Would you believe that how you spend $5 can sometimes matter more than how you invest $5,000? It’s true because the small, intentional choices you make every day compound into real financial security. With consistency, these daily money habits create a self-reinforcing cycle that promotes smart money management, prevents frivolous spending, and quietly grows your net worth. Here are 20 daily habits that require minimal effort but create massive financial results over time.

Table of Contents

Toggle1. Check Your Bank Balance Every Morning

Most people skip it, but checking your accounts each morning is one of the simplest, most powerful money habits.

A quick glance at your bank balance gets you oriented for the day. Note how much is available, any automatic payments due, and recent charges that might look unusual. This simple check helps you spot errors, avoid accidental overdrafts, and plan your spending realistically.

2. Set a Daily Spend Limit Before You Leave Home

Boundaries keep your choices intentional. So, decide your max spend for the day and then write it down or set a note in your phone. An example could be, “Today’s budget is $40.” This creates a mental barrier against impulse purchases, allowing you to focus solely on necessities.

Enforce this limit by using only cash or a debit card – payment methods that prevent you from spending money you don’t have. That way, when the money’s gone, so is the option to overspend.

3. Pack Your Lunch the Night Before

Mornings get hectic, which is why “I’ll just grab something later” can become a $15 habit. So, don’t leave tomorrow’s meals to “future you.” Before bed, prep something simple like a sandwich, leftovers, or a grain bowl in a container.

That short amount of prep eliminates morning excuses and could save $10-$15 daily. Even two packed lunches a week put about $1,000 back in your pocket each year. The savings add up.

4. Make Coffee at Home Instead of Buying it

Invest once in a decent coffee maker or French press. Buy beans or grounds in bulk. Brewing your own coffee takes less time than going to a café, costs under $1 per cup, and saves you about $1,600/year. You can always add flavor syrups to bring back the café feel (minus the price).

Bonus: The ritual also adds calm to your morning, rather than waiting in line with 20 others rushing for caffeine.

5. Review Yesterday’s Expenses While You Drink Coffee

Now pair that fresh brew with a quick scan of yesterday’s spending. Open your expense app or bank log, skim yesterday’s charges, and note the leaks.

If you do this every day, you’ll spot recurring weak spots, delivery apps, streaming rentals, and convenience buys faster than you think. This builds daily self-correction instead of waiting until your monthly statement shocks you.

6. Carry Water Instead of Buying Drinks

A $3 bottled drink may seem harmless, but when you repeat that three times a day, you’ve silently added roughly $200 to your monthly spend, which is entirely avoidable.

Bring a reusable bottle with you before leaving home. Fill it up the night before if you’re leaving early, and you can always refill it. While it’s not the most exciting thing to do, this way you cut those couple of dollars to zero while keeping yourself hydrated.

7. Use Company Perks (Free Snacks, Gym, Park)

Maximize company benefits that you already pay for, like gym access, commuter reimbursements, snacks, or learning stipends.

Also, cancel any duplicate memberships you’re paying for and replace them with the company version. That alone could save $50-$100 per month. Even smaller perks, like free coffee or software licenses, add up when used daily.

8. Walk or Bike Short Distances Instead of Rideshare

For trips of two miles or less, default to walking or biking. Ten quick Uber trips at $15 each add up to $150 for a distance your legs could cover for free.

So, set a rideshare threshold: only use Uber/Lyft if it’s raining, unsafe, or over two miles. Move your body for everything else. With each skipped ride, you’ll save money and get in shape. If you track all the avoided rides weekly, you’ll see how fast they add up to hundreds saved.

9. Eat Snacks from Home, Not Vending Machines

Carry your own snacks, because a $1 granola bar from home can easily turn into $4 at a vending machine. Keep a small “snack kit” stocked in your desk, backpack, or car, with nuts, fruit, and other snacks. Each swap can save you $2-$3, and at just two vending machine purchases a day, you’d spend over $60/month on snacks that could be bought for under $20.

10. Check Prices Before Any Purchase Over $20

Before buying anything above $20, do a quick three-minute search. Use Google Shopping, Honey, or store apps to scan discounts. It will often reveal discounts, coupons, or cheaper retailers. This habit alone can reduce 10-30% of most purchases.

11. Wait 24 Hours Before You Buy Anything Over $50

Add items over $50 to a “Hold List” in your phone instead of buying impulsively. Revisit the purchase tomorrow. Often, the urgency fades, or you find a better deal. If you still want it, you’ll know you really need it, and it’s not just emotional spending. This 24-hour cooling period protects your budget and kills impulse regrets before they happen.

12. Check Three Prices Before You Make Purchases

Another daily money habit that’ll help you in the long run is to avoid paying the price you see first. Compare at least three sources before a purchase, whether it’s electronics or groceries. This builds a natural habit of frugality that will help you in everyday life.

Start with one online retailer, one in-person store, and one discount site. Apps like CamelCamelCamel (for Amazon) or Google Shopping make this quick and easy. Daily money habits like this one will save you hundreds of dollars each year, help you avoid overpaying, and shield you from “limited-time” tricks.

13. Use Cashback Apps for Every Purchase

Download one or two cashback apps (Rakuten, Ibotta) and link them to your browser or card. You can activate offers and then shop at participating retailers.

With the right apps, you’re earning 1-5% back on eligible transactions. That’s hundreds annually on expenses you’d pay anyway. Once you check offers regularly, it becomes second nature.

