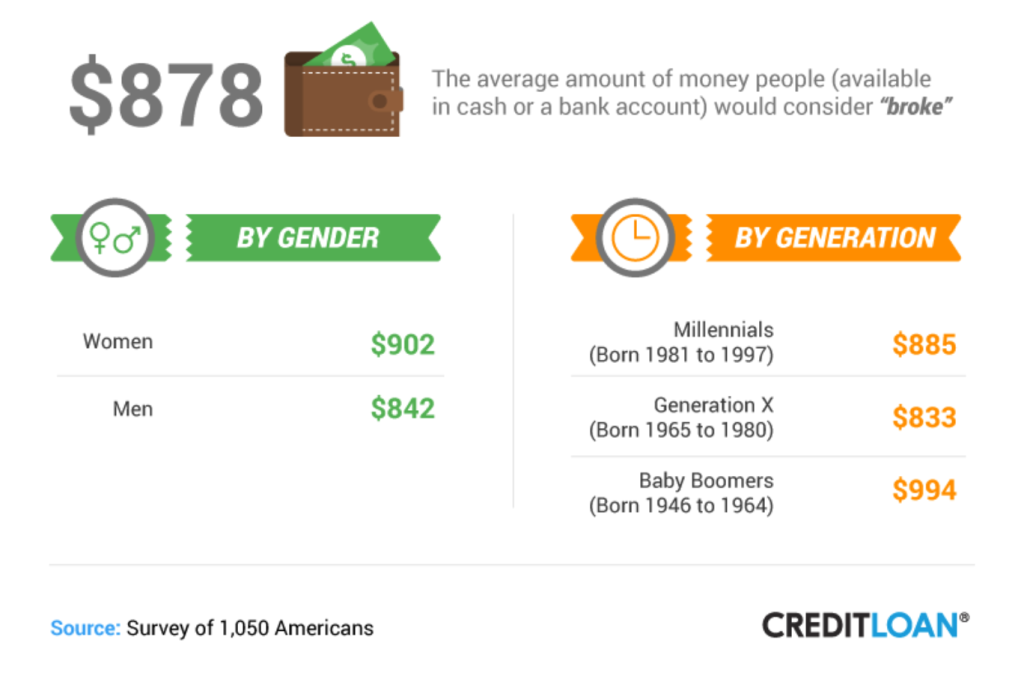

In general, people considered having only $878 available either in cash or a bank account to mean they were bankrupt. Although it might not seem like much, it represents 71.3% of the national average rent. Since 28% of your income should not be spent on housing, many people’s $878 quickly disappears.

In terms of being broke, there’s a gender issue as well. There are actually different reasons why men and women go broke. It may be due to a change in jobs or too much drinking on the part of men. Women, on the other hand, are in debt because they spent too much on food or had to wait for their partner to get paid.

It is also important to consider the generational differences. Gen Xers are the most likely to be dependent on their partners’ salaries, while Millennials spend too much on food. However, Baby Boomers are too generous, and they went broke mostly by spending on others.

Obviously, this survey was before the devastating global pandemic. And, things have probably gotten even worse.

According to the Consumer Financial Protection Bureau, almost a quarter of consumers (24 percent) do not have an emergency savings account, while 39 percent have less than a month’s worth of income saved for emergencies, and 37 percent have a minimum of a month’s worth.

In addition, households have been burdened by high inflation in 2022.

A LendingClub report found 64% of Americans live paycheck to paycheck as of December 2022, up from 61% a year earlier.

Additionally, the number of six-figure earners who feel stretched too thin has risen from 42% a year ago to more than half.

“The effects of inflation are eating into every American’s wallet and as the Fed’s efforts to curb inflation drive up the cost of debt, we are seeing near record numbers of Americans living paycheck to paycheck,” Anuj Nayar, LendingClub’s financial health officer, told CNBC.

Why am I Broke?

External factors, such as COVID-19 or inflation, may hurt your finances, you may be self- sabotaging your financial futures. Consequently, this could lead to a lifetime of financial hardship.

The following are ten reasons why most people are broke. To avoid being like most people, you simply need to avoid these financial mistakes.

1. You don’t have clearly defined financial goals.

A financial goal serves as the basis of all your financial decisions. By setting financial goals, you guide your financial decisions in the future. It gives you a sense of purpose and a sense of direction. Furthermore, you will lack accountability in your financial life without them.

Some examples would be:

- Saving enough for a family vacation during the holidays

- Getting out of credit debt

- Saving up for a down payment on a house

- Building an emergency fund that would cover 3 months of expenses

To avoid being broke, you should set financial goals as soon as possible. Ideally, you should set two habit goals and two achievement goals. Here’s what they are if you don’t know.

