What would you do with an extra $1,000 a month?

For most of us, this could be a real game-changer. After all, with this influx of extra cash, you could pay off financial debt, purchase a life insurance policy, or invest in your retirement. What’s more, you could finally take that dream vacation, make home repairs, or take a class to further your career. And, considering that fewer than 4 in 10 Americans could pay for a $1,000 emergency expense, you could build a substantial emergency fund.

But, unless you receive an inheritance or win the lottery, this $1,000 per month isn’t just going to appear out of the blue. You’re going to have to earn it. And, your first thought might mean picking up a second job.

There’s nothing wrong with this approach — especially if you’re in a financial crisis or have a short-term financial goal. On the flip side, this can pull you away from your family, friends, or hobbies. Plus, it can be exhausting in addition to your full-time job. In turn, that could actually put your main source of income in jeopardy if your performance or productivity plummets.

So, where can you realistically earn an extra grand each month? Through a passive income.

Table of Contents

ToggleWhat is a passive income?

A passive income is when you make money without exerting much effort. In fact, this requires so little effort that many people describe a passive income as earning money while sleeping. Obviously, that doesn’t always literally happen. But hopefully, you have at least a basic understanding of what a passive income is.

There is, however, a passive income myth that must be debunked. Many people assume that earning a passive income is so easy that you only need a weekend to start. And, after that, you can just sit back and wait for the money to roll into your bank account.

In reality, there’s a lot of work to be done upfront. Even after the initial legwork, you’ll still have to maintain and update your passive income sources. It’s like taking care of your home or vehicle. Without properly taking care of these assets, they will quickly deteriorate and lose value.

If you do put in a little elbow grease and stay committed, then yes, a passive income can create an additional income stream. Eventually, this can help you achieve financial freedom, stability, and security. As a result, this reduces stress and anxiety.

In short, earning a passive income can significantly improve your life. And, if that sounds appealing to you, here are 11 passive ideas that can bring in an extra thousand bucks per month.

1. Investing.

As Jeff Rose, the Wealth Hacker, says, this first idea should be a no-brainer. And, despite what you may believe, it doesn’t take a small fortune to begin investing.

“Whether it be 50 bucks a month, $100 a month, anything that you can start investing, you can start making gains, start making interest, of your investment,” he adds. Examples include;

- Index funds. These are mutual funds or exchange-traded funds that are tied to a market index, such as the S&P 500. Because of this, these funds’ performance correlates with that of the underlying index. Moreover, they’re passively managed as well.

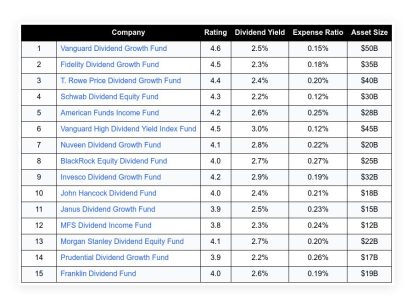

- Dividend stocks. If you want to make this a worthwhile investment, you will have to invest a significant amount of time and money. If you invest regularly in dividend stocks and put in the time and effort, you will have a very stable recurring income.

- Peer-to-peer lending. Through platforms like LendingClub and Prosper, you can lend money directly with a click of a button. You can expect a 10.58% average interest rate.

- Cryptocurrency. It’s not advisable to go all-in with crypto. But, as Cale Moodie wrote in a previous Due article, “the risk of investing in crypto is evening out, and as the market continues to correct itself, we’ll see more legitimate crypto investment opportunities rise to the top.”

What if you don’t know where to start? No worries. You can get assistance with robo-advisors.

“There are Robo Advisors such as Betterment, Wealthfront, Acorns, Robinhood, Ally Invest, E-Trade,” Rose says. “If you know nothing about investing and you want somebody to pick those investments for you, that’s why I have to recommend Betterment.

“Betterment doesn’t have any money to start and they will choose an ETF model for you,” he explains. “So, if you’re putting any money in, they’re gonna choose those investments and then you’ll sit back and start making those capital gains in dividends, otherwise passive income.”

