Now that you’ve decided that starting a home-based business service is the right choice for you, you’re excited and love to think about setting your own schedule, naming your business, selecting a cool looking logo — the fun stuff right? And then maybe the overwhelm hits because there are so many things to think about.

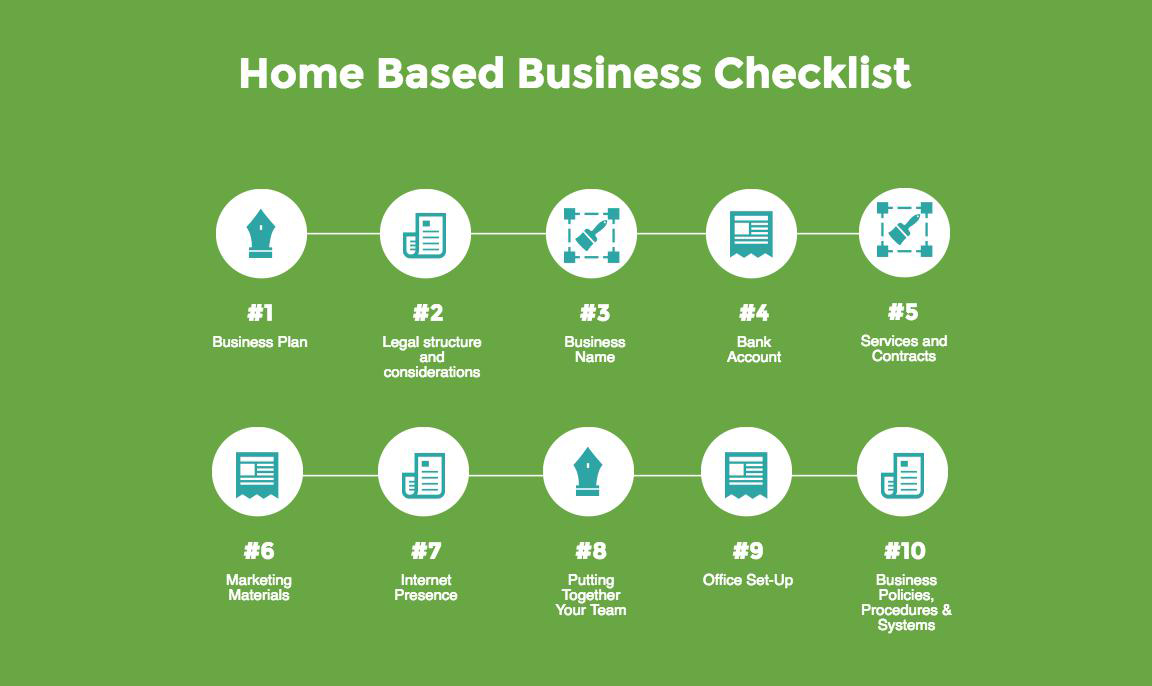

To that end, here’s a checklist — not in any order because everyone has his/her own process — of tasks you want to complete before you go live with your business:

Business Plan: – Many don’t want to take the time to think about their mission, goals and objectives, but really it’s the process of answering these tough questions that is the benefit. The Marketing Plan portion of the Business Plan forces you to figure out how to get clients in a concrete way, and without them you don’t have a business. The Financial Plan section helps you determine if your rate for services and forecasted revenue will bring you the level of income you need as well as determine your breakeven point. After completing your plan honestly, you’ll be able to tell if your business vision is viable.

Legal structure and considerations – Many choose the default legal structure for their business, which is a sole-proprietorship. It’s the simplest and requires the least amount of work to combine your business with your personal taxes. A Limited Liability Company (LLC) is worth considering, however, and is just a tad more difficult while protecting your family assets. Other options that you’ll want to research include partnerships and corporations of various types. On legal considerations, check your city, state, and county for government license requirements and laws. It takes a little time to research this, but then you’ll feel confident that you are compliant.

Business Name – Choosing the name of your business is fun and you’ll want to take into account how your business will be branded: by your name or a company name. Research if the name you want is available as a domain name, ideally one that matches your business name. Additionally make sure that the assumed business name is not taken on your state’s Secretary of State’s website.

Bank Account – In an effort avoid co-mingling personal and business funds; do set up a separate business account. Most likely you’ll want to get a Tax Identification Number (TIN) from the IRS first, which is simple. Determine your legal structure before opening a bank account so that you won’t have to do this process twice.

Services and Contracts – In your Marketing Plan of your Business Plan, you will have determined what services to offer. In this area sometimes less is more because by forming a niche that you specialize in, you’ll attract specific clients (ideal clients) with whom you want to work. Start with an excellent boiler plate contract and over time you’ll tailor it to your unique business.

Marketing Materials – You’ll want business cards of course. Whether you’ll need brochures might depend on whether you’re networking online or in person. Often, business cards with a link to your website will suffice early on. Your Marketing Plan will determine other aspects of how you will get the word out about your business.

Internet Presence – You must have a website. Most likely it will include the following pages: home, services, about you, and a contact page at a minimum. Make sure that it looks polished and represents you well to attract the clients that you want. To increase website visitors, a blog is an excellent addition. Social Media (Facebook, LinkedIn, Twitter, Google+, Pinterest, and others) are free ways to spread the word about your business. Choose which social media channels work best for you and your business and post consistently while engaging with your audience keeping in mind not to spread yourself too thin.

Putting Together Your Team – Although entrepreneurs think they can do it all, most need a team to help, especially when the business starts growing. Who else will be on your team? A bookkeeper/accountant/tax professional, attorney, insurance agent, computer tech support, web developer/maintainer, and a virtual assistant are all professionals that can help your business succeed.

Office Set-Up – Determining where your office will be is an important step. You’ll want to strike the balance between privacy and seclusion. Some people are comfortable working alone whereas others need a lot of social interaction. Select furniture and equipment that meet the needs of your business, but perhaps hold off getting everything you want until the cash flow begins. Keep in mind ergonomic concerns to avoid injury. Add aesthetics so that your office is a place that you enjoy being because you’ll spend a lot of time there.

Business Policies, Procedures & Systems – Now that you are no longer an employee, you are calling the shots. Make sure that you have business policies in place to establish boundaries between you and your clients such as business hours and turnaround times. Create procedures and systems in your work to become efficient and be consistent.

As you can see, there are a lot of things to think about and decide on. Keep envisioning your ultimate goal of having the freedom and control of owning your own business. Make it happen!