For many Americans, the importance of planning for retirement has become a financial priority as soon-to-be retirees are gearing up to exit the workforce.

As people get older, retirement planning takes a superior position among other financial priorities. In a time where the cost of living is constantly rising, against the backdrop of an uncertain future, planning for your financial future becomes increasingly challenging as you start to age.

Table of Contents

ToggleThe state of retirement in America

Several studies and surveys have recently found that it’s become increasingly hard for Americans to boost their retirement savings due to ongoing economic risks

In a GOBankingRates survey of 1,000 Americans aged 18 years and older, around 32.9% had no more than $100 in their savings account. A similar study published in 2022 found that nearly 22% of Americans had less than $100 in their savings accounts.

There’s no correct time or age to start planning or saving for the future, especially when everything seems to have so many added risks these days.

According to a Northwestern Mutual 2021 Planning & Progress Study, Americans have in recent years been increasing their retirement savings, with the average retirement savings account growing by 13% from $87,500 to $98,800.

Despite many bumping up their saving efforts, soon-to-be retirees, those aged 55 to 64 have a median savings balance of $120,000, while younger U.S. adults, under 35 currently have a median account balance of $12,300 according to a PwC report.

A number of unplanned scenarios throughout the last few years have forced many people into early retirement. Those who were unable to properly save and plan, have in recent years stepped out of retirement and back into the workforce as a way to financially sustain themselves.

The average age of retirement has increased from 60 in 1990 to 66 in 2021. With the majority of adults now living longer than previously, enjoying life after work can be costly if you don’t start planning well before the age of retirement.

Retirement calculation – cutting costs before retirement

Economic uncertainty and rising costs have beckoned American adults to start saving early on in their careers.

From this, research shows that for those born between 1981 and 1985, the retirement outlook is more optimistic. Experts predict these younger earners to have the highest inflation-adjusted median annual income by the time they reach 70.

Early millennials, as they’re called, will see a 22% increase in their annual earnings once they enter retirement, compared to pre-boomers, or those workers born between 1941 and 1945.

Generation Z, individuals aged 19 to 25 are even better at saving for their future, with a majority of them putting away on average 14% of their income according to one BlackRock study published last year.

Younger generations have more confidence, and more optimism when it comes to planning for their retirement and future. Now with a majority of them taking up space in the workforce, financial priorities will soon begin to change, as many look to build a nest egg that could last them through retirement.

Following a strict budget, cutting unnecessary expenses, and learning how to work with money are some of the few things many people are doing to reduce costs to stuff their retirement savings.

Reduce high-interest debt

Inflationary pressure throughout much of last year has seen an increasingly high number of American adults lean on credit cards and personal loans to help them pay for everyday expenses. As of 2023, close to half – 46% – of U.S. adults carry month-to-month debt, whether it’s credit cards or other interest-related debt.

Keeping expenses to a minimum can start by reducing high-interest debt such as credit cards or personal loans. For the majority of the working class, while it’s still possible to afford it, it’s suggested to minimize any interest debt you may still have, while you’re still receiving a monthly income.

Having this financial safety net means you’re in a position to lower your future expenses and direct more cash towards more important financial goals such as saving for retirement.

Taking control of your debt can be a challenge, as these expenses tend to accumulate over time. There it’s best advised to look at which payments can be dealt with first and foremost, and whether it’s possible to shorten the payment period so that it doesn’t stretch into your retirement years.

Assess your insurance coverage

Another way to cut expenses early on in your career is to assess your insurance coverage. As you become older, health insurance coverage becomes an increasingly important product that you will need to carry for much of your golden years.

Taking the necessary steps now to ensure you have the right insurance coverage will help you better understand what type of product you should take out, and what you are paying for.

Often people only take out insurance coverage later in their life, once they are in a comfortable financial position. While this would make sense at the time, insurance products tend to become more expensive as you age.

While the difference in products may be a few dollars each month, over the long term these quickly add up. Speaking to a financial professional or broker will give you better guidance on which insurance products are best for someone in your position, and will give you the most benefits once you step into retirement.