2. Deal and/or survey sites.

Some might not consider this as a passive income since you are putting in a little work. But, signing up for deal and/or survey sites let you earn a minimal income while going about your daily life.

For example, you can make money when you’re doing your online shopping or filling surveys while watching Netflix or on your commute to or from work.

Sure. This probably won’t buy you a yacht. But, instead of just sitting there and wasting time, why not pick up some extra cash on the side?

3. Cash-back reward points.

“This one’s a little bit outside the box, but hear me out,” Rose states. “Taking advantage of cash-back reward points,” is another proven passive income idea.

“Now, I know, I’m sure you’re thinking how is that really passive income?” he asks “But, check this out.

“Before I started using credit cards to pay all of our bills, we used to use debit cards all the time, “ Rose states. “Because I always subscribed to the idea of like you shouldn’t have credit cards because credit cards are evil.” The thing is, when used responsibly, credit cards aren’t that evil.

Why? Because credit cards offer various reward points. And, if you don’t take advantage of them, you’re missing out on free money.

Rose explains that began using rewards points for cash back, hotels, or airline miles. “Anything like that that we knew that we’d be using on a frequent basis.,” he says. “So, now everything that we buy, whether it’s our cell phone bill, our satellite bill, Netflix, groceries, gasoline, we run all of our expenses through our credit cards and we get back tons of reward points.”

In fact, Rose was able to take a family vacation to Jamaica without having to spend a dime. “So, using your credit cards to take advantage of these reward points is so passive because you don’t have to do anything. You’re doing something that you’re already gonna do to begin with.” You just sit back and watch the money roll in.

4. Sell photos online.

Today, more than ever, photographers of all levels are in high demand. The reason? Bloggers, graphic designers, marketers, publishers buy and use photos online every day. Specifically, those on a shoestring budget, like bloggers and small to medium-sized website business owners are purchasing stock photos for their site or marketing materials like brooches.

But, where exactly can you sell your photos online? Unsplash, Shutterstock, iStock. Adobe Stock or Dreamstime are some of your best choices. Or, you could be in complete control by creating your own photography website in WordPress.

5. Patron.

“So, there’s this cool service called Patreon,” says Rose. “It’s for any artist that has a community, a growing community, and you wanna get paid for your work. And, you have a community of people that love your art whether that be your drawings, your music, whatever that art may be. And each time that you release a new item, you can get paid a fee for that.”

Best of all? You determine the amount of the fee.

An example of how this works is from Evan Burse, aka the Cartoon Block, who is friends with Rose. Burse has a thriving YouTube channel where the community will pay a fee whenever release a new image. And, he loves showing people how to sketch superheroes.

Since Burse was already sketching superheroes, he’s making some extra cash from a dedicated community that is excited and supportive of his work.

6. Write a book.

There’s no need to sugarcoat this. You aren’t going to compose a book overnight. Thankfully, the process is relatively simple.

Write a book about a niche you’re familiar with, self-publish it on Kindle Direct Publishing, Kobo, IngramSpark, or Smashwords. Although you’ll have to market as well, if it’s well-written and unique you’ll have another income source for years. In fact, Ross says that he’s still getting paid on sales of his book Soldier of Finance that he released in 2013.

7. Physical goods.

With physical goods, the sky’s the limit. For instance, you could sell coffee mugs, t-shirts, dog leashes, yoga mats, or handkerchiefs online. Especially, through Amazon’s FBA program.

“Amazon offers a couple of different fulfillment strategies,” explains Serenity Gibbons in a previous Due article. “One is their Fulfillment by Amazon platform – also known as FBA. The other option allows sellers to fulfill their own orders. Each method comes with its own pros and cons.”

“The major benefit of using FBA is that you don’t have to worry about a thing,” adds Serenity. “Amazon stores your inventory and does all of the picking, packing, and shipping. They also provide tracking numbers, handle returns, and deal with customer correspondence.” Just be aware that you will “have to pay for this service, which can eat away at your profits.”

Another option? Sell your own handmade products, like jewelry, belts, furniture, pet supplies, clothing, or candles. Afterward, you can list them on online platforms such as Etsy or Shopify.