Goals that have an endpoint are achievement goals. Almost always, they relate to a specific dollar amount. There is always a finish line to these goals, whether you want to save $6,000, pay off all your debt, or save for a down payment on a car.

Habit goals, however, do not have an end date. Consistency is the goal since they are ongoing. Investing 15% of every paycheck is an example of a habit goal.

The difficulty of maintaining habit goals lies in their lack of excitement. By pairing them with achievement goals, you can overcome this problem. In this case, if you set an achievement goal of investing $5,500 in a Roth IRA this year, you might also set a habit goal of investing at least 20% of my income in retirement. Habits are ongoing, but they complement achievement goals.

2. You’re living beyond your means.

It’s also possible to end up broke simply because of math. In other words, you spend more than you earn.

You could find yourself in this position for any number of reasons. Perhaps you are spending too much to keep up with friends or buying unnecessary things. You may also be prone to impulsive purchases instead of planning and saving ahead.

What can you do to fix this? Get a bigger picture of your monthly cash flow – what money is coming in and going out. After taxes, figure out how much you net from each paycheck. Assess your expenses and find out where you can cut back if you’re overspending.

3. You’re overpaying for fixed expenses.

Any budget can be challenged by recurring expenses. After all, you’ll be haunted by these repeating costs if you pay too much.

What are these recurring expenses? This includes your rent, car payment, or even phone bill. There are other fixed expenses, such as entertainment subscriptions or gym memberships, that could be eliminated.

What can be done? Identify recurring expenses on your account statements and consider ways to lower them. There may be memberships or subscriptions you don’t need or would not miss if you canceled them. Ask your cable or phone company for discounts. You may be able to find cheaper car insurance rates if you shop around.

To make life easier, you could download a tool like Trim. As well as negotiating your cable, internet, and phone bills, it locates and cancels unused subscriptions.

4. The way you think about money is wrong.

If you want to be successful in life and finances, you need to have the right mindset. Your perspective will prevent you from succeeding if you are always telling yourself that you are broke. What you think determines what you do.

You need to believe you can succeed, make up your mind to work hard, and learn how to motivate and inspire yourself.

To help fix your broken mindset, we recommend you try the following advice from Jeff Rose at Good Financial Cents.

- Make every day count by living a purpose-driven life.

- Work with what you have.

- Live within your means.

- Don’t be afraid to invest.

- Keep your goals in plain sight.

- Stop hanging out with “Buttpews,” aka anti-wealth hackers.

- Read more financial books.

- Take advantage of debt strategically. For example, using a credit card and paying the balance each month to improve your credit score.

5. Your finances are in disarray.

Another common problem is disorganized finances, which can be expensive. For example, you can easily incur overdraft and bounced check fees if you lose track of your bank account balances. Missed payments or late fees can result from mixing up due dates for bills. Your checking account might even be charged monthly fees if you forget about it or don’t use it.

The good news? You can get your financial house in order without too much difficulty.

To begin with, organize and manage all your accounts and bills. Set up your bank’s mobile app for easier money management so you can access it wherever you are. It might also be a good idea to use a budget app such as Mint.

If you want to avoid tracking due dates for bills and debts, you can set up autopay. Adding low-balance alerts to your checking account would also be helpful so you will know when your balance starts to fall.

6. Borrowing money to buy depreciating assets.

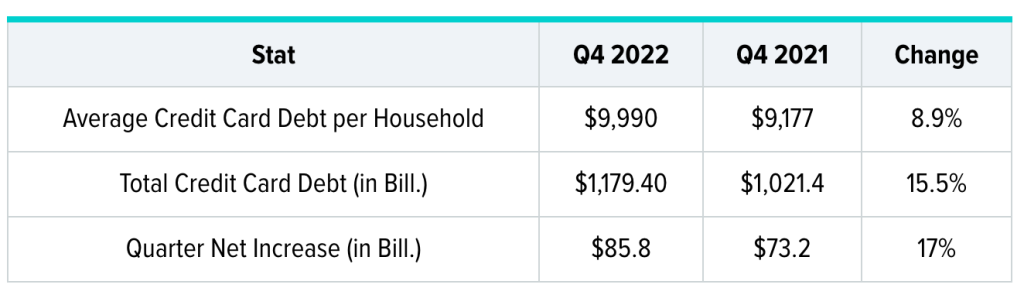

In the fourth quarter of 2021, the average household’s credit card balance was $9,990, up 9%. The amount of debt added by consumers in 2022 was the highest in history, totaling $180 billion.

Credit card debt can be crippling. But, again, a budget can help you find out where to trim the fat so that you put extra money on your balance. It may also be a good idea to consider debt consolidation or getting a credit card with balance transfer capabilities. Often, these cards offer 0% APR for up to 21 months as an introductory offer.