Take control of student loans

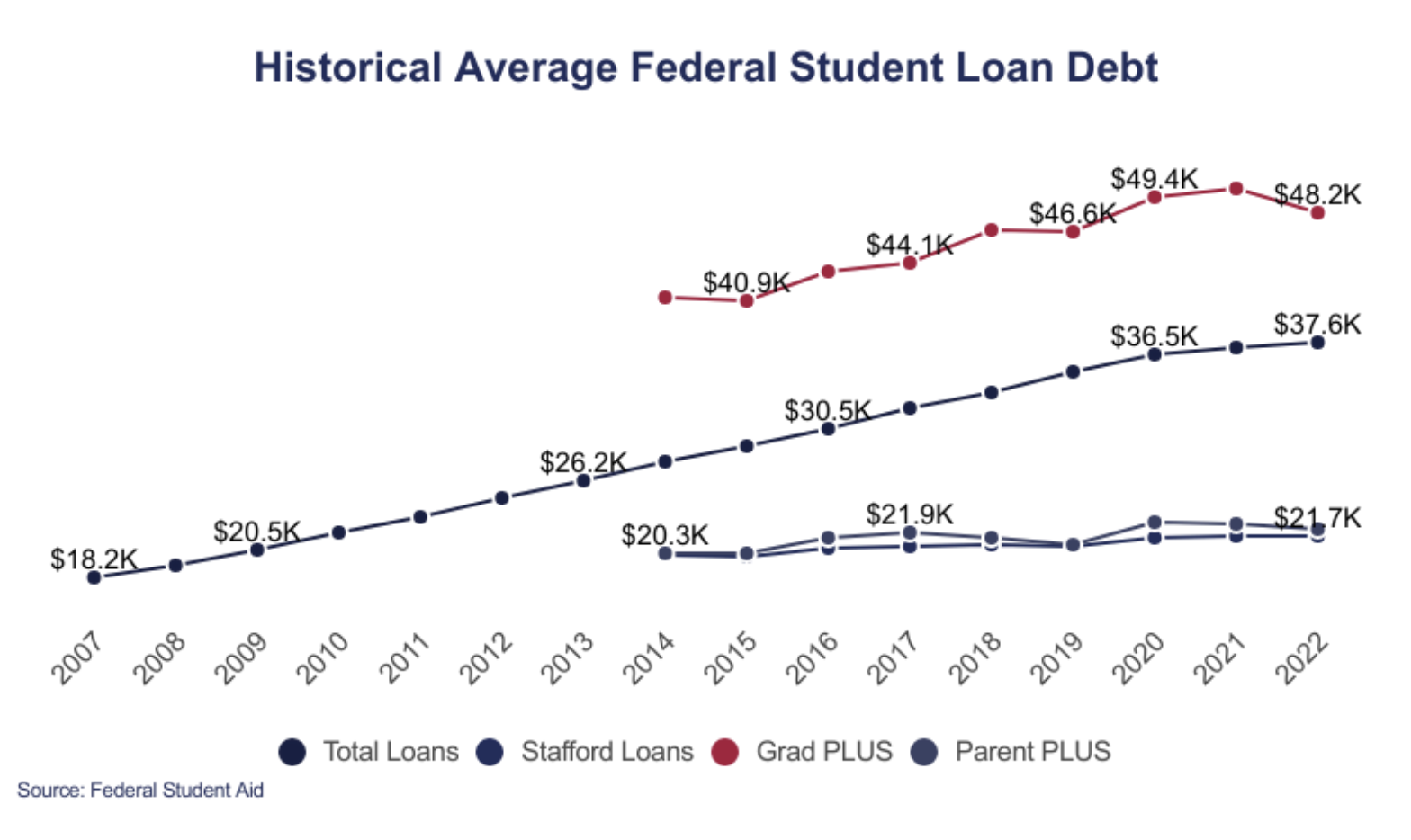

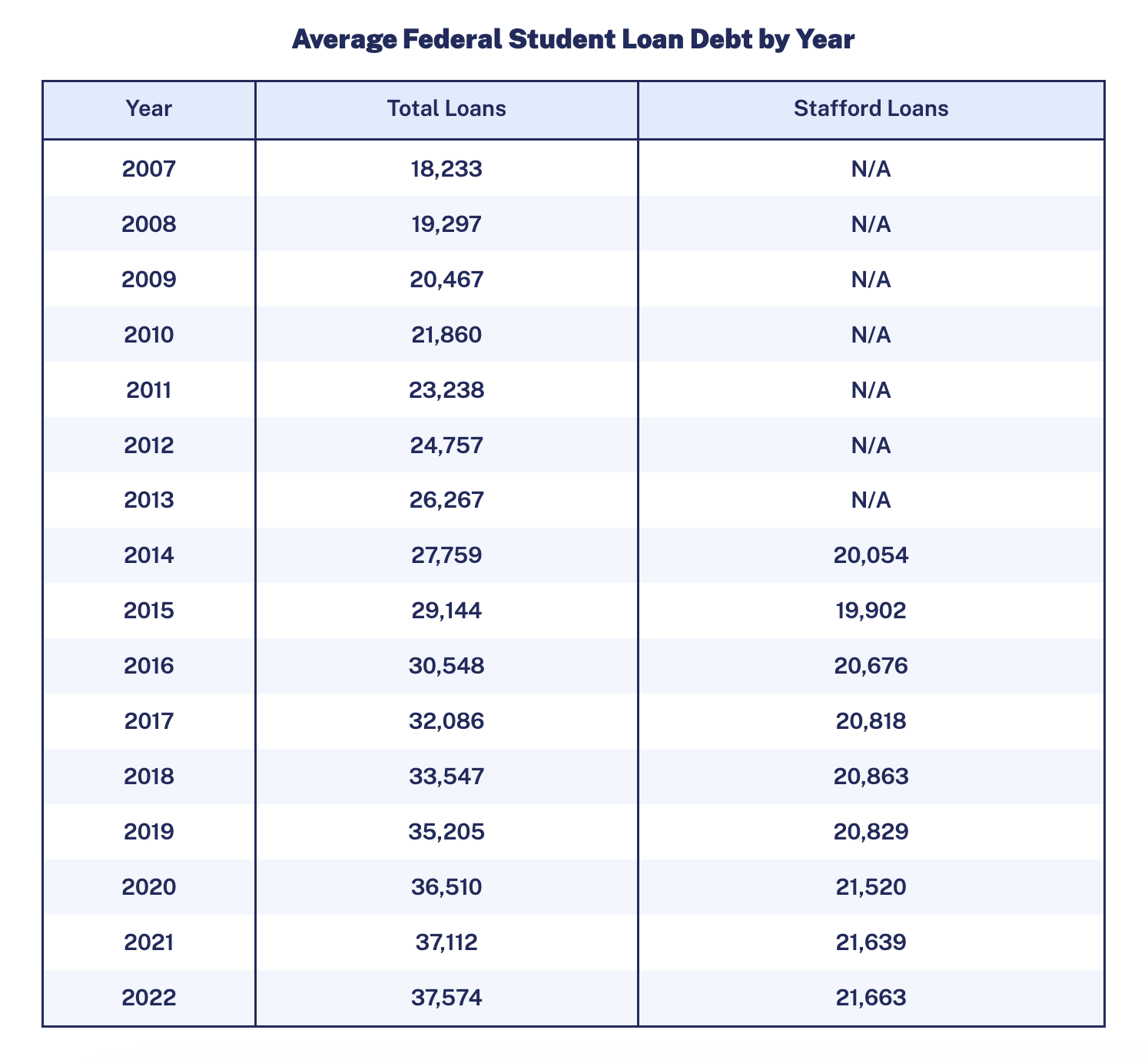

Student loan debt is a massive burden for the majority of American adults. According to the Education Data Initiative, the average federal student loan debt is $36,575 per borrower, while private student loan debt averages $54,921 per borrower.

As of the start of this year, around 45.3 million adults in America have some form of student loan debt, with a majority of them – 92% – having federal student loan debt.

Carrying this debt into retirement is not only a financial burden, but it takes a strain on your retirement savings plans if you don’t manage to prioritize these payments.