14. Buy Generic Brands for Household Items

Make a list of non-negotiables (perhaps you’re particular about coffee), then switch everything else, such as cleaning supplies, pantry staples, and over-the-counter medications, to store brands.

Try one swap per shopping trip. Quality is usually identical, but the price cut may be 20-40%. Redirect those savings into an automatic transfer to your savings account. You’ll barely notice the switch to generic brands, but you’ll definitely notice your growing account balance.

15. Pay with Cash for Discretionary Spend

Set aside a fixed amount, like $50, at the start of the week for dining out, coffee, or small treats. Using only that cash naturally caps your discretionary spending. This simple psychological trick adds a pause and makes each purchase feel real, helping prevent overspending.

16. Track Every Expense in an App Before Bed

Take two minutes in the evening to record daily spending in a simple app. Download a simple tracker (YNAB, Nerdwallet, PocketGuard) and log what you spent that day.

This way, you’ll have a real-time view of where your money actually went, not where you thought it went. Over time, patterns emerge, leaks become obvious, and your budget stops being a guess.

17. Plan Tomorrow’s Meals to Avoid Takeout

Plan ahead for next day’s meal to avoid the costly habit of ordering delivery when you’re tired. It doesn’t have to be anything fancy. Thaw meat, pre-chop veggies, or set up the slow cooker, either way, you’re creating a low-cost default. Even a five-minute plan like this can prevent three takeout orders a week, saving you $150 a month.

18. Transfer Loose Change to Save

Use round-up apps (like Acorns) or jars at home to stash “loose change” daily. Round a $7.40 purchase into $8, and that spare 60 cents goes straight to savings. These small amounts may go unnoticed, but over time, the deposits grow into meaningful balances. It’s an easy way to trick yourself into saving without noticing.

19. Check Credit Card Charges for Errors

Fraud and billing errors can cost hundreds if left unnoticed. A daily review of charges can help you avoid these disputes.

Open your card app once a day and skim new transactions. Look for unfamiliar names or double charges. Catching a $15 charge error now is easier than dealing with a $1,500 mess later. This habit also prevents forgotten subscriptions from draining your finances. These two minutes a day protect both your money and your credit score.

20. Read One Financial Article or Podcast

Spend 10 minutes daily feeding your financial brain. Choose a newsletter, blog, or podcast about money habits, investing, or side hustles. Note one actionable takeaway and apply it.

The more knowledgeable you become, the sharper your instincts. This means better decisions on credit, investments, and even negotiation. Over time, you’ll think differently about opportunities, risks, and wealth-building strategies.

Make These Habits Stick

You’re probably wondering how you’ll remember all these daily money habits, let alone maintain them daily. That’s the catch: you don’t need to adopt all of them at once.

Start by choosing three habits from this list that feel easiest to adopt, and stick with them for a week until they become natural. For example, start by checking your bank balance, setting a spending limit, and carrying water. Once those become effortless, add lunch prep or paying with cash.

A powerful way to cement new habits is through habit stacking, linking a new habit to an existing routine. For example, check your bank balance while your coffee brews or record expenses before brushing your teeth at night.

As you pair the new with the familiar, your habits become easier to maintain. The goal isn’t to juggle 20 new practices in one week; it’s to gradually weave them into your life so they no longer feel like “extra work.”

Over time, these habits become simply who you are: disciplined, intentional, and financially resilient.

Finally, celebrate small wins. Each time you pack lunch, log expenses, or skip an unnecessary purchase, acknowledge it. That positive reinforcement makes your brain crave the behavior, reinforcing the loop.

The Annual Impact

Individually, these expenditure habits might seem justified, like what’s $3 on a coffee, or $10 on takeout? The problem with dismissing small amounts as “not enough to matter” is that a $5 habit repeated daily becomes $150 monthly, or nearly $2,000 a year, without you even realizing it.

But when you combine multiple money management habits, like bringing lunch twice a week, brewing coffee at home, and walking instead of ridesharing short distances, you’re basically reclaiming those thousands.

In fact, for most people, these 20 habits might even unlock between $3,000 and $8,000 annually. That’s enough to fund a vacation, crush credit card debt, or max out an IRA contribution.

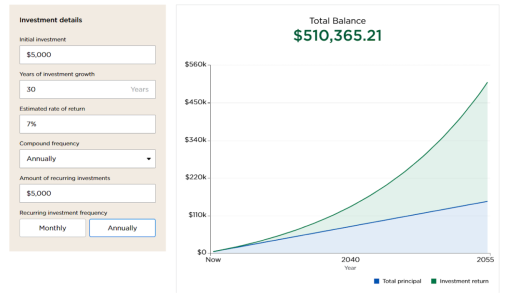

The real impact shows when you redirect those savings. Instead of letting them disappear into lifestyle upgrades, channel them into debt payoff or investments. For example, $5,000 invested yearly at a 7% average return compounds into over $500,000 in 30 years. That’s half a million dollars built from tiny, repeated choices that never felt painful in the moment.

Investment Calculator – NerdWallet

That’s the quiet, compounding power of habit-driven wealth.

Conclusion

These habits work because they run on autopilot: checking balances, setting limits, and stacking small wins.

The difference between financial stress and financial freedom isn’t luck; it’s your daily money habits. Over months, they free up thousands; over decades, they create economic independence. Nothing here requires sacrifice, only consistency. Small actions, compounded relentlessly, are what separate those who struggle from those who quietly build lasting wealth.

Photo By: Kaboompics.com via Pexels