8. Real estate.

“Real estate investing is a great way to not only build your passive income but your financial future,” notes Catherine Way in another piece for Due. “Thankfully there are many easy ways to start investing in real estate despite your background. From flips or note investments, it is easier than ever to start real estate investing.”

In order to start investing, you must understand the basics such as the local market conditions, how to calculate your return on investment, profits, and the different types of real estate prior to investing in real estate

Another option for real estate investing? Rental property that’s run by a managing company via platforms like;

- Roofstock provides the option for renting cash-flowing single-family homes.

- Fundrise lets investors invest in private real estate through a crowdfunding platform.

- RealtyMogul allows you to invest in large developments, such as commercial or multifamily buildings.

- EquityMultiple permits you to invest in real estate with as little as $10,000.

- Groundfloor aims to make private capital markets accessible to all by crowdsourcing real estate investing and lending for as little as $10.

- FarmTogether lets you invest in farmland to create a predictable investment strategy.

9. YouTube.

In terms of what type of channel to launch on YouTube, there are quite a few options available to you. You might review products, give your opinion, or share instructional tips. You can even provide updates on a niche topic that you’re either familiar with or passionate about.

But, how does that translate into money?

That’s an easy question to answer; ads. Of course, you need to be a quality content creator and build an audience. When you do, you’ll get paid through those ads that you’re probably skipping. Additionally, you could have your videos sponsored by a company. If you spend any time on YouTube, you’ve no doubt come across videos that have been sponsored by companies like Magic Spoon, Manscaped, Raycon, or ExpressVPN.

10. Blogging.

Yes. You can make serious coin by blogging. You just need to take that all-important first step and actually start your blog by;

- Select a blog name related to your name, product, or service.

- Purchase the domain and web hosting so that your blog goes live.

- Customize your blog through a website builder or hire a pro to do this for you.

- Write and publish your first post.

Next, keep creating and sharing your content. Like with YouTube, having quality content and a dedicated following can help you monetize your blog. Generally, this is through banner ads or affiliate marketing. But, you could also offer coaching services or sell information products like an instructional guide, eBook, or case study.

To turn this income into a passive income you’ll want to take advantage of automation. “Simply find tools that streamline the tasks you’re tired of doing and integrate them into your blogging workflow,” suggests Peter Daisyme is the co-founder of Hostt. “There are apps to automate email marketing, social media, list segmentation, proofreading, writing headlines, scheduling meetings, tracking analytics, finding link-building opportunities, optimizing images, automating business payments, and everything in between.”

On the other hand, there is only so much you can automate.” At some point, you have to build up a team of skilled professionals who can help you handle the tasks that require human energy and creativity,” he adds. “This is where outsourcing to freelancers and virtual assistants comes into play.

11. Create your own online course.

“Creating a course is one way to diversify your income,” says personal finance writer and founder of Tay Talks Money Taylor Gordon. “If you’re making money from a business, there’s a good chance you have something to teach that people want to learn.”

“I like making and taking courses from other people because they’re often a smaller ticket product that gives me an introductory into what the person is about,” adds Gordon. “From there, I can decide if I want to invest with them again.”

Interested? Then let’s rundown the steps you’ll need to take to create an online course;

- Choose the right idea. Your course topic should be one that is likely to be of interest to people. Make sure to do your research and ask the right questions beforehand. “Sometimes courses that people say they’re interested in aren’t actually courses that they will dig into their wallets to purchase, she says.

- Outline the course. You don’t have to include every single detail. But, you’ll want to flesh out a lesson plan so that you and your students know where the course is heading.

- Test the market. Gauge interest through a presale or beta version.

- Choose a course platform. Delivering your course via daily emails is probably the easiest and cheapest method, says Gordon. Alternatives include Udemy, Teachable, Thinkific, or Zippy Courses, which are more involved sites. You could also go with a straightforward payment and digital delivery service such as SendOwl or Gumroad.

- Promote like it’s your job. Finally, go on a marketing blitz through email marketing, purchasing ads, hosting a webinar, or being a podcast guest.