Taking more ownership of your student loan debt now will help you in the long term, allowing you to direct more of your financial efforts later in your life toward setting up your nest egg. If you’re not sure how to manage your student loans or have been struggling to make payments, reach out to a financial advisor for guidance, or apply for student loan relief assistance.

If you currently work in the public sector, or for a government entity, see whether there are any student loan relief programs you can qualify for to help lighten the burden.

Pay-off your mortgage

Mortgage rates have nearly doubled in a year, as the Federal Reserve continues with its aggressive monetary tightening, making it more expensive for consumers to borrow money.

In mid-January 2023, the benchmark 30-year mortgage rate was 6.48%, up from 3.22% at the same time a year ago. According to the U.S. Census Bureau, the median monthly mortgage payment sits around $1,100.

Americans have witnessed house prices soar in recent months, as demand grows, supply decreases, and the cost of labor and building materials continue to rise.

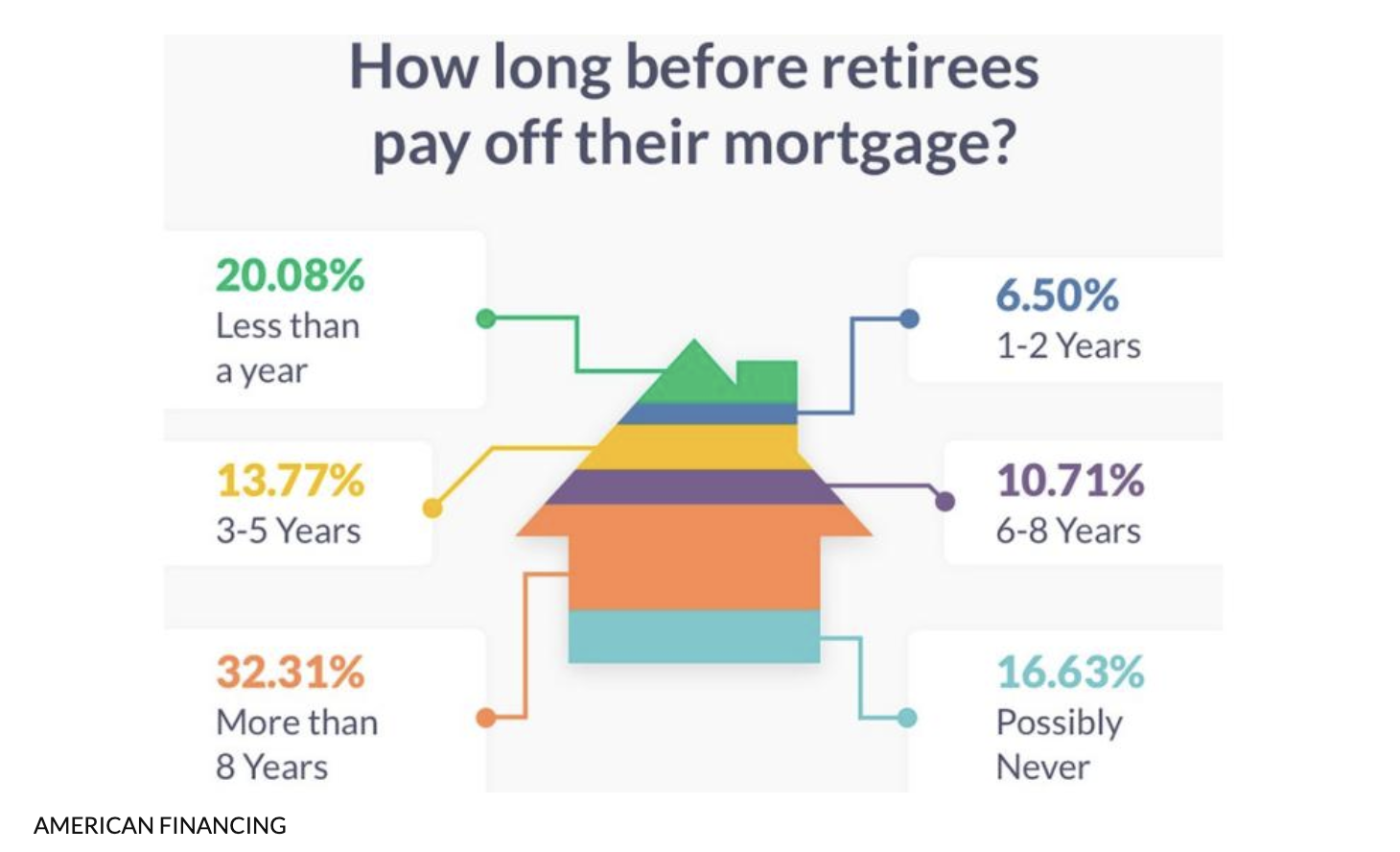

Despite these challenges, many adults still sit with a mortgage by the time they retire. Shockingly enough, 44% of Americans aged 60 to 70 have a mortgage once they step into retirement, with 17% saying they will never be able to completely pay it off according to the American Association for Retired People.

Many soon-to-be retirees and even those still active in the workforce are living with the high-cost burden of their mortgages. Being proactive to reduce these settlements while you’re still pulling a paycheck each month may help you lower your down payment term, but also give you some breathing room to rather put this money towards your retirement fund.

Several different financial programs exist to help homeowners with fulfilling their mortgage payment duties, and often banks provide clear and more concise financial guidance. Take the opportunity to resolve these payments sooner rather than later, and take advantage of lower rates where possible.

Reassess your car insurance

Vehicle insurance tends to increase over the years, and insurance providers adjust payments based on inflation and the market value of your vehicle.

Over time, you may end up paying slightly more for your car insurance, even if you still have the same car, or perhaps have downsized. Values for car insurance are calculated by your insurance provider using the actual cash value (ACV) of your car, to determine how much they will need to pay out in the event of an accident or to conduct any repairs on the vehicle.

What some insurers have done in more recent times, is to provide lower premiums for older customers, to help lighten the expense burdens they might have on their cars. This would make it a lot cheaper and perhaps more affordable for some retirees or car owners to hold onto more than one car.