Aside from credit card debt, most people are broke due to borrowing money for large purchases they cannot afford.

Typically, loans are used to buy depreciating assets like cars, RVs, boats, and any other motorized item. In my opinion, the key to wealth is to do things that make your money grow, rather than paying someone extra for something that becomes worthless over time.

7. Your emergency savings are nonexistent.

Life is full of unexpected expenses, from replacing a flat tire to visiting the urgent care center. In the event of unavoidable expenses, you could be forced to drain your bank account without an emergency fund. You may even have to borrow money to cover an emergency — with added interest and fees.

The solution is pretty obvious. Make sure you have an emergency fund to cover these expenses without having to borrow money or stress out. If you keep a buffer, you’ll be able to bounce back faster from these small setbacks and keep yourself from going bankrupt.

Consider the case where you avoid spending more money once your bank account balance reaches $400 or less. It would be better if you raised that floor to $800 instead to give yourself more flexibility. You can also set up small, automatic savings transfers to gradually build up your savings. You should keep saving until you have enough emergency savings to cover any major setback, such as losing your job.

8. It is necessary for you to earn more money.

You might not be broke because of what you spend, but because of what you earn. Reducing costs is important, but there are limits to how much you can cut. You may also find that your living costs rise faster than your income.

In the long run, living paycheck to paycheck can make it difficult to save money and get ahead financially — especially if you’re underpaid.

To improve this situation, brainstorm ways to boost your income. In some cases, hourly employees may request to work overtime or cover extra shifts. As an alternative to your regular job, you can also work part-time, start a side hustle, or find ways to earn a passive income.

A pay raise is also an option. If you want a raise or promotion, be open with your manager. By applying for a higher-paying job, you can also significantly increase your income quickly as well.

9. You don’t invest money.

Let’s start by saying saving money alone won’t make you wealthy. It takes consistency over time to become wealthy, and that means putting your money to work.

Have you ever wondered if there is a difference between broke people and rich people?

A poor person pays interest, whereas a wealthy person earns interest.

You need to do two things if you want to avoid being broke. Keep your debt low, and invest your money. By doing so, you won’t have to pay interest, instead you’ll earn it.

If you’re a first time investor, here are some costly mistakes you’ll need to avoid:

- Even with the best stock investing tips from friends or financial experts, investing without a plan is never a good idea.

- Investing in stocks, ETFs, or any other market instrument without extensive research is risky. In case you aren’t sure what you should look for, take the advice of a financial advisor who knows stocks and the market at large, and who can make good decisions based on your financial goals.

- There are often minor fees associated with investing platforms. It is important to be aware of these fees ahead of time.

- When it comes to investing, never chase temporary, hot-button trends.When it comes to investing, never chase temporary, hot-button trends.

- Stocks, bonds, and other assets should only be purchased with money you can afford to lose.

- First-time investors make the mistake of delaying investing. You’ll have more money in the longrun if you invest early, even if it’s in a slow-growth, low-risk mutual fund.

- It will take time for a company or asset to increase in value when you invest money into it. So, be patient.

10. You’re griped by fear.

Fear of failure keeps many people in bad financial situations. Those who do not want to make mistakes or lose money are afraid of the effort, the sacrifice, the commitment. In their minds, learning how to manage money well takes too much time and effort.

If fear is holding you back, you need to realize you cannot succeed without trying. To achieve that, you must take things step by step.

Taking stock of where your finances stand right now and creating a budget and long-term plan are the first steps. Struggling to do this alone? Asking for help is not a sign of shame. In fact, there are plenty of free resources to help you get started on your financial journey. These include Your bank or credit union, online brokers, Consumer Financial Protection Bureau (CFPB), or the Financial Planning Association (FPA).

Remember, failing is not the end of the world. Don’t let it hold you back.

FAQs

What does it mean to be broke?

When you are broke, you live paycheck to paycheck without any savings. Being broke means having a mountain of debt. The definition of broke is buying a brand-new $35,000 car but having insufficient funds to cover an emergency cost of $1,000.

Could I be poor or broke?

Poor people’s lives are shaped by poverty, and changing that takes a lot more than cutting back. People who are broke may face temporary financial hardship. However, quick solutions can help them overcome the problem.

How do people become broke?

The majority of people are broke because they borrow money to make large purchases they cannot afford, in addition to credit card debt. Furthermore, almost all loans are used to purchase depreciating assets, such as cars, boats, RVs, etc.

What can you do to stop being broke?

Paying off your debts faster can be achieved by making even a few extra payments each year. You will be debt-free in the long run if you make extra payments towards your debt, even though it might make your budget even tighter right now.