Additionally, you can approach your current insurance provider to help settle a more manageable insurance premium based on several factors such as years of driving experience, age, and condition of the car, where it’s parked overnight, how often you make use of it, and who the primary driver of the car might be.

These factors, along with others will influence the total monthly amount you will need to pay for your insurance. It’s advised to annually assess your vehicle insurance to make sure you get the most budget-friendly deal available.

Cut unnecessary expenses and subscriptions

Another useful and smart way to minimize your expenses early on in your career is to avoid any unnecessary expenses such as subscriptions, streaming services, and internet bills.

While some may argue that these are essential to their everyday lifestyle and entertainment. The latest figures indicate that the average American spends roughly $114 on video downloads and streaming services, a nearly four-figure increase from 2016.

Internet bills have also increased over the last couple of years, despite seeing a growing number of consumers coming online.

The typical American household pays between $40 and $100 per month for internet services, with the average being $64 per month. Even the lowest internet packages can cost households close to $58 per month when adjusted for taxes and other service fees.

While there is a need and use for these products or services in the everyday household, it’s often best to keep these costs to a minimum. Splitting costs between those residing in the same house or apartment can be one way of bringing down expenses.

Another could be to take out fewer streaming or subscriptions and keep only the necessary products that have a purpose.

Make sure to research the best possible deals for these types of services, and now and again take some time to review your account statements so that you can see where your income is being spent.

You can always opt out or cancel these subscriptions, but make sure to read the fine print first, so that you don’t end up paying a higher cancellation fee, or continue paying for something you no longer use.

The bottom line

Planning for retirement has become an essential financial priority for many Americans. For those that still have enough time before the age of retirement, it’s best to plan and strategize as much as possible to ensure you’re on track with your financial and savings goals.

On the other hand, for those individuals that might soon step out of the workforce, and into retirement, making some cutbacks to minimize unnecessary expenses, while also boosting your retirement portfolio is perhaps the best way to ensure you can enjoy your golden years, without any financial stress.

There’s no right time to start saving for retirement, the sooner you have a savings plan in action, the better. Take control of your finances, and make an effort of breaking down the smaller costs, and minimize costs that could rather be directed to your retirement